Send money from the US to the Philippines online

"Over 16 million customers use Wise, mostly for their excellent mobile app, transparent fee structure & use of mid-market rates. Now increasingly used for larger transfers."

"24/7 live chat support provided in six languages. Special first transfer rates available, with airtime topup supported to many countries in Africa, Asia and South America."

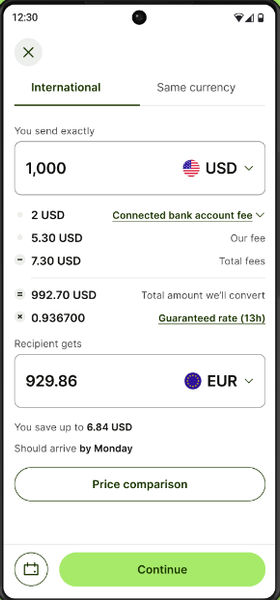

"Sendwave is trusted by over 1 million users across the US, UK, Canada and EU. 24/7 support is available online and via the app."

"24/7 live chat support provided in six languages. Special first transfer rates available, with airtime topup supported to many countries in Africa, Asia and South America."

"OFX have been helping individuals and businesses send money for over 25 years. Transfer in 50+ currencies to 170+ countries, with 24/7 phone access to currency experts."

"Securely send money to and from 150+ countries and 20+ currencies. Same-day transfers avaialble on most major currencies."

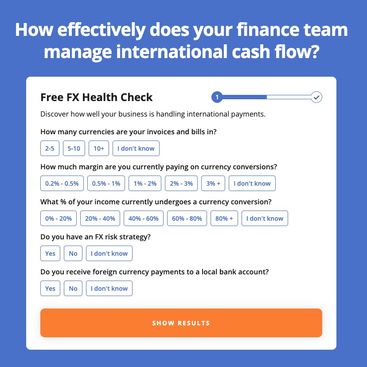

"Over 16 million customers use Wise, mostly for their excellent mobile app, transparent fee structure & use of mid-market rates. Now increasingly used for larger transfers."

"Remitly focuses on sending money to friends and family in Asia, Africa and South America. Wide coverage and well-suited to regular transfers home."

"Western Union agents help you send money from a wide variety of countries. Find a local branch near you to deposit cash and send your funds abroad."

"With MoneyGram you can send money globally. Find a local MoneyGram branch near you to deposit and send cash abroad."

"Over 16 million customers use Wise, mostly for their excellent mobile app, transparent fee structure & use of mid-market rates. Now increasingly used for larger transfers."

"24/7 live chat support provided in six languages. Special first transfer rates available, with airtime topup supported to many countries in Africa, Asia and South America."

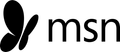

Managing business payments between the US and the Philippines?

In our experience, there are always efficiencies to be made in how businesses manage payments between the Philippines and the US.

Why not take our free FX health check test to see how effective your business is in managing these? It only takes a couple of minutes.

Compare today's USD to PHP (US Dollar to Philippine Pesos) exchange rates

The key to lower fees is understanding the mid-market rate. The mid-market rate is how much your USD is worth in PHP. This value is the ‘real’ exchange rate that constantly moves around and directly affects how much PHP you will receive. The best rate to send money to the Philippines is when USD/PHP reaches the highest value (which is 59.0465).

Over the last 7 days, we’ve seen:

The USD-PHP exchange rate average at 59.0057 Philippine peso per USD.

The highest rate to send money to the Philippines was 59.0465 PHP, while the lowest was 58.8645 PHP per dollar.

There are currently 14 providers offering USD-PHP transfers close to this rate.

It is hard to predict the best day and time to send money to the Philippines, however, waiting a day or two can result in a better rate and more PHP on the other end.

Want to secure the best USD-PHP deals?

Sign up for our rate alerts and we'll tell you when it's the best day and time to buy Philippine pesos.

Latest USD to NGN Conversion Rates

Here are the latest USD-PHP exchange rates for popular conversion amounts. These are the ‘real’ exchange rates, the actual payout will vary depending on the money transfer company used.

| USD | PHP Price |

|---|---|

| 1 USD | 59.04 |

| 10 USD | 590.45 |

| 50 USD | 2952.23 |

| 100 USD | 5904.45 |

| 1000 USD | 59044.50 |

| 100000 USD | 5904450.30 |

| PHP | USD Price |

|---|---|

| 1 PHP | 0.02 |

| 10 PHP | 0.17 |

| 50 PHP | 0.85 |

| 100 PHP | 1.69 |

| 1000 PHP | 16.94 |

| 100000 PHP | 1693.60 |

How much does it cost to send money to the Philippines?

The total cost of sending PHP from the US is made of a combination of fees and exchange rate markup.

The exchange rate markup is what transfer companies (including banks and apps) add on top of the ‘real’ USD/PHP rate.

Based on our analysis of 14 companies offering USD to PHP transfers, Wise offers the best deal with no exchange rate markup and very low fees on PHP transfers.

Do not use your US bank for transfers to the Philippines

Based on our analysis, banks charge around 4-7% exchange rate markup and have much higher fees ranging from $25 - $75 per transfer.

About money transfers to the Philippines from the US

Ways to send money to the Philippines from the USA

Philippines remains a cash-based society event in 2025, however, almost 33% of the population now use mobile apps and e-wallets.

This is why it is important to consider how are you going to make the transfer (to save on fees) and how your recipient will receive it.

Ways to receive money in the Philippines

Bank account

This is the most common withdrawal method and is usually the cheapest option. Depending on the amount of USD you send, it might take a bit longer but usually is almost instant.

All money transfer companies support this delivery method, and will likely process your transfer as an ACH transfer (which is cheaper compared to SWIFT transfers).

The recipient will have PHP land in their account without them needing to do anything.

Foreign-currency accounts

Apps

Pre-paid cards

Cash pick up & home delivery

Airtime

The best way to send money to the Philippines from the USA is a bank transfer with Wise

Our analysis of 14 companies shows that Wise is the premier service for sending money to the Philippines from the US.

The biggest standout feature of Wise is its commitment to using the mid-market exchange rate for USD-PHP conversions.

This means when you send USD to the Philippines, you will get 59.0445 PHP per US Dollar, without any hidden fees eating into the amount your recipient gets.

Wise fees are clear and transparent, you will know exactly how much the receiver will get. For example, a $200 to PHP transfer would cost you $4.5 in total vs $45 with Bank of America in fees alone.

Wise also offers a highly useful multi-currency account, ideal for those who juggle finances in more than one currency.

You can hold, manage, and send money in multiple currencies, all within one account. This flexibility is a game-changer for many users, making international financial management a breeze.

Wise is fair, and transparent, and often leads to significant savings compared to traditional banks or other money transfer services.

Watch our Wise video review

The cheapest way to send money to the Philippines from the USA is with Sendwave via the bank transfer

Sendwave offers the best rates and lowest fees for USD to PHP conversion and transfers.

They offer a fee of 0* USD and an exchange rate markup of 0.12% on top of the ‘real’ USD-PHP rate.

*The most common fee applied to USD-PHP by Revolut.

The fastest way to send money to the Philippines from the US is with XE

Our analysis shows that XE stands out as the fastest service for sending money to the Philippines.

Most of the USD to PHP transfers will arrive within minutes with XE, which is similar to Wise.

However, one of the most appealing aspects of using XE is the absence of transfer fees for amounts over $500, as well as, uncapped transfer limits out of all 18 providers.

This feature is a game-changer for those who regularly send large sums of money, as it significantly reduces the cost, and will still arrive within minutes to the Philippines.

XE is still slightly more expensive than Wise due to the exchange rate markup, but if you need PHP fast, this is your best option.

For example, a $5,000 transfer with XE will get you ₱288,320 within minutes vs ₱288,547.03 with Wise in one business day.

This flexibility, combined with the convenience of a user-friendly platform, makes XE a reliable and efficient choice for PHP transfers from the US.

Whether you're supporting family back home or managing business transactions, XE provides a swift and secure service that you can count on.

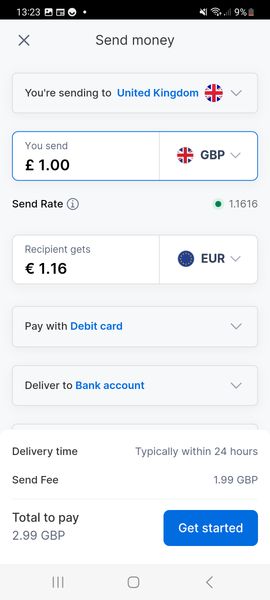

The easiest way to send money to the Philippines from the US is with Wise

The ease of use of the Wise app cannot be overstated. Designed with user experience in mind, the app makes it straightforward to send money on the go.

Its intuitive interface ensures that whether you're a tech guru or someone who prefers simplicity, you'll find managing and sending USD to the Philippines hassle-free.

This, combined with the real-time tracking feature, gives you peace of mind, knowing exactly where your money is and when it arrives in the Philippines.

Sending over $20,000 to the Philippines?

Regency FX is the best option for large PHP transfers from the US

Regency FX is a currency broker with bespoke exchange rates and fees.

Every transfer will be handled individually, by your dedicated account manager. This means, that if you have any questions, concerns, or need to negotiate the rates, you will speak to the real human within minutes of your request.

With the large transfers to the Philippines, you need to prioritize the support, safety, and fees involved.

Regency FX will give you exactly that, and more, for every transfer you make.

How to send money from the USA to the Philippines online

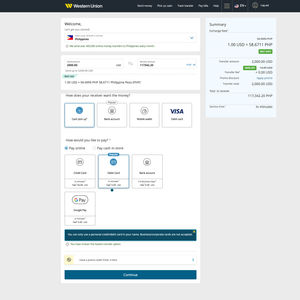

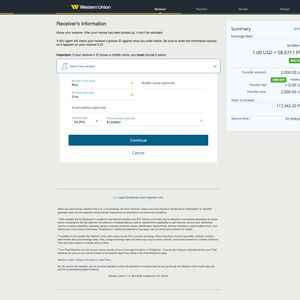

Considering the cash dominance in the Philippines, you will likely want to send a cash transfer for pick up in the Philippines. Here is a step-by-step guide on how to make a cash transfer with Western Union.

USA to the Philippines money transfer payment methods

Bank transfers

Bank transfer is the most popular deposit option in the US because most transfers are made via ACH which is cheap and quick.

Based on the analysis of 14 companies supporting the Philippines, we found Wise and Revolut to offer the best USD-PHP rates.

Either option is great for one-off transfers, recurring transfers, or traveling from the US to the Philippines.

For larger transfers, we recommend using Regency FX or XE with bank transfers, their limits are higher, support is better, and much more responsive.

Debit cards, credit cards, and pre-paid cards

Debit card payments are quicker than bank transfer deposits but are a bit more expensive. This is because most US terminals charge a small fee, so for the companies, it is more expensive to run.

We found Wise to be the best company to use with a debit card.

You can also use a credit card to deposit USD and receive PHP, but it is much more expensive, as the deposit will count as a cash advance, incurring additional cash advance fees.

Mobile money apps

Besides cash, mobile money is the most popular payment method in the Philippines.

If you are from the Philippines and have your e-wallet with you, such as GCash, M-PESA, or Maya, you can use it to fund the transfer with WorldRemit and Wise.

What’s better, with Wise you can send money to GCash as well, making it more convenient for the recipient.

Apple Pay & Google Pay

While GCash and Maya are popular in the Philippines, Google Pay and Apple Pay are popular in the US.

You can use both to fund your transfer at most of the 14 money transfer companies servicing transfers from the US to the Philippines.

The process is slightly different because you can’t use these to fund the transfer directly, instead, you will use Apple Pay and Google Pay to top-up your balance, and use the balance to fund the transfer.

We recommend using Wise or Western Union depending on how you want the money delivered in the Philippines.

Cash

Cash deposits are not as popular in the US as they are in the Philippines, however, it is still a viable deposit option.

Although you can’t send a money order to the Philippines, you can use cash to fund your transfer in the physical store.

All you need to do is visit your local Western Union, MoneyGram, or Ria Money Transfer branch, provide the details, and hand over the cash to pay for the transfer.

Cash transfers and the fees are paid in USD on top of the amount you are sending.

Need to send money from the US to a Filipino bank account?

You don’t need to use your bank to send money to a Filipino bank account. Using your bank to wire money to a Filipino bank account will be much more expensive.

Instead, use a money transfer service like Wise to link your bank account and send money directly to major banks in the Philippines, including BDO, IBC, LBP, Metrobank, BPI, and others.

Tips for sending money from the USA to the Philippines

Consider USD and PHP transfer limits

There is no limit on how much money you can send to the Philippines, as well as, there is no legal limit on how much you can send from the US.

The main limits to be aware of are the limits imposed by the transfer method you use. In our experience, money transfer companies offer the highest limits.

Here’s a quick overview:

Western Union will cap the transfer at $19,000 to the Philippines

Wise will cap the receiving amount at 9,000,000 PHP (around 155,000 USD)

XE has no transfer limit, however, for transfers over $423,000 you will need to contact them directly instead of using the online portal

Bank of America is limited to $1,000 per transaction

In addition, if you’re sending over $10,000 to the Philippines, the transfer will be submitted to and reviewed by the IRS.

Choose the right transfer method method

Consider how quickly you need PHP

Are you making a recurring or scheduled transfer to the Philippines?

Tax obligations on money transfers to Philippines

Money transfers from the US to the Philippines are not taxed by themselves, however, the key here is the nature of the transfer.

Depending on the nature of the transfer, there may be tax obligations in the Philippines including gift tax, business tax, income tax, capital gains tax, or estate tax.

Personal remittance

Personal money transfers from the US are not taxed in the Philippines, so most senders and recipients will not need to pay direct taxes on remittances to the Philippines.

Receiving gifts

The Philippines has implemented strict guidelines on gifts from abroad, the US included.

For any gifts over ₱250,000 (~$5,000), there is a 6% tax rate.

If you are sending over $15,000 to the Philippines in a single year (be it one-off or multiple small transfers), you may also be subject to gift tax on the excess.

However, there are exemptions that many Filipino expats in the US will fall under. If you are sending money for:

If you make a transfer to a minor dependent child, meaning the remittance is for the sole benefit of the child, you may be exempt from the gift tax.

If you send money to family members and it’s under $15,000 (for example sending $5,000 to your sister and $8,000 to your father), you may be exempt from the gift tax.

If you send money to your own bank account in the Philippines. But as we’ve mentioned before, any transfer over $10,000 must be reported to the IRS and the transfer may be subject to other guidelines.

Please note, that this is for general information only, make sure to consult your tax advisor before making any transfers to the Philippines if you are unsure.

Income taxes

Any transfers from America to the Philippines representing any type of earning (such as earnings from employment or freelancing, profits from a business, payments for services and goods, etc…) are considered taxable income.

Income tax brackets vary, but here is the general summary:

Amount of Net Taxable Income (PHP) | Tax Rate |

|---|---|

₱250,000 and below | 0% |

Over ₱250,000 – ₱400,000 | 15% of the excess over ₱250,000 |

Over ₱400,000 – ₱800,000 | ₱22,500 + 20% of the excess over ₱400,000 |

Over ₱800,000 – ₱2,000,000 | ₱102,500 + 25% of the excess over ₱800,000 |

Over ₱2,000,000 – ₱8,000,000 | ₱402,500 + 30% of the excess over ₱2,000,000 |

Over ₱8,000,000 | ₱2,202,500 + 35% of the excess over ₱8,000,000 |

Filipino nationals working abroad

Filipinos working abroad and sending money home to family will be exempt from Filipino income taxes as long as they are registered with the Philippine Overseas Employment Administration (POEA).

Those who are registered with POEA, are treated as Overseas Filipino Workers (OFWs) who are exempt from Filipino income taxes.

Business transfers

If you have a business in the Philippines and send money from the US, the government takes 20-25% of any after-tax profits.

This is because the transfer is usually much larger which makes it cheaper, and the individuals involved in the transfer do not rely on these payments directly.

There are a lot of nuances and earning brackets involved, please consult with your tax advisor before proceeding with large business payments.

This information is intended for general guidance and should not be taken as professional tax advice. Please speak to a tax professional for more information.

How we analyze the market

We track the cost, speed, and product offerings of the leading money transfer services available in Philippines.

Our comparison engine and algorithms evaluate providers based on over 25 factors, including transfer fees, ease of use, exchange rates, mobile apps, transfer times & customer support.

We also consider how these services are rated on platforms like TrustPilot, AppStore, and Google Play, giving you a comprehensive view of what to expect.

This thorough analysis helps you get the best available deal - every time you want to move money to Philippines.

We also provide unbiased and detailed reviews of all the top money transfer companies. You can use these reviews to find the best service for your needs when sending money to Philippines

For a deeper understanding of our commitment to integrity and transparency, we invite you to read our editorial policy and review methodology.

.svg)

.svg)