Wells Fargo for international wire transfers

Here’s an overview of Wells Fargo’s international transfers, and how they compare to money transfer companies.

Transfer type | Wells Fargo | Money Transfer Companies |

|---|---|---|

Sending fees | $25 - $50 per transfer | $0 - $20 |

Receiving fees | $15 per transfer | $0 |

Exchange Markup | Around 6% | 0% - 2% |

Transfer Times | 1 - 5 business days | Instant - 3 business days |

Payment Methods |

|

|

Compare now to get the best transfer rate

Scoring Wells Fargo

It’s important to consider lots of things when making a transfer with Wells Fargo.

The obvious consideration is cost, but there’s also customer service quality, how easy it is to transfer money with Wells Fargo, and how quickly your money will arrive.

While transferring with your checking account may seem easier than using another provider, you might be surprised.

International transfers with your bank can take a long time, and often you’ll need to visit your local branch to be able to authorize them.

We’ve looked at and analyzed the exchange rates, transfer costs, support, and online user reviews. Here’s a quick summary of the top highlights and drawbacks.

Pros

Cons

Wells Fargo fees and exchange rates

Fees and rates

Exchange rates

Like a lot of traditional banks, Wells Fargo adds a markup to the mid-market exchange rate when you make an international transfer.

On average, we found that they add a 6% markup to the exchange rate, meaning you’ll get 6% less money back on your exchange than you would if you used the mid-market exchange rate.

Here are a few examples of where we got it from.

Amount | Wells Fargo rate | Mid-market rate | Markup |

|---|---|---|---|

1 USD | 15.98 MXN | 17.10 MXN | 6.55% |

1 USD | 51.08 PHP | 56.04 PHP | 9.72% |

1 USD | 0.76 GBP | 0.79 GBP | 4.78% |

*Calculated on 28/02/2024.

Can you exchange money for what it’s actually worth?

You can get the right value for your exchange if you use a provider that offers the mid-market rate on exchanges.

Online money transfer providers like Wise, Revolut, and Instarem all make exchanges using the mid-market rate, but there’s a small fee for your transfer.

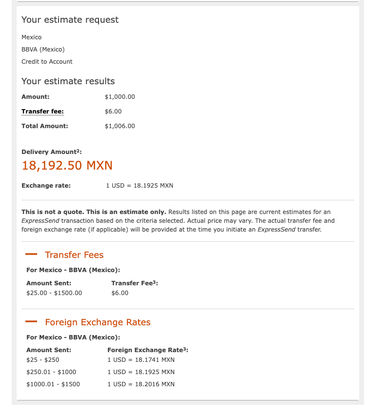

However, Wells Fargo does offer ExpressTransfer service, which limits the location and transfer limits but is much cheaper for smaller transfers.

Let’s take a look at the example below.

Practical example

Let’s assume you are making a $1,000 transfer from the US to Mexico BVAA bank.

According to Wells Fargo, the exchange rate is 1 USD = 18.1925 MXN via ExpressTransfer, as well as a $6.00 fee on top. This means you will need to deposit $1,006 and will receive 18,192.50 MXN.

In comparison, using Wise you could send money at the mid-market rate (1 USD = 18.3848 MXN) and pay a 0.35% fee. This means you will send $1,000 ($996.50 minus the fee) and receive 18,320.45 MXN.

Meaning, you deposit less and get more with a money transfer company.

Here's how online reviews reflect Wells Fargo fees in comparison to Wise.

International transfer fees

Wells Fargo charges for incoming international wire transfers.

Receiving an international wire transfer into your Wells Fargo account costs $15. This isn’t uncommon; a lot of traditional banks charge a fee for receiving wire transfers.

They also charge a foreign transaction fee, these range from $4 - $30 per transfer, depending on your transfer method and where you’d like to send the money.

International wire transfers have a flat fee of $30.

While, bank deposits and cash transfers with ExpressSend are a bit cheaper, between $4 and $8 per transfer (for example, sending $1,000 from the US to Mexico will cost you $6).

Below is a summary of the transfer fees and rate markups on Wells Fargo wire transfers. We’ve compared them to two transfer providers, Wise and Xe, to put them into context.

Transfer amount | Wells Fargo | Wise | Xe | |||

|---|---|---|---|---|---|---|

FX margin (approx) | Fees | FX margin | Fees | FX margin (approx) | Fees | |

$250 | $16.37 | $30 | Mid-market rate | $5.77 | $2.25 | $3 (variable). |

$1,000 | $65.50 | $30 | Mid-market rate | $10.33 | $9 | None |

$5,000 | $327.50 | $30 | Mid-market rate | $37.57 | $45 | None |

Transfer amount | Wells Fargo | Wise | Xe | |||

|---|---|---|---|---|---|---|

FX margin (approx) | Fees | FX margin | Fees | FX margin (approx) | Fees | |

$250 | $12.68 | $30 | Mid-market rate | $2.44 | $2.25 | $3 (variable). |

$1,000 | $50.70 | $30 | Mid-market rate | $7.37 | $9 | None |

$5,000 | $253.50 | $30 | Mid-market rate | $33.63 | $45 | None |

Transfer amount | Wells Fargo | Wise | Xe | |||

|---|---|---|---|---|---|---|

FX margin (approx) | Fees | FX margin | Fees | FX margin (approx) | Fees | |

$250 | $24.30 | $30 | Mid-market rate | $2.98 | $2.25 | $3 (variable) |

$1,000 | $97.20 | $30 | Mid-market rate | $8.43 | $9 | None |

$5,000 | $486.00 | $30 | Mid-market rate | $37.48 | $45 | None |

Transfer amount | Wells Fargo | Wise | Xe | |||

|---|---|---|---|---|---|---|

FX margin (approx) | Fees | FX margin | Fees | FX margin (approx) | Fees | |

$250 | $11.70 | $30 | Mid-market rate | $2.18 | $2.25 | $3 (variable). |

$1,000 | $46.78 | $30 | Mid-market rate | $6.82 | $9 | None |

$5,000 | $233.88 | $30 | Mid-market rate | $31.49 | $45 | None |

Transfer amount | Wells Fargo | Wise | Xe | |||

|---|---|---|---|---|---|---|

FX margin (approx) | Fees | FX margin | Fees | FX margin (approx) | Fees | |

$250 | $18.07 | $30 | Mid-market rate | $3.94 | $2.25 | $3 (variable). |

$1,000 | $72.25 | $30 | Mid-market rate | $13.63 | $9 | None |

$5,000 | $361.22 | $30 | Mid-market rate | $65.25 | $45 | None |

Transfer amount | Wells Fargo | Wise | Xe | |||

|---|---|---|---|---|---|---|

FX margin (approx) | Fees | FX margin | Fees | FX margin (approx) | Fees | |

$250 | $11.95 | $30 | Mid-market rate | $2.22 | $2.25 | $3 (variable). |

$1,000 | $47.78 | $30 | Mid-market rate | $6.93 | $9 | None |

$5,000 | $238.89 | $30 | Mid-market rate | $31.99 | $45 | None |

*Fees taken 28/02/2024.

We've also looked at what online users have to say about Wells Fargo in terms of fees (and how it compares to Wise).

Transfer speed

Transfer speed

On average, international transfers with Wells Fargo take around 2-7 business days.

Most money transfer providers are quicker than this, with Wise and Xe being some of the fastest transfer providers out there.

As for the user reviews, it looks like Wells Fargo's transfer speed is worse than money transfer provider Wise, averaging around 1/5.

Transfer limits

Transfer limits

The daily transfer limit varies depending on where you’d like to send the money, ranging from $600 to $5,000 for bank credits, and $500 to $1,500 for cash pickup.

There’s a consecutive 30-day limit on all transfers of $12,500.

Wire transfers are limited to $25,000 per transfer, but this can be lifted in some cases if you visit a Wells Fargo branch.

All these amounts are on the low side when compared to most transfer providers. Global66 for example has the strictest limits at $15,000 per transfer, with some providers like TorFX and OFX having no upper transfer limits.

Similar to what we found, lower transfer limits are mentioned in user reviews. On average Wells Fargo is rated as 1/5 for transfer limits.

Product offering

Product offering

Wells Fargo lets you send money abroad by wire transfer, credit deposit, or cash for pickup.

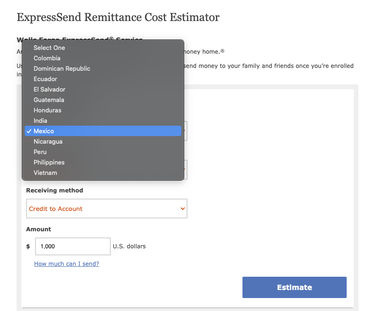

Bank deposits and cash transfers are available through ExpressSend, but this can only send money to 12 countries around the world.

Wire transfers are managed by Wells Fargo directly. They cost $30 each, and add a markup of about 6% to the exchange rate.

Keep in mind

You can send money from your Wells Fargo account to an international money transfer provider. Transfer providers are cheaper than sending wire transfers with your bank, and they’re often faster too.

There’s no fee for buying foreign currency with Wells Fargo, but there is a markup of around 6% on the mid-market exchange rate.

You can buy more than 50 different currencies with Wells Fargo, including:

You can order these as cash, or request them online, via mobile, in a branch, or over the phone.

Online

You can order foreign currency via Wells Fargo Online. Log into online banking, go to Accounts, and select ‘Foreign currency cash’.

Mobile

You can order your foreign currency via the Wells Fargo Mobile app. Tap the Menu button, tap Account Services, and choose ‘Foreign Currency’.

In-person

If you’ve got an account with Wells Fargo, you can go to your local branch and order foreign currency for pickup. You won’t be able to get your currency right away.

By phone

You can contact Wells Fargo using their phone number, 1-800-626-9430. Lines are open Monday - Friday 8 am - 8 pm, and Saturday 10 am - 5 pm, Eastern Time.

They can arrange for your foreign currency to be delivered to your home address or your local branch.

Similar to other areas of this review, Wells Fargo is rated 1/5 on average for the product features. Companies like Wise outperform traditional banks due to their innovative, online only approach.

Ease of use

Ease of use

In terms of ease of use, Wells Fargo is just like any regular bank. Online reviews suggest they have a decent offering and an easy-to-use platform (even when compared to money transfer providers).

Customer service

Wells Fargo offers a lot of support options, here's a table summarizing the options:

Support Option | Description | Availability |

|---|---|---|

Customer Service Phone | General customer service for personal banking | 24/7 |

Online Banking Support | Help with online banking issues | 24/7 |

Mobile Banking Support | Assistance with the Wells Fargo mobile app | 24/7 |

Lost or Stolen Cards | Report lost or stolen debit/credit cards | 24/7 |

International Access Codes | Toll-free international customer service | Varies by country |

Social Media Support | Customer service via Twitter and Facebook | Typically responds within 24 hours |

Mailing Address | Contact through traditional mail | Standard mail delivery times |

Secure Message Center | Send secure messages via online banking | 24/7 |

Branch/ATM Locator | Find the nearest branch or ATM | Online tool available 24/7 |

Virtual Assistant (Erica) | AI-powered virtual assistant for quick queries | 24/7 |

Appointment Scheduling | Schedule in-person or virtual appointments | Online scheduling tool available 24/7 |

You can use the following details to contact Wells Fargo:

Customer Service Phone Number (U.S.): 1-800-869-3557

Online Banking Support Number: 1-800-956-4442

Lost or Stolen Cards: 1-800-869-3557 (Debit) / 1-800-642-4720 (Credit)

International Access Codes: Varies by country, available on Wells Fargo's website

Social Media: Twitter (@Ask_WellsFargo) and Facebook (Wells Fargo)

Mailing Address: Wells Fargo, PO Box 6995, Portland, OR 97228-6995

There are not many reviews for Wells Fargo support, however, it seems to be generally in line with money transfer operators. Unfortunately, in both cases, it seems to be the main pain point for the users and almost a standard in the industry.

Safety and trust

Safety and trust

Wells Fargo, as one of the biggest banks in the US is safe to use and is regulated by the Central Bank of Ireland and the OCC.

Similarly to the support, there aren't as many positives and negatives online about the safety features.

This is likely due to the general perception of high security around traditional banks. On the other hand money transfer services do get more attention from the users regarding the safety features (likely because they are newcomers to the market in comparison to the banking giants).

Customer feedback

Customer feedback

Wells Fargo is rated very low on TrustPilot, getting only 1/5 stars. In general, users seem to have mixed opinions on Wells Fargo.

ANALYSIS OF USER REVIEWS

Overall, the majority of online reviews focus on customer service and fraud protection. Customers seem to have positive experiences with Wells Fargo's customer service and fraud detection, there are considerable complaints about inefficiency, poor communication, and significant service failures that have caused distress and financial loss for others.

On the positive side, some highlight instances where staff were helpful, professional, and quick to resolve issues. For example, some mentioned satisfaction with Wells Fargo's proactive approach in detecting and addressing fraudulent activities on their account and felt supported during financial hardships such as a painful divorce. In general, users say that the staff is consistently friendly and professional, contributing to a highly satisfying banking experience.

However, many customers criticize the bank for its poor customer service, with agents described as unhelpful, lacking knowledge, and often providing inaccurate information. Some reviews highlight issues with international transactions, where the accounts are getting blocked while traveling abroad, causing severe disruption and incurring significant costs on return home to the US.

Additionally, there are accusations of mishandling disputes and engaging in practices perceived as fraudulent, further tarnishing the bank's reputation among some users.

Here's a summary of average user reviews this year.

Jan 24 | Feb 24 | Mar 24 | Apr 24 | May 24 | Jun 24 | Jul 24 | |

|---|---|---|---|---|---|---|---|

International Transfers | 0 | 0 | 0 | 5 | 3 | 1 | 1 |

Fees | 0 | 0 | 1 | 1 | 1 | 0 | 1 |

Exchange Rates | 0 | 1 | 0 | 0 | 0 | 1 | 4 |

Speed | 1 | 0 | 0 | 0 | 1 | 0 | 0 |

Limit | 0 | 0 | 0 | 1 | 0 | 0 | 1 |

Features | 1 | 0 | 0 | 1 | 1 | 1 | 1 |

Ease of Use | 0 | 0 | 1 | 0 | 0 | 0 | 1 |

Safety | 0 | 0 | 0 | 0 | 1 | 1 | 2 |

Customer Support | 0 | 0 | 0 | 2 | 1 | 1 | 1 |

*0 means there are no reviews for a given category in the given month.

Making international transfers

International transfer requirements & details

To make an international transfer with Wells Fargo, you will need the following details:

Full bank details of your recipient: you’ll their name, address, and IBAN or SWIFT code.

To transfer with ExpressSend: you’ll need to visit a Wells Fargo branch first.

To make a wire transfer: you’ll need to register for an online account first.

Wells Fargo’s SWIFT code is WFBIUS6S.

Making wire transfers

Sign in

Add the recipient’s details

Check the information and send

Bank deposit or cash pickup

To make an international bank deposit or arrange a cash transfer with Wells Fargo, you’ll need to enroll in the Wells Fargo ExpressSend service.

Contact your bank

Complete the ExpressSend service agreement

Send your transfer

Use Wise to send money from your Wells Fargo account

It may be simpler to fund your transfer with your Wells Fargo account, but use a transfer provider like Wise to send your money overseas. Here’s how.

Register for a Wise account

Add the details of your transfer

Review the received amount

Send the money

Receive international transfers

To receive an international wire transfer with Wells Fargo, you’ll need to supply the following information to the sender.

Your ABA, RTN, or SWIFT code

For domestic wire transfers, you’ll need to supply the Wire Routing Transit Number (your ABA or RTN), 121000248.

For international wire transfers, you’ll need to supply your SWIFT code or BIC: WFBIUS6S.

The bank name and address

This is Wells Fargo Bank: NA, 420 Montgomery Street, San Francisco, CA 94104.

This is the same, regardless of where your account is located.

Your account number, name, and address

You’ll need to supply your complete Wells Fargo account number, the name on your account, and the complete address of your account as it appears on your bank account.

Remember the receiving fee

There is a $15 fee for receiving a wire transfer with Wells Fargo.

It will usually be cheaper for both you and the person sending you money if they use a different method. Debit card payments, bank transfers, and specialist transfer providers are cheaper.

Most transfer providers will be able to send money directly to your Wells Fargo account, too.

How Wells Fargo compares to money transfer services

Money transfer services are cheaper, faster, and have higher transfer limits than Wells Fargo.

Transfer services like Wise are around 16% cheaper than Wells Fargo, and they’re very easy to use.

Here’s an overview of the top alternatives:

If you’re a Wells Fargo account holder, you can save money on your international transfers by using these alternatives.

Don’t worry, all of them can be funded from your Wells Fargo account.

Wise is an international money transfer service that uses the mid-market exchange rate for its transfers.

Wise fees vary depending on where you want to send your money, but they average at between $4 and $11. This is up to $26 cheaper than making an international wire transfer with Wells Fargo.

Using Wise, you can make a bank transfer from your Wells Fargo account to another country. Wise services more than 70 countries worldwide, slightly more than Wells Fargo does alone.

A lot of bank transfers made through Wise are completed instantly, too.

If you need to hold foreign currency for some reason, perhaps a holiday, Wise is great for this too. They let you open a multi-currency account which can hold up to 9 currencies at once.

You get these exchanges at the mid-market rate too, but exchanging does come with a small fee.

Xe lets you make bank transfers internationally at a much cheaper price than using a wire transfer.

There are no fees for transfers of more than $500, but there’s a small markup on the exchange rate of about 0.9%. This gives you a saving of about 5% on Wells Fargo’s markup on foreign currency exchanges.

You can send up to $535,000 per transfer with Xe, far outstripping Wells Fargo, but not quite as high as Wise’s $1.2 million, or OFX’s limitless transfers.

Finally, you can make a transfer from your Wells Fargo account to around 200 countries with Xe, and transfers are often completed in 24 hours.

If you use Wells Fargo to send money overseas with TorFX, you could save money on fees and exchange rates.

TorFX doesn’t charge a fee for its transfers, but there is a markup on the exchange rate.

You also get a dedicated account manager (like you would with many currency brokers) who can help you manage your transfer, including helping you find the best deal.

OFX has no transfer limits and a minimum transfer requirement of $1,000.

This is considerably higher than Wells Fargo’s limit of $12,500 per consecutive 30 days.

OFX doesn’t charge any fees for its transfers, but does add a small markup to the exchange rate.

While transfers aren’t quite as fast as Xe and Wise, they’re still much faster than Wells Fargo.

So, if you need to send a large amount of money quickly, OFX is a good option.

Save money getting foreign currency with Wells Fargo

The best way to save money getting foreign currency with Wells Fargo is to exchange when rates are better. You can check the mid-market exchange rate using our currency converter tool.

Other Alternatives

Alternatively, consider using one of these neobanks for international transfers.

Wells Fargo: Is it good for transfers abroad?

If you need to send money domestically, you can use your Wells Fargo account without much trouble.

But when it comes to international transfers, Wells Fargo is more expensive, more complicated, and more time-consuming than a lot of other transfer methods.

If you need to send money overseas, we recommend using one of the top money transfer companies instead. Use our comparison form below, to find the best service to send money abroad.

Find the best rates for your transfer

A bit more about Wells Fargo

Does Wells Fargo buy back foreign currency?

What are the international wire cut-off times at Wells Fargo?

Can Wells Fargo international wire transfers be reversed, recalled or canceled?

Does Wells Fargo offer currency exchange?

Does Wells Fargo have an app?

Help & FAQ

Get answers to the most common questions asked when sending money abroad. Covers costs, fees and the best way to compare.

More Banks