Exclusive rates for new customers

Africhange offers exclusive exchange rates on your first 3 transfers from GBP, NGN, and CAD. Maximum transfer limits apply.

Is Africhange right for you?

Africhange is best for transfers from Nigeria, since hardly anyone offers these transfers.

Africhange is good if… | Find an alternative if… |

|---|---|

|

|

Scoring Africhange

The key areas of our Africhange review are focused on the fees & exchange rates, transfers limits & speed, product offering, ease of use, safety and customer feedback.

Below is a quick summary of Africhange. Each area is covered in more detail below.

Exchange rates & fees

Africhange does not charge separate international transfer fees on most routes, instead built into the exchange rate.

Its FX rates are generally competitive and often close to the mid-market rate, although transfers from NGN tend to have a higher markup (around 3-6%).

This might seem like a lot, but it is one of the few money transfer companies offering transfers from Nigeria.

Transfer speed

Transfer limits

Product offering

Ease of use

Regulation and safety

Customer feedback

Before you choose whether to transfer funds overseas with Africhange, here’s a quick summary of benefits and drawbacks.

Pros

Cons

Africhange fees and exchange rates

Provider

Exchange rates

Just like many other top money transfer companies, Africhange charges a markup on top of the interbank exchange rate.

This means they add a small percentage to the real exchange rate, and the difference they make is their profit.

On average, you can expect to get almost an interbank exchange rate, and in some cases even better.

The only exception is transfers from NGN, which come with 3% markup.

This is often known as the hidden fee because you don’t actually know how much you are overpaying.

But we did our homework and looked at all the exchange rates offered and worked out the difference:

From | To | Africhange Rate | Mid-market rate | FX markup |

|---|---|---|---|---|

AUD | USD | 0.663515 | 0.6635 | 0.00% |

AUD | CAD | 0.912489 | 0.9123384 | 0.02% |

AUD | GBP | 0.494285 | 0.494315 | -0.01% |

AUD | GHS | 7.9 | 7.62929456 | 3.43% |

AUD | KES | 85.427644 | 85.425625 | 0.00% |

AUD | NGN | 980 | 963.766925 | 1.66% |

CAD | UGX | 2588.526353 | 2588.834424 | -0.01% |

CAD | AUD | 1.095904 | 1.09602 | -0.01% |

CAD | CAD | 1 | 1 | 0.00% |

CAD | GBP | 0.541689 | 0.54179 | -0.02% |

CAD | EUR | 0.617953 | 0.618005 | -0.01% |

CAD | KES | 93.620459 | 93.63150625 | -0.01% |

CAD | USD | 0.727148 | 0.727235 | -0.01% |

CAD | GHS | 8.5 | 8.362155281 | 1.62% |

CAD | NGN | 1065 | 1056.345199 | 0.81% |

GBP | UGX | 4724.825 | 4780.549 | -1.18% |

GBP | USD | 1.342372 | 1.342295 | 0.01% |

GBP | AUD | 2.023123 | 2.02349 | -0.02% |

GBP | CAD | 1.846077 | 1.845745 | 0.02% |

GBP | KES | 171.2375 | 173.1651 | -1.13% |

GBP | GHS | 15.96 | 15.44345 | 3.24% |

GBP | NGN | 1995 | 1949.86 | 2.26% |

NGN | UGX | 2.39 | 2.450746618 | -2.54% |

NGN | NGN | 1 | 1 | 0.00% |

NGN | GBP | 0.000492610837 | 0.0005128573 | -4.11% |

NGN | EUR | 0.000558659218 | 0.0005849321 | -4.70% |

NGN | KES | 0.084745763 | 0.0886372242 | -4.59% |

NGN | GHS | 0.008 | 0.0079161199 | 1.05% |

NGN | AUD | 0.00101010101 | 0.001037439 | -2.71% |

NGN | CAD | 0.000892857143 | 0.0009466387 | -6.02% |

NGN | USD | 0.000662251656 | 0.00068844446 | -3.96% |

USD | NGN | 1470 | 1452.55 | 1.19% |

USD | USD | 1 | 1 | 0.00% |

USDC | USD | 1 | 1 | 0.00% |

USDC | NGN | 1470 | 1452.55 | 1.19% |

USDT | NGN | 1470 | 1452.55 | 1.19% |

USDT | USD | 1 | 1 | 0.00% |

*Data and FX rates collected in December 2025 directly from Africhange website. Negative values mean a worse rate than the interbank rate.

Generally speaking, Africhange’s FX rates are great, and in many cases are similar to, if not better than the ones offered by the industry giants like Wise and WorldRemit.

Africhange is also great for transfers from Nigeria.

Not because their rates are good, but because it is extremely rare for companies to facilitate these transfers, meaning you don’t really have much choice.

The FX rates are high, but still better than using your bank (and chances are your bank won’t be able to facilitate it).

International transfer fees

Most Africhange transfers do not have additional international transfer fees on most routes.

Less common corridors may incur a small fee, which will be presented at the time of transfer.

Instead, Africhange makes its money through the exchange rate spread (above), meaning the cost of the transfer is built directly into the rate you receive.

In a few cases there may be additional fees involved, mainly for withdrawals from the virtual wallet.

To put these numbers into perspective, let’s assume you’re making a £200 transfer from the UK to a bank via bank transfer:

Country | Africhange received | Wise received | WorldRemit received |

|---|---|---|---|

✅ 399,000.00 | 396,874.00 | 396,269.00 | |

✅ 3,192.00 | 3,032.02 | 3,087.36 | |

✅ 34,247.50 | 33,875.00 | 33,502.00 |

Transfer speed

Provider

Most Africhange transfers are processed within minutes, typically taking around 10 - 30 mins to complete.

However, this does not include any delays with your bank.

Occasionally banks may flag transactions for verification purposes, which may slow down the transfer (sometimes up to 3 days).

Transfer limits

Provider

Africhange has monthly transfer limits, and no daily or weekly limits.

Transfer limits depend on the account tier you have.

Two tiers are based on unverified (Tier 1) and verified (Tier 2) users.

If you have a Tier 2 account (verified), you can send up to 100 million NGN per month (~68,800 USD).

Product offering

Provider

Supported currencies & destinations

Africhange is mainly popular for transfers to and from Africa.

With Africhange you can convert the following currencies:

USD

CAD

NGN

GBP

AUD

USDT

USDC

To these currencies:

UGX

USD

AUD

CAD

KES

GHS

NGN

If you need to send or receive another currency, we suggest running a quick comparison using the form below.

Compare live money transfer deals

Payment methods

Africhange offers a few deposit methods, including:

Interac e-Transfer (CAD)

You can fund your CAD wallet by sending an Interac e-Transfer from your Canadian bank using details provided by Africhange. Deposits are usually credited quickly once the transfer is accepted, though timing depends on the bank.

Interac auto-deposit (CAD)

This is a one-time setup that allows CAD deposits to be credited automatically without security questions. After activation, funding is faster and more seamless for repeat deposits.

NGN bank transfer (virtual account)

Africhange creates a virtual Nigerian bank account after BVN verification, allowing you to fund your NGN wallet via local bank transfers. Once set up, deposits work like standard domestic transfers and are typically very fast.

Bank transfer (virtual account)

You can fund your virtual wallet by sending money from your bank account to your virtual USD account details.

Crypto deposits (USDC & USDT)

Africhange allows funding the USD wallet using stablecoins by sending USDC or USDT to a generated wallet address. Crypto deposits depend on blockchain confirmation times and are irreversible if sent to the wrong address or network.

Receiving methods

Africhange allows you to receive money from multiple sources, including personal transfers, businesses, and other Africhange users.

Wallet-to-wallet (Africhange P2P)

You can receive money directly from other Africhange users through internal wallet transfers. These transfers are typically instant, free, and credited directly to your wallet balance.

Bank transfers (virtual accounts)

Africhange provides virtual bank accounts (such as NGN and USD) that can receive transfers from yourself, family members, employers, and supported platforms.

Funds are credited to your wallet once the incoming transfer is completed, with timing depending on the sending bank.

Business & platform payments (USD virtual account)

The virtual USD account can receive payments from approved businesses, employers, and international platforms. Once received, funds are available in your wallet and can be withdrawn to a linked bank account.

Withdrawals to bank accounts

Funds received in your Africhange wallet can be withdrawn to your linked local bank account, depending on the wallet currency and country. Processing times vary by payout method and banking network.

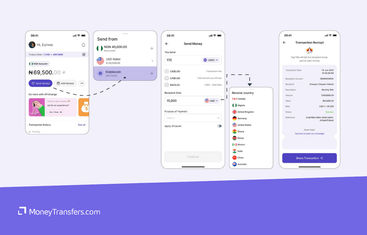

Mobile app

Africhange’s mobile app is generally well-rated across platforms, with a 4.6/5 rating from ~1100 reviews on iOS and a 4.2/5 rating from 1.16k reviews on Google Play.

Most reviews highlight fast transfers, competitive exchange rates, and responsive customer support, while negatives tend to focus on onboarding issues, verification delays, or occasional transaction holds.

In terms of features, the app supports:

Sending and receiving money

Multi-currency wallets (including GBP and NGN)

Referral rewards

Transfer tracking

Real time notifications

Fund wallets

Monitor exchange rates

Manage transactions

The app is also actively maintained, with frequent updates introducing new features like crypto wallet funding, GBP accounts for UK users, Apple Pay support, performance improvements, and security updates.

Business account

Africhange also offers a business account for international business money transfers.

It is aimed at licensed businesses (around the world) and entrepreneurs in Nigeria who need a reliable way to send and manage international payments.

Africhange Business supports cross-border transfers between Canada, Nigeria, and Ghana, with access to major currencies including CAD, NGN, USD, GBP, and EUR.

Business users get access to a multi-currency wallet, transaction histories, downloadable receipts, and other business features.

To get access, you can contact the support after having your personal account verified.

This is a great option if you’re running a business from Nigeria or deal with NGN transfers. Otherwise, I’d suggest Wise Business, Equals Money, or Airwallex.

Ease of use

Provider

Customer service

If you ever need to contact the support or have any issues, you can reach them via:

Live-chat on the app or web

Call or Text at +1(672)9060892

Email at support@africhange.com

Use social media DMs

Safety and trust

Provider

Legitimacy & regulation

Customer funds

Compliance, KYC & AML controls

Customer feedback

Provider

Africhange has a 4.1 out of 5 rating on Trustpilot, based on 24 reviews.

This is not much to go over, but whenever I see high ratings and a small number of reviews, I naturally start questioning the validity of it.

Most recent reviews are very positive, with many frequently mentioning fast transfers and competitive exchange rates, though there are a few negatives relating to delayed transactions.

In general, here’s a roundup of what other users are saying about Africhange:

Main positives

Common negatives

As you can see, generally users are not happy with the customer service.

Unfortunately, even money transfer giants like Revolut and Wise have issues with it, to the point that it’s just getting worse over time.

From 100s of money transfer reviews I wrote, customer service is the usual pitfall in most cases.

Opening an account with Africhange

To open an account with Africhange, you will need the following:

A valid email address and mobile phone number

A government-issued photo ID (such as a passport or national ID)

Personal details that match your identity documents

A smartphone with a working camera (BVN may be required for NGN wallets)

Once you have these details, follow the steps below to open an account:

Download the Africhange app

Download the Africhange mobile app from the App Store or Google Play.

Create your account

Sign up using your email address and phone number, then verify your email to continue the registration process.

Complete identity verification (KYC)

Upload your identity documents and complete the in-app verification process. Africhange may request additional details to meet regulatory requirements.

Set up your wallet

Once verified, you can create and access your available currency wallets and add any required bank details.

Start using Africhange

After your account is approved, you can fund your wallet, send money, or receive transfers through the app.

Making international transfers

To send money with Africhange, you will need the following:

A verified Africhange account

Sufficient balance in your wallet (CAD, NGN, USD, or supported currency)

Recipient details (bank account details or Africhange user, depending on transfer type)

The amount you want to send and destination currency

Sending money abroad

Once you have all the details ready, you can send money with Africhange by following the steps below:

Select “Send Money”

Open the Africhange app and choose the Send Money to begin a transfer.

Choose currencies and destination

Select the currency you are sending from and the currency you want the recipient to receive, then choose the destination country.

Enter recipient details

Provide the recipient’s bank details or select an existing recipient. For P2P transfers, you can send directly to another Africhange user.

Review exchange rate and fees

Africhange will show you the exchange rate and final amount the recipient will receive before you confirm the transfer.

Confirm and send

Confirm the transaction to complete the transfer. Most transfers are processed quickly, though timing can depend on banking networks and destination.

Canceling transfer

Once a transfer has been submitted, it cannot usually be canceled. In some cases, Africhange may attempt a reversal, but this is not guaranteed.

If you’ve made a mistake, contact Africhange support ASAP and they might be able to help.

Receive international transfers

Africhange allows you to receive international transfers directly into your virtual wallet, making it easy to accept money from abroad without needing a traditional foreign bank account.

Funds can be received from yourself, family and friends, businesses, employers, and supported international platforms.

To receive money, you simply need an active and verified wallet in the relevant currency (such as NGN, CAD, or USD).

Senders use your provided wallet or virtual account details, and once the transfer is completed, the funds are credited to your Africhange wallet.

Received funds can be held in your wallet, exchanged to another supported currency, or withdrawn to your linked local bank account.

Does the recipient need an account with Africhange?

No. In most cases, the recipient does not need an Africhange account to receive money. Funds can be sent directly to the recipient’s local bank account.

If your recipient does have an Africhange account, transfers between Africhange users are typically faster, cheaper, and the funds are credited directly to their wallet.

How Africhange compares to other transfer services3

Other Alternatives

Alternatively, consider using one of these neobanks for international transfers.

Africhange: Is it good for transfers abroad?

Yes, Africhange is a good option for transfers involving Africa, especially if you’re sending money to or from Nigeria.

It offers fast transfers, competitive exchange rates with no separate transfer fees, and supports NGN routes that most international providers simply don’t offer.

That said, exchange rate markups are higher when sending from NGN, customer support can be inconsistent, and currency coverage is smaller compared to platforms like Wise.

If you’re sending to non-African destinations or don’t need NGN support, you may want to consider an alternative.

Because exchange rates and fees change constantly, we still recommend comparing Africhange against other providers before sending.

Chances are it will come out near the top, but running a quick comparison will help you find the best deal for your specific transfer.

Find latest money transfer deals

A bit more about Africhange

Is Africhange legit and regulated?

How long do Africhange transfers take?

Is my money protected if Africhange goes out of business?

Help & FAQ

Get answers to the most common questions asked when sending money abroad. Covers costs, fees and the best way to compare.

More Money Transfer Services