Is Felix right for you?

Felix is unique in terms of how you send money. All transfers are made through WhatsApp, making it much more convenient compared to other top money transfer companies.

However, before you start chatting with Felix to make your transfer, you should consider this.

Felix Pago is good if… | Find an alternative if… |

|---|---|

|

|

Scoring Felix

Just like for other money transfer reviews, I’ve tested Felix’s fees & rates, product features, transfer speeds, usability, user feedback, and safety.

Here’s a quick summary of what I found.

Exchange rates & fees

Felix’s fees and rates are fairly competitive, especially on small transfers.

You can expect to pay a fee of around $2.99 - $27.99, depending on the amount and destination, as well as a markup of around 0.61% - 2.21%.

Transfer speed

Transfer limits

Product offering

Ease of use

Regulation and safety

Customer feedback

Before you choose whether to transfer funds overseas with Felix, here’s a quick summary of the benefits and drawbacks.

Pros

Cons

Felix fees and exchange rates

Exchange rates

Just like any other money transfer company, Felix charges a markup on transfers abroad. This is the percentage difference between their rate and the real mid-market rate (learn more about it here).

In this case, the exchange rate markup can range somewhere between 0.5% and 2.2% depending on the currency you send.

Here’s the table summarising Felix’s exchange rates to give you an idea of what to expect.

Felix supported currencies | Felix exchange rate | Felix fee | Receive amount |

|---|---|---|---|

USD / COP | 3611.5200 | $2.99 | $1,794,961.56 |

USD / DOP | 59.5100 | $2.99 | $29,577.07 |

USD / GTQ | 7.5800 | $2.99 | Q 3,767.34 |

USD / HNL | 26.4800 | $2.99 | L 13,160.82 |

USD / MXN | 16.9400 | $2.99 | $8,419.35 |

International transfer fees

Felix Pago fees are fixed but vary depending on the country, the transfer amount, and the delivery method.

Here’s a breakdown of their fees:

Country | Type | To Bank Account | To Cash Pickup |

|---|---|---|---|

Mexico | Flat fee | $2.99 flat | $4.98 flat |

Colombia | Flat fee | $2.99 flat | $4.98 flat |

Guatemala | Flat fee | $2.99 flat | $4.98 flat |

El Salvador | Flat fee + percentage | $3.99 + 1.25% | $4.99 + 1.25% |

Honduras | $0 - $200 | $5.99 | $5.99 |

Honduras | $200 - $400 | $7.99 | $7.99 |

Honduras | $400 - $600 | $8.99 | $8.99 |

Honduras | $600 - $800 | $10.99 | $10.99 |

Honduras | $800 - $1,000 | $11.99 | $11.99 |

Honduras | $1,000 - $2,000 | $19.99 | $19.99 |

Honduras | $2,000 - $3,000 | $27.99 | $27.99 |

Dominican Republic | USD payout | $2.99 + 1% | $3.99 + 1% |

Dominican Republic | DOP payout | $2.99 flat | $4.98 flat |

However, they often offer the first transfer for free.

In addition to these, there are also cash deposit fees depending on where you do it:

Retailer | Fee per Cash Deposit |

CVS | $3.95 |

7-Eleven | $3.95 |

Walmart | $3.74 |

Casey’s | $3.95 |

Walgreens | $3.95 |

Office Depot | $3.95 |

*These only apply if you are paying in cash for your transfer.

It might seem like a lot, but this is a great offering, considering many other companies charge a percentage fee.

For example, on a $1,000 transfer to Mexico, Wise would charge around 6.59 USD vs $2.99 with Felix.

So why not use Felix for all your transfers?

Well, the total fee is the combination of the exchange rate markup and the fee.

Most of the time, a better exchange rate will outweigh lower fees.

To make it a bit easier to understand, let’s take a look at a few transfer examples below.

As you can see, Felix is not the worst, but also not the best in terms of price. And this is where you need to decide: do you need convenience or a better deal?

Transfer speed

Based on our testing, you can expect most transfers to settle within minutes, but it will depend on the amount, the deposit method, and the delivery method.

Generally, you can expect the following:

Bank deposits

Once the payment is completed, the money should be available immediately. If you’re making a cash deposit, it can take around 15-30 minutes.

Cash pickup

If you’re depositing with a card/bank for cash pickup, money will be available immediately. Similarly to bank deposits, if you’re paying by cash deposit at a store, it can take around 30 minutes.

In some cases, cash pickup may take up to a day, depending on the processing in place, but this is rare, according to Felix.

Barcode processing

If you’re depositing money in the US store, Felix can take around 15 minutes to process the deposit before applying the transfer times above.

In rare cases, if you are sending money to a bank account, the receiving bank may delay the transfer while performing extra security checks.

Transfer limits

Depending on your account status, your limits and account type will change.

The accounts you can have with Felix are:

Basic Level: When you just sign up with minimal information.

Advanced Level: Once you verify your identity, your limits will increase.

This is what the limits to like for Felix Pago:

Level | Daily Limit | Monthly Limit | 6-Month Limit |

|---|---|---|---|

Basic Level | USD 1,500 | USD 3,000 | USD 18,000 |

Advanced Level | USD 2,999 | USD 9,999 | USD 30,000 |

Minimum Transfer | USD 0.50 | USD 0.50 | USD 0.50 |

You can find more information about this on their website here.

This is done to ensure the safety of money transfers and compliance with regulators.

In addition to these limits, there are also limits on cash deposits in the US retail stores (CVS, Walmart, 7-Eleven, etc.):

Per transaction: $20 min / $500 max

Per day: up to $1,500 (3 transactions of $500)

Per week: up to $3,500

Per month: up to $5,000

Transactions allowed: 3/day, 12/week, 20/month

Essentially, this means that:

If you’re sending by card or bank transfer, your daily/monthly limits depend on whether you’ve verified your ID.

If you’re sending by cash deposit, your per-transaction cap is $500, with those daily/weekly/monthly limits layered on top.

Product offering

Felix is simple and unique at the same time. Their coverage is low compared to competitors, but the simplicity of WhatsApp transfers is unmatched.

Supported currencies & destinations

Felix Pago has a very simple product offering.

You can send money from the US to:

Country | Currencies |

|---|---|

Mexico | MXN |

Guatemala | GTQ |

Honduras | HNL |

El Salvador | USD |

Dominican Republic | DOP & USD |

Colombia | COP |

Nicaragua | USD |

Compare your options

Payment methods

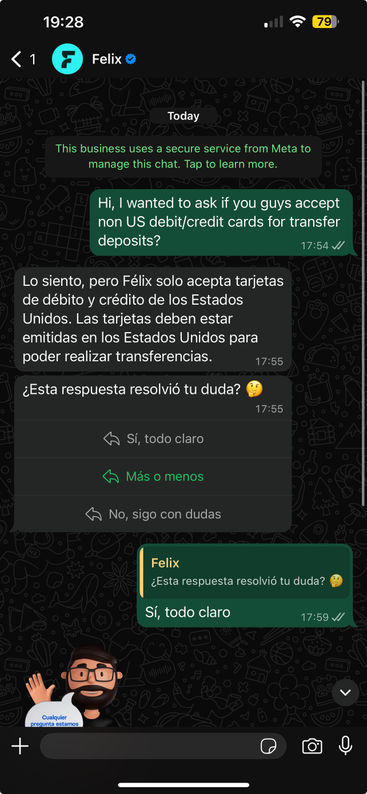

Felix accepts multiple payment methods, however, most need to be US-based, these include:

US debit cards

US credit cards

US bank accounts

Cash deposits at US retail stores (barcode payments)

We suggest avoiding credit cards because they are generally the most expensive due to additional cash advance fees charged by credit card companies.

Instead, use a debit card or a bank transfer if you can.

Delivery methods

Felix allows transfers to mobile wallets, bank accounts, and cash pickup.

Digital wallets

You can send money from WhatsApp to wallets like Mercado Pago, Nu, and Spin by OXXO. The money will land directly into the receiver's wallet without them needing to do anything.

Bank account deposit

This is the most traditional withdrawal method. Money will arrive in the recipient's bank account without them needing to do anything.

It usually takes a few minutes for the money to arrive, but the receiving bank may delay the transfer for security checks.

Cash pickup

This is one of the most popular pickup methods in Colombia, Mexico, Guatemala, Honduras, El Salvador, Dominican Republic, and Nicaragua. The receiver will need to show their ID and might need to provide transfer details (transfer number, your name, amount, etc.).

Cash pickups are usually available the next working day.

For cash pickup, here are a few examples of where you recipient can pick up the cash:

Mexico

Guatemala

Honduras

Ease of use

Felix has no app or website portal, all transfers are handled through the WhatsApp chat.

It is one of their main selling points, because it’s probably the most convenient way to send money that I’ve ever seen.

The process is simple, fill in your details on the site, and start chatting on WhatsApp.

The whole process takes less than 5 minutes from starting to money being sent.

However, I did find a few nuances while testing it out, mainly related to their English website.

Firstly, the EN website is partially not translated, so if you don’t speak Spanish, you may find it a bit confusing. Also, the instructions you get in Felix chat are in Spanish.

There is a decent blog section on Felix's website, however, there’s not enough information on getting help, getting started, or anything related to using them for that matter.

However, considering their primary offering is towards Spanish-speaking users, I don't think these are major issues.

Customer service

Customer service options are lacking with Felix, however, the actual service is good.

You can only get support via WhatsApp, which is available 24/7 regarding any problem (be it refunds or security issues).

I’ve messaged them to confirm a few bits on this review, and they responded fairly quickly.

Safety and trust

Felix is regulated and takes security and safety very seriously.

Legitimacy of Felix

Key industry partnerships

Protection of customer data

KYC

Customer feedback

Feelix has a 4.2 rating on Trustpilot from 350 users. This is not much, but generally it is positive.

Most users tend to say that they are great at the start, and the service tends to get a bit worse over time, while others say it’s super convenient, great value, and easy to use.

You can also check out some Felix reviews from our users at the bottom of this page.

Opening an account with Felix

To open an account with Felix, you will need the following for a basic account:

Full name

Date of birth

Email address

Physical address

And to get verified, you will need:

Government-issued ID

Once you have these details, you simply need to:

Navigate to Felix's website on your phone

Fill in your phone number and click “start free transfer”

This will open a new WhatsApp message with Felix

Making international transfers

To send money with Felix, you will need to know the following:

Recipient details

A US debit/credit card or bank account

Sending money abroad via WhatsApp

Once you have all the details ready, you can send money with Felix by following the steps below.

Start a chat on WhatsApp

Instead of downloading a separate app, you simply start a conversation with Felix’s official account. This is where you’ll manage your transfer from start to finish.

Provide transfer details

The chat will guide you through a few questions, including who you want to send money to, how much you’d like to send, and whether the recipient should receive funds into a bank account, a digital wallet, or as cash pickup.

Get a payment link

Once you’ve entered the transfer details, Felix generates a secure payment link. This link allows you to choose your preferred payment method: US debit card, US credit card, US bank account, or cash deposit at a participating retail store.

Complete the payment

If you’re paying by card or bank transfer, you complete the payment directly online. If you choose cash deposit, you’ll need to use the barcode method (detailed below).

Get the receipt and confirmation

Felix immediately provides a digital receipt in the WhatsApp chat.

Canceling transfer

If you’ve made a mistake, you can just message Felix in the same chat. If your transfer hasn’t been processed yet, they will be able to stop it.

However, most transfers take minutes, so you need to be very quick. If it has been processed, it’s unlikely they will be able to revert it.

How to Pay with a Barcode (Cash Deposit in the US)

To make a transfer with a cash deposit, follow these steps.

Generate a Barcode in WhatsApp

If you prefer to pay with cash, Felix will generate a unique barcode during the payment process. This barcode is valid for one hour and can be shown on your phone or printed out.

Visit a Participating Retail Store

Take the barcode to a participating US store such as CVS, Walmart, 7-Eleven, Walgreens, Office Depot, or Casey’s. These stores act as cash deposit partners for Felix.

Hand Over Cash and Pay the Store Fee

At the register, the cashier scans your barcode. You hand over the cash for your transfer plus the store’s fee (typically around $3.74 - $3.95, depending on the retailer).

Processing and Confirmation

Once you’ve paid, the store sends the deposit information to Felix. It usually takes around 15 minutes for the payment to register in Felix’s system. After that, the transfer continues as normal.

Receive international transfers

Depending on where the money was sent, there’s not much you need to do to receive it:

If sent to a bank account, the money will be deposited instantly into the given account

If sent to a wallet, the funds will appear in the recipient’s balance

If sent for cash pickup, the recipient can collect the funds at a local partner location, often within 30 minutes

Does the recipient need an app or account with Felix?

No, you don't need to have a Feelix account or an app to receive the funds. All money is sent through WhatsApp and directly to the recipient's bank account, mobile wallet, or for cash collection.

How Felix compares to other transfer services

Other Alternatives

Another alternative to money transfer apps is to use a challenger bank (also known as neo banks). These give you the benefit of a multi-currency account and banks in one app.

Felix: Is it good for transfers abroad?

Overall, Felix is a great service and I would suggest you try it out.

Its offering is very niche (only covering 7 destinations), but the fees are fairly competitive for small transfers home compared to other companies.

I always recommend comparing your options first to find the best deal, especially on bigger transfers. But here, if you only need to send a few hundred abroad once in a while, I’d suggest you check them out.

Help & FAQ

Get answers to the most common questions asked when sending money abroad. Covers costs, fees and the best way to compare.

More Money Transfer Services

Felix user feedback

Comments

Patricia Madera Soriano

Terrible experience. As of now, 29 hours after being charged for a transaction that has not gone through. No response from anyone other than virtual assistants or call center agents, who cannot say more than how sorry they are. Found the CEO and CFO emails and thought it would help, but my message was rejected by their servers. Now I am facing serious consequences for using Felix Pago services. Be careful.