How to Receive Money from Abroad

Sending and receiving money abroad are two sides of the same coin. The costs of receiving can be high, and often go unnoticed. In this article I'll share tips on how to receive payments efficiently, whether we're talking $100 or $1m.

- Over 16 million customers

- Multi-currency account available

- No hidden fees

Wise is the best option for most incoming transfers, especially with their multi-currency account.

Receiving money from abroad can involve various methods like bank transfers, cash pick-up, mobile money, and multi-currency accounts. The best option is a multi-currency account from Wise. This account offers flexibility and conversion costs from 0.33% for incoming transfers.

As the recipient of an international transfer, it's easy to get a raw deal.

The sender is in control. They're the ones who set the exact timing of the transfer, as well as the way it's paid.

Will they use a money transfer company to ensure you get favourable rates? You can ask, but in many cases, it's unlikely.

Sending money to yourself?

Perfect - it should be simple to transfer in a cost effective way.

The recipient, on the other hand - other than sharing their payment account details - doesn't have much to do.

Thankfully, there is a way you can take the control back when receiving a transfer from abroad.

In this article, I'll explain exactly how, potentially leaving you with thousands more in the bank once funds are safely received.

Summary of best ways to receive

Receive method | ✅ Best for | ❌ Not great for | 👉 Offered by |

|---|---|---|---|

Receive to regular bank account | Incoming international payments in same currency | Incoming international payments in different currency | Your regular bank |

Receive to multi-currency account | Most incoming transfers | Very large incoming transfers | |

Receive as cash for pick-up | Fast transfers under $1,000 | Larger transfers, bargain hunters or those with bank accounts | Western Union, MoneyGram, Ria, WorldRemit + more |

Receive to mobile | Fast, cheap transfers under $1,000 | Larger transfers | Western Union, MoneyGram, WorldRemit, Xoom + more |

Receive as airtime | Small transfers where mobile top-up is helpful | Medium to large transfers for other purposes | WorldRemit + more |

Currency conversion vs funds transfer

When we think about receiving a transfer from another country, we often focus on the movement of funds from A to B.

That's not too surprising. Money is sitting in one country, and you want it to safely arrive wherever you are.

However, the more important part of the equation is actually the currency conversion.

That's because sending money from one country to another, in the same currency, isn't so costly.

The real driver of money wastage is inefficient, expensive currency conversion.

Keep that in mind as I talk you through an example of receiving an overseas payment.

Alternative ways to receive

For now we're focusing on receiving to a bank account. You can skip down to read about cash pick-up or receiving to a mobile wallet if that's more relevant.

So you’re expecting to receive an international payment

Let’s assume the following:

The sender is in the United Kingdom

They have £100,000 in a UK bank account and wish to send it to you

You are in the United States

You want to receive the payment to your bank account, in US dollars

Visual example - receive to regular bank account

In the first example, we show what happens if you rely on the sender, or banks.

.png)

It's clear that by not giving the sender a local payment account, you lose control of the currency conversion, and therefore the costs.

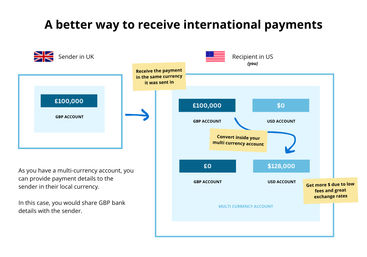

Visual example - receive to multi-currency account

In this example, you'll see how the transfer can be improved.

By simply using a multi-currency account, you can take control back.

Receive the payment in the same currency it was sent in, without any conversion fees.

You're then free to convert whenever you want to - at a lower overall cost.

Multi-currency accounts

It makes a lot of sense to consider a multi-currency account when receiving money from abroad.

Pros

Cons

The most suitable multi-currency account for receiving money will need to meet the following needs:

Competitive currency exchange rates & fees (helping you receive more money in your local currency)

Suitable limits for the size of your currency receipts

Excellent customer service

Multi-currency for business

Are you receiving international business payments?

We have a separate guide on multi-currency accounts for business.

The two standout options here are Wise and Revolut.

Let's contrast the two and see which is best for who:

Best for FX conversion rates & fees

If you're receiving and converting small amounts each month, Wise is the best option. If you're converting larger amounts, Revolut's Premium or Metal accounts could be more cost effective.

Feature | ✅ Wise | ✅ Revolut |

|---|---|---|

Exchange rates | 0% markup – offers the mid-market rate | 0% markup – offers the mid-market rate |

Currency conversion fees | From 0.35% | 0% within your plan's limit (Standard: $1,000/month, Premium: $10,000/month) From 0.5%–1% above limit Weekends: +1% fee applied |

Account fees | Individual accounts are free | Basic account is free Multiple upgrade tiers available |

If you can't decide between the two options, have a look at our in-depth comparison of Wise vs Revolut.

Best for high receive & convert limits

Wise has the more generous limits.

Feature | ✅ Wise | Revolut |

|---|---|---|

Limits | Unlimited receive amount & currency exchange | $100,000 per ACH transfer received Unlimited currency exchange with Premium card |

Notes | Exceptions include: • Personal customers & businesses receiving USD with routing number starting 026 • Business customers requesting money via card payments • Additional limits if registered in India, Japan, Malaysia, Philippines, or Singapore | Usually no extra steps needed to receive large amounts. Revolut may contact you if they need more info on large payments. |

Best for local account coverage

Wise offers more currencies, but depending on which currencies you need, Revolut might suit just fine.

Feature | ✅ Wise | Revolut |

|---|---|---|

Local accounts | 8+ currencies GBP, EUR, USD, AUD, NZD, SGD, RON, CAD, HUF, TRY | 2 currencies GBP, USD |

Hold & convert | 40+ currencies GBP, AUD, AED, BDT, BWP, BGN, CHF, CLP, CNY, CRC, CZK, DKK, EGP, GEL, GHS, HKD, CAD, HUF, IDR, ILS, INR, JPY, KES, KRW, LKR, MAD, MXN, MYR, NGN, NOK, NPR, NZD, EUR, USD, PHP, PLN, PKR, RON, SEK, SGD, THB, TRY, TZS, UAH, UGX, UYU, VND, XOF, ZAR, ZMW | 37 currencies AED, AUD, BGN, CAD, CHF, CLP, COP, CZK, DKK, EGP, EUR, GBP, HKD, HUF, IDR, ILS, INR, ISK, JPY, KRW, KZT, MAD, MXN, NOK, NZD, PHP, PLN, QAR, RON, RSD, SAR, SEK, SGD, THB, TRY, USD, ZAR |

How to receive money by bank transfer to a multi-currency account

You need to...

Open a multi-currency account that supports the relevant currency

Make sure the account is fully verified with any KYC before the transaction is made

Give the sender the IBAN and BIC/SWIFT of your relevant currency account

The sender needs to...

Focus on the 'sending' side

Don't want to open a new currency account?

It's still possible to receive funds cheaply by working with the sender.

Your job is to convince them to use a dedicated money transfer service, or a multi-currency account of their own. Either way, you're avoiding a regular bank payment.

The idea is the same. Don't let the banks convert currencies for you. The exchange will be handled by a specialist instead, at a much lower cost.

You'll conveniently receive funds into your existing local bank account, minus most of the fees.

Prefer this route? I suggest you read our Best Money Transfer Companies guide.

There are lots of fast, cheap & secure options to choose from.

You might want to share the link with the sender, too...

Cheap Ways to Send Money Abroad

Sending money to yourself?

If so, the transfer is fully in your control! This is good news.

There's nothing special about moving money between your own currency accounts in different countries.

The main difference is it's a lot easier to get things right if you are both the sender and the receiver.

Aside from the use cases I've described below, it's very common to receive money from another of your own accounts abroad.

If that's the case, then I recommend using a money transfer company (like those listed below). Fewer people involved definitely makes things simpler!

| Name | Score | Visit | Security | Customer Support Options | Mobile Support | Launch Date | Disclaimer | |

|---|---|---|---|---|---|---|---|---|

| 9.2 | Visitwise.com | 2FA, Biometrics | Phone | Android, iOS, Web App | 2010 | ||

| 8.2 | Visitxe.com | 2FA, Biometrics | Email, Live Chat, Phone | Android, iOS, Web App | 1993 | ||

| 8.9 | Visittorfx.com | PIN | Dedicated Account Manager, Email, Phone | iOS, Android, Web App | 2004 | ||

| 8.9 | Visitcurrenciesdirect.com | PIN | Phone, Email, Dedicated Account Manager | Android, iOS, Web App | 1996 | ||

| 8.1 | Visitinstarem.com | Biometrics, PIN | Email, Live Chat | Android, iOS, Web App | 2014 |

Common reasons for receiving money from abroad

Remittances

Sending money back home to friends and family is a personal matter.

It's important to you that the recipient gets funds quickly, cheaply and with minimum hassle.

These transactions tend to be small to medium sized, and frequent.

✅ Our recommendation: the recipient should open a multi-currency account. If your country or currency is not available as a multi-currency account, send funds using a money transfer specialist. You might want to consider a remittance-focused service like Remitly, WorldRemit or similar. This will maximise the amount your loved ones receive.

Inheritance

Dealing with inheritance can be complicated and stressful given the circumstances.

The last thing you want to be worrying about is whether money will be lost to the banks in the process.

Ideally the executor would make distributions from the estate using a cost-effective currency solution, but this might be out of your control.

We have a guide dedicated to receiving inheritance from overseas if you would like to read more on the topic.

✅ Our recommendation: the benefactor (recipient) should open a multi-currency account to receive international inheritence into. Depending on the amount, we also recommend discussing the situation with an FX broker for tailored support.

Remote employment

It's increasingly common to be employed by a company based in another country. You may also have agreed to take a salary in the employer company's local currency.

For example, a £60,000 salary paid by a UK company to a remote employee in the US.

So whether you're receiving weekly, twice-weekly or monthly payments for your employment, the FX savings could really add up over time.

✅ Our recommendation: open a multi-currency account to receive your employment payments into. Enjoy cost-effective conversions and have more left over to spend or save.

Pensions

Living abroad, backpacking, or spending half the year on holiday? Not a bad way to enjoy your retirement!

But if you're relying on your pension payments to fund your retirement lifestyle, you'll want to be careful.

Receive one-off or regular pension payments with minimal currency impact. That'll leave you with more time to soak up the sun.

✅ Our recommendation: for regular pension withdrawals, open a multi-currency account. For larger lump-sum money movements, chat things through with a managed FX service.

Selling a property

Cashing in on a property purchase is a common cause of cash receipts from abroad.

This is a scenario where you have one chance to get it right. There could be thousands lost to currency fees unless things are handled well.

✅ Our recommendation: benefit from a two pronged approach: get a multi-currency account ready should you need it, while discussing your options with a currency broker with experience in foreign property transactions.

Rental income

Rental costs for an international property will be defined in the local market currency. The renter will expect to pay in this currency.

You'll want a convenient way to receive these payments. You may also want to hold some of the local currency, making repairs and other costs easier to handle.

✅ Our recommendation: open a multi-currency account and pass the tenant or rental agency your new bank details. This will make sure they bypass the bank's poor conversion rates & high fees.

Receiving business payments

Freelance & consulting income

The workplace has become increasingly global & remote since 2020.

It's very common for freelancers and side hustlers to work with clients all around the globe.

If you agree a price for your services in a foreign currency, the bank might end up taking a large cut.

This is especially common for those outside the US, where pricing is often set in USD.

💼 Our recommendation: freelancers should open a multi-currency account tailored to the needs of their small business. This will make existing business and expansion cheaper and lower friction.

Sales revenue

It's easier than ever to tap into global demand for your products.

But how do you manage your finance function across multiple currencies and countries, without seeing painful foreign exchange impacts on your P&L?

There are plenty of smart ways to optimise your growing business from an FX perspective.

Receiving more money at the end of the day, while losing less to banks, could really propel your business forward over time.

💼 Our recommendation: open a specialist business multi-currency account, and speak with a business-centric FX broker for more advice and options.

Cash pick-up

One of the most common ways of receiving small to medium size payments is cash pick-up.

This involves visiting a local branch of a remittance company, like Western Union or Moneygram, to redeem the transfer in physical cash.

Pros

Cons

To pick up your cash, you'll need to bring the transaction reference number. This is usually sent to you via SMS, or provided by the sender. Remember to also bring a valid photo ID document.

Depending on the company and country, you may need to register before collecting.

Western Union, Moneygram and Ria are some of the best known cash pick up providers. They each have over 10,000 global locations for cash collection.

We recommend this method for transfers under $1,000, where immediate access to cash is important.

How to receive money by cash pick-up

You need to...

Provide the sender with your full name and preferred pick-up location (for example, a Western Union agent nearby)

Once sent, visit your pick-up location, bringing the transaction reference, photo ID and proof of address if required

Collect the cash

The sender needs to...

Mobile money

For both the unbanked and those with bank accounts, mobile money is popular for small, regular transfers.

Funds can be sent to a mobile number, then redeemed for cash at an agent or spent directly at participating stores.

Pros

Cons

Mobile money payments are supported in a wide range of countries, and are most popular in Africa. You might be familiar with service providers like M-Pesa, Airtel, MTN and Orange Money.

How to receive international mobile money payments

You need to...

Make sure your mobile network supports international mobile wallet payments

Provide the sender with your mobile phone number with country code, network operator name, and your country

Once sent, check your available credit to confirm it was received

The sender needs to...

Airtime

If someone sends you airtime, you won't actually receive money. You will however get credit added to use with your phone provider.

This method bypasses the usual means of sending money. It's use case is quite narrow, but for those with family overseas, staying connected is essential.

Pros

Cons

How to receive airtime top-up from abroad

You need to...

Make sure your mobile network supports international airtime topup

Provide the sender with your mobile phone number with country code, network operator name, and your country

Once sent, check your available credit to confirm it was received

The sender needs to...

More tips

Be aware of potential extra costs when receiving to your bank

Depending on your transfer provider and destination country, intermediary banks could charge additional processing fees.

These external bank fees are usually in the range of $20, so they have more of an impact on small transactions.

The transfer provider charges these fees when it doesn't have its own bank account in the destination country.

Knowing exactly if you will incur a fee like this, or how much, can be challenging. That's because the fee is not part of the sending, but a potential cost of receiving.

You could avoid this charge by receiving into a multi-currency account.

Try to set the amount in your local currency instead

Whenever the transaction amount is set in the foreign currency, alarm bells should go off: this creates a currency risk.

For example, have you agreed to sell a property for £350,000, or $425,000?

If you can agree how much will be paid in your own currency (i.e. you agree the 'receive' amount), then the transaction is calculated the other way. This puts the risk on the sender.

Depending on the circumstances, it could benefit you to agree the price or transfer amount in your own currency.

Related Content

Contributors