Scoring BoxyPay

Is BoxyPay worth it? Probably not, as there are many better alternatives such as Wise, WorldRemit, Nala, or Paga.

Wise is much more reliable and is cheaper for recurring transfers to Nigeria while WorldRemit is better for one-off large payments due to their promo rates and fees.

The only time it makes sense to use Nala is when you want to benefit from the phone card services and need to make a one-off small transfer to avoid creating multiple accounts.

If you still want to use it, here’s a quick summary of the company.

Pros

Cons

BoxyPay fees and exchange rates

Fees and rates

BoxyPay charges a markup of 0.25% and adds a fixed fee of $7.99 to every transfer.

This is expensive compared to other options.

For example, WorldRemit offers promo rates and no fees on the first transfer to Nigeria which is ideal for large transfers.

Wise offers money transfers at the mid-market rate (meaning no markup) and a $9.66 fee for a $1,000 transfer to Nigeria.

Exchange rates

BoxyPay adds a markup of 0.25% to every transfer to Nigeria.

It might seem good, as similar services add a higher markup, for example, Nala offers better rates to Nigeria than the mid-market rate (almost 3% better).

However, there is a catch, the fees.

BoxyPay charges ~$8 while Nala fees range from $0.99 - $5.99. Add the two and Nala is now cheaper.

International transfer fees

The transfer fee at BoxyPay is $7.99 no matter the amount you send.

This is very high compared to many similar services focusing on Africa. For example, Nala charges from 0.99%, and WorldRemit offers $0 fees.

To put these numbers into perspective, let’s imagine you’re making a $1000 transfer from the US to a bank in Nigeria via bank transfer:

Money transfer service | Total fees (fee and markup) |

|---|---|

BoxyPay | $10.49 |

Wise | $9.66 |

WorldRemit | $0.00 (promo) |

NALA | $5.99 |

Transfer speed

Transfer speed

BoxyPay offers two transfer methods and the delivery window for each is different.

Cash pickups

The funds will be instantly available for the recipient to collect from the physical pick-up location.

Direct deposit

Direct deposits can take 1 - 5 business days to arrive.

Product offering

Product offering

Supported currencies & destinations

The BoxPay website claims to facilitate transfers to all four corners of the globe, but as it stands, the only sending destination is Nigeria.

This is misleading and customers should be aware of this coverage limitation before creating an account.

In addition, you can only make transfers in USD.

Looking to send different currencies?

Transfer types

BoxyPay provides 2 transfer types:

Cash Pickup

This involves the sender making the payment and the recipient visiting a physical location to collect the cash. The recipient can pick up the money immediately, once the transfer has been executed.

It is a good choice when sending money to someone who does not have a bank account.

Direct Deposit

You can send a wire transfer via direct deposit which takes 1 - 5 business days to arrive in the recipient’s bank account, which is much slower than the cash pickup option.

Payment methods

Before sending money with BoxyPay, you need to top up your account.

You can do this using one of the accepted payment methods:

Prepaid voucher

You will need to buy a voucher from an available merchant store and use it within the app to top up. In a way, it is similar to cash top-up.

Debit card

Here you will need to link your debit card directly within the app and use it to fund your transfer.

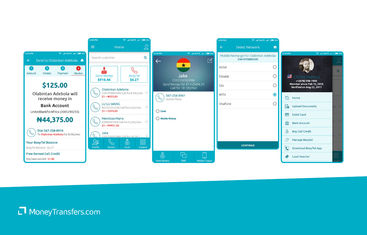

Mobile app

BoxyPay is an app-only service and is only available on the Google Play store.

The app has a rating of 3.7/5 from 186 reviews which suggests there is a big room for improvement.

Some of the problems noted by users include issues with account creation, getting in touch with customer service, and long transfer times.

Safety and trust

Safety and trust

There is no information on licensing or registration of the company.

However, the company seems to follow general security guidelines.

BoxyPay approaches money transfer in a responsible and trustworthy way, explaining common Nigerian scams users need to avoid when using their service.

BoxyPay makes use of 128-bit encryption on its website, ensuring information will be protected from hackers or fraudsters.

In addition to this, two-factor authentication is mandatory, ensuring account access is secure.

BoxyPay also uses bank-grade security, passwords, and PIN systems to guarantee user data is protected.

The customer service at BoxyPay is widely accessible since there is an international number that offers support when help is required. Here it is: +1(470) 800-7361.

The live chat feature is also reliable and can be found by clicking on the chat icon located on the right-hand side of the page.

Customer feedback

Customer feedback

BoxyPay is rated 3.7/5 from 186 reviews on the Google Play Store, 92% recommend the service on Facebook from 18 reviews, and multiple 1-3 star reviews on their website.

Mostly, other users complain about the customer service, transfer times, and reliability of the app.

Making international transfers

Here’s how to make an international money transfer via BoxyPay.

Download the app

Find the app on the Google Play store and download it.

Deposit Money

The first step is to deposit money and you can do so using a prepaid voucher, a debit card, or at a merchant store.

Choose the Recipient

Choose the recipient who will receive the money, which you can do using a phone number.

Select Amount

Choose the amount you will send and you can only use USD as the currency.

Canceling transfer

It is possible to cancel a transaction within 30 minutes of it being initiated. However, this option is not available if the funds have already been deposited into the beneficiary’s account or collected by the recipient.

Receive international transfers

There are a few options for withdrawal and pick-up.

Cash pickup

The first option is cash pickup which will require a government-issued ID. The receiver will also need to show the transfer number when picking up the cash.

Direct deposit

With direct deposit, money will land in the recipient’s bank account and they won't need to do anything.

How BoxyPay compares to other transfer services

Other Alternatives

Alternatively, consider using one of these neobanks for international transfers.

BoxyPay: Is it good for transfers abroad?

Regardless of the options you pick, we always suggest you to compare your options.

BoxyPay would not be my first choice for transfers.

Considering how many variables there are when it comes to picking the right provider, we suggest using the form below to find a better option.

Find the best rates for your transfer

A bit more about BoxyPay

Does BoxyPay accept cash or cheque payments?

Help & FAQ

Get answers to the most common questions asked when sending money abroad. Covers costs, fees and the best way to compare.

More Money Transfer Services