Capital One for international wire transfers

You can send international wire transfers with Capital One, however, at a higher cost compared to other banks and services. They also use a SWIFT network to process their transactions, meaning transactions will take longer.

Here’s a breakdown of how Capital One compares to an average money transfer provider.

Transfer type | Capital One | Money Transfer Companies |

|---|---|---|

Sending fees | $50 | $0 - $20 |

Receiving fees | $15 | $0 |

Exchange Markup | ~4% - 6% markup | 0% - 2% |

Transfer Times | Up to 10 business days | Instant - 3 business days |

Payment Methods |

|

|

Compare now to get the best transfer rate

Scoring Capital One

We’ve analyzed the exchange rates, transfer costs, support, and online user reviews. Here’s a quick summary of the top highlights and drawbacks.

Pros

Cons

Capital One fees and exchange rates

Fees and rates

Exchange rates

Capital One doesn’t disclose its exchange rates, meaning we can’t compare it to the mid-market rate and figure out the markup.

This usually means that their rates are worse or the same as other high street banks.

Based on our analysis and experience, the average high street bank adds around 4%-6% to the real exchange rate. So you should expect to pay for that.

We would recommend contacting the bank directly for a specific quote, otherwise, you might not be able to view the given exchange rate until you are charged for the transfer.

Like other banks, exchange rates for Capital One may not be competitive compared to money transfer services. Some providers like Wise and XE process international transfers using the mid-market rate (this means they don’t add a markup to the exchange rate).

Can you exchange money for what it’s actually worth?

You can get the right value for your exchange if you use a provider that offers the mid-market rate on exchanges.

Online money transfer providers like Wise, Revolut, and Instarem all make exchanges using the mid-market rate, but there’s a small fee for your transfer.

To make sure we haven’t missed anything, we’ve looked at what users had to say online about Capital One. Here’s how users have rated Capital One’s exchange rates.

International transfer fees

At the time of writing, Capital One doesn’t let you send international wire transfers online or over the phone. You can only transfer money abroad in one of their branches.

And even then, not every account is eligible for international transfers. Capital One recommends you to contact them (1-800-655-BANK) to confirm your eligibility before visiting the branch.

With this in mind, Capital One charges a flat fee of $50 to send international wire transfers.

In addition, Capital One will charge you $15 to receive money into your account.

For other fees (and a general summary), refer to the table below:

Channel | Fee | Domestic wire eligible | International wire eligible |

|---|---|---|---|

Online | $30 | Yes | No |

Phone | $30 | Yes | No |

Branch | $40 | No | Yes |

Notice: The cutoff time for international wire transfers is 3 pm ET.

Capital One international transfer fees are expensive, especially for smaller transfers. Here’s a fee comparison against Wise and Chase Bank.

Let’s assume you’re making a $1000 transfer from the US to a bank via wire transfer to an account in the following countries:

Country | Capital One fees | Chase Bank fees | Wise fees |

|---|---|---|---|

$50 + ~4-6% markup | $40 + ~5.5% markup | $10.79 + 0% markup | |

$50 + ~4-6% markup | $40 + ~5.5% markup | $13.16 + 0% markup | |

$50 + ~4-6% markup | $40 + ~5.5% markup | $10.36 + 0% markup |

Similarly, we’ve looked at how users have rated the transfer fees.

Transfer speed

Transfer speed

When it comes to international wire transfers, it can take up to 10 business days to be deposited to the recipient's account.

This is extremely high, regardless of who we compare it to.

For example, Bank of America takes 1-2 business days, Truist Bank takes 3-5 business days, and WorldRemit takes up to 24 hours.

However, we found that as long as the transfer has been submitted and successfully verified before 15:00 (ET) on a business day, the money will be processed on the same day. Meaning you will save a day on processing times.

Domestic transfers can be processed faster than international ones, and the cut-off time is 14:00 (ET).

When it comes to speed, this is how users have reviewed their service.

Transfer limits

Transfer limits

Considering you can only send an international wire transfer to your local branch, there is no limit on the amount you can send.

It might seem good, as it's more secure to send money through a branch, and you can make any size transfer. But, all other banks offer this feature, in addition to the international wire transfers made online.

Here’s how other users have rated Capital One’s transfer limits online compared to Wise.

Product offering

Product offering

Mobile app

There is a Capital One Mobile app for customers in the US, Canada, and UK. The app has a rating of 4.0 in the Google Play Store, and 4.8 in the App Store.

However, it only provides convenience for day-to-day banking, and as already mentioned, you can’t send international transfers using it.

Travel credit cards

Not directly related to international transfers, but you can use your Capital One credit card when traveling abroad without paying the usual 3% - 5% fee on conversions.

However, the merchant might still charge you a fee for using your credit card, and other fees may apply.

This is a win for Capital One, as other banks charge hefty fees for using your credit card abroad.

But even then, if you are looking to spend money abroad, there are better options:

We’ve also looked at the general sentiment of user reviews when it comes to product offerings. This graph illustrates how the ratings have changed over time, compared to Wise.

Ease of use

Ease of use

This is how other users have rated Capital One in terms of their usability.

Customer service

In the US, Canada, and the UK customer service representatives can be reached by phone, email, and mail.

There is also an FAQs section on the website for each respective country.

Support option | Details |

|---|---|

Email support | |

Telephone support | 1-877-383-4802 |

International wire transfer support | 1-800-655-BANK |

Chat support | Virtual Assistant |

In-branch support | 775 branches available |

However, most of the contact options are geared toward managing your money, credit cards, and financial support.

To get any information on international transfers, you will need to contact your branch directly via 1-800-655-BANK (where BANK is your branch number).

Similar to the usability, we’ve looked at how users have rated Capital One’s support over time and compared it to Wise.

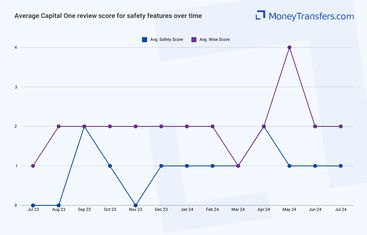

Safety and trust

Safety and trust

Just like any other modern bank, you get key security features such as:

Facial recognition

Fingerprint ID

Real-time alerts

Debit/credit card locks

Fraud and suspicious transaction alerts

$0 liability for unauthorized charges

And many more

Finally, just like with other parts of this review, we’ve taken a look at what users had to say in the past year about Capital One’s security features. This is how it looks when compared to Wise.

Customer feedback

Customer feedback

ANALYSIS OF USER REVIEWS

The online reviews of Capital One are very mixed.

On the positive side, users find it easy to use and highlight the efficient customer service as well as a generally smooth online banking experience.

However, there are a few negatives as well. Common complaints include difficulties in accessing accounts, problems with customer service responsiveness, and specific issues like unwarranted account closures or delayed transactions.

Some users have also reported frustrations with fraudulent activities and poor dispute resolution.

Overall, while some customers find Capital One reliable and user-friendly, others have faced significant challenges, especially regarding customer support and account management.

Here's a summary of average user reviews so far this year.

Review Category | Jan 24 | Feb 24 | Mar 24 | Apr 24 | May 24 | Jun 24 | Jul 24 |

|---|---|---|---|---|---|---|---|

International Transfers | 1 | 1 | 1 | 0 | 0 | 1 | 1 |

Fees | 1 | 1 | 1 | 2 | 1 | 1 | 1 |

Exchange Rates | 1 | 1 | 5 | 1 | 1 | 1 | 1 |

Speed | 0 | 1 | 0 | 1 | 0 | 0 | 1 |

Limit | 2 | 1 | 1 | 2 | 1 | 1 | 1 |

Features | 1 | 2 | 2 | 2 | 2 | 2 | 1 |

Ease of Use | 0 | 0 | 3 | 3 | 1 | 0 | 0 |

Safety | 1 | 1 | 1 | 2 | 1 | 1 | 1 |

Customer Support | 1 | 2 | 0 | 1 | 0 | 1 | 1 |

Opening an account with Capital One

To open an account with Capital One, you will need the following information:

An ID: Your driver’s license, passport, or other government-issued ID card

SS or ITIN number: Social Security number or Individual Taxpayer Identification Number (ITIN)

Alternative payment method to make an initial deposit: A blank check, debit card, or credit card to make that first deposit

Once you have these ready, follow the steps below to open an account.

Sign Up

Follow the Application Steps

Review and Accept the Terms

Deposit Money

Making international transfers

When arranging a wire transfer with Capital One, you will need to provide the following:

Recipient’s full name (or business name)

Recipient’s address and contact number

Recipient’s account number

Recipient’s routing number (ABA)

The full name, bank address, SWIFT Bank Identifier Code (SWIFT BIC), and branch identifier of the recipient’s bank

An International Bank Account Number (IBAN) may be required

The amount you want to send

Capital One’s swift code is HIBKUS44

Sending international wire

To make an international wire transfer with Capital One, follow the steps below:

Contact your local branch

Visit your local branch

Provide the information

Confirm your transfer

Pay for your transfer

Use Wise to send money from your Capital One account

It may be simpler to fund your transfer with your Capital One account, but use a transfer provider like Wise to send your money overseas.

Register for a Wise account

Add the details of your transfer

Review the received amount

Send the money

Receive international transfers

To receive an international wire transfer to your Capital One account, you’ll need to provide the following information to the sender.

Your ABA, RTN, or SWIFT code

For domestic wire transfers, you’ll need to supply the Wire Routing Transit Number (your ABA or RTN): 031176110 (please double check in the app or online banking, under “View Details”).

For international wire transfers, you’ll need to supply your SWIFT code or BIC: HIBKUS44

The bank name and address

Depending on the type of transfer, the Capital One address is: 1680 Capital One Drive McLean, VA 22102-3491

Your account number, name, and address

You’ll need to supply your complete Capital One account number, the name on your account, and the complete address of your account as it appears on your bank account.

How Capital One compares to money transfer services

Generally, money transfer companies are much cheaper than any high street bank. Here’s a list of top alternatives to Capital One if you’re planning to make international transfers.

Other Alternatives

Alternatively, consider using one of these neobanks for international transfers.

Capital One: Is it good for transfers abroad?

While Capital One is a great option for anyone looking for a new credit card (or travel credit card), it is evident they are not made for international transfers.

For those who rely on day-to-day banking, Capital One provides fantastic features such as My Savings Goals, credit score tracking, and mobile deposit for depositing checks in real-time.

However, the bank’s quality and international transfer services are not that great (even when compared to other high street banks).

The major downside is that you can only send money abroad through the branch, and still have to pay high fees.

If you need to make a transfer abroad, you can still use your Capital One account and link it to any money transfer provider.

This is the best of both worlds, you can use your bank and save a lot of money on fees (especially if making a large transfer).

Use our form below to find the best money transfer app for your needs, link your account, and send.

Find the best rates for your transfer

A bit more about Capital One

Can I open a Capital One account in any country?

Can I use a Capital One debit card when traveling abroad?

Help & FAQ

Get answers to the most common questions asked when sending money abroad. Covers costs, fees and the best way to compare.

More Banks