Scoring LuLu Exchange

When reviewing LuLu Exchange we’ve looked at the fees & exchange rates, transfer limits & speed, product offering, ease of use, safety and customer feedback.

Here’s a quick summary of LuLu Exchange.

Pros

Cons

LuLu Exchange fees and exchange rates

Fees and rates

Exchange rates

LuLu exchange rate depends on the currency pair you want to exchange or send.

On average, we found that LuLu Exchange is adding a markup of 1.56% on top of the mid-market rate.

Here’s an overview of what their rates look like when you send money from the United Arab Emirates.

Destination currency | Markup |

|---|---|

INR | 0.39% |

EUR | 1.54% |

IDR | 1.76% |

PKR | 0.01% |

BDT | 1.31% |

PHP | 0.42% |

EGP | 0.00% |

NPR | 0.38% |

SGD | 3.23% |

AUD | 2.42% |

JPY | 9.55% |

GBP | 0.00% |

HKD | 1.01% |

CHF | 0.00% |

JOD | 0.00% |

ZAR | 2.71% |

SAR | 0.16% |

EUR | 0.00% |

CAD | 2.49% |

USD | 0.00% |

NZD | 6.04% |

KWD | 0.00% |

QAR | 2.31% |

*Rates updated as of September 2024. All rates are based on transfers from AED.

The exchange rates are the same whether you convert through the app or at the branch.

This is fairly competitive in terms of rates, however, on top of this there will be additional fees for making a transfer.

International transfer fees

LuLu Exchange fees vary depending on where the money is coming from and the destination, as well as come with an additional 5% VAT charge.

The fees are the same in the branch and in the app, however, they vary depending on the amount you are sending.

Here’s a summary of LuLu Exchange fees.

Country | Amounts & Currencies | Service Charge (AED) | Including VAT (5%) |

|---|---|---|---|

Bangladesh | Below AED 1000 | 18.62 | 19.55 |

Bangladesh | Above AED 1000 | 25.19 | 26.45 |

Egypt | EGP | 17.25 | 18.11 |

Egypt | USD | 28.75 | 30.19 |

India | Below AED 1000 | 18.62 | 19.55 |

India | Above AED 1000 | 25.19 | 26.45 |

Indonesia & Jordan | - | 23.00 | 24.15 |

Morocco | - | 28.75 | 30.19 |

Nepal | - | 17.25 | 18.11 |

Pakistan | Below AED 368 ($100) | 18.40 | 19.32 |

Pakistan | Above USD 100 | 0.00 | 0.00 |

Philippines | - | 23.00 | 24.15 |

Sri Lanka | Below AED 1000 | 18.62 | 19.55 |

Sri Lanka | Above AED 1000 | 25.19 | 26.45 |

Cross Border Remittances | Through SWIFT | 69.00 | 72.45 |

In addition to the fees above, there might be external fees that LuLu Exchange has no control over; a nominal wire transfer fee, the payment gateway fee, as well as, the receiving fee on the recipient's end.

To put this into perspective, let’s say you want to send 4872 AED (~$1,000) from the UAE via cash transfer to a bank account in the following countries:

Country | LuLu Exchange fees | Wise fees |

|---|---|---|

26.45 AED + 1.31% (90.28 AED) | Total 66.35 AED | |

26.45 AED + 0.39% (45.45 AED) | Total 48.31 AED | |

24.15 AED + 0.42% (44.61 AED) | Total 54.46 AED |

Transfer speed

Transfer speed

Most LuLu Exchange transfers should arrive within 30 minutes, especially if using LuLu Now or cash pickup.

Bank account transfers are usually quick but can take up to 3 business days due to intermediary delays.

Transfer limits

Transfer limits

There are no transfer limits.

You can send as little as 1 AED with no maximum limits.

Product offering

Product offering

Supported currencies & destinations

You can send money from the following locations:

United Arab Emirates

Kuwait

Bahrain

Qatar

Oman

India

Philippines

Hong Kong

Malaysia

Singapore

As for supported currencies, these depend on the country you are sending money from.

Here’s a breakdown of each:

INR, PKR, BDT, PHP, EGP, SGD, MAD, NPR, LKR, AUD, JPY, GBP, HKD, CHF, JOD, ZAR, BHD, IDR, SAR, KWD, CAD, OMR, NZD, USD, EUR, QAR

INR, PKR, BDT, PHP, EGP, EUR, NPR, AED, SAR, LKR, JOD, USD, GBP, IDR

INR, PKR, PHP, IDR, LKR

INR, PKR, BDT, PHP, EGP, HKD, BHD, CAD, JOD, USD, GBP, NPR, EUR, AED, LKR

INR, PKR, BDT, PHP, EGP, AED, GBP, JOD, IDR, NPR, EUR, SAR, USD, LKR

IDR, INR

USD, INR

PKR, SAR, LKR, EUR, AED, EGP, INR, PHP, GBP, IDR, NPR, USD, BDT, JOD

MYR, BDT, VND, IDR, INR, LKR

Transfer types

There are three ways to send money with LuLu Exchange: LuLu Now, direct to account, and cash pickup.

LuLu Now

LuLu Now lets you transfer credit to banks in India, the Philippines, Bangladesh, Nepal, Egypt, and Indonesia.

Direct to account

This way you can send money directly to a bank account or use any interbank network (such as SEPA or SWIFT).

Cash pick-up

With cash pick-up, you can send money to over 50,000+ stores where money can be picked up by the recipient.

Payment methods

There are three ways you can pay for your transfer with LuLu Exchange:

Payment Gateway

This is an online payment platform linked to your bank.

Once you enter the transfer details, simply choose Payment Gateway on the app and you'll be prompted to select your bank.

When there, log in and pay for your transfer.

Wire Transfer

When you initiate a transfer through the app and intend to pay using a wire transfer, you should select the LuLu Exchange bank account you want to wire the money.

The system will then generate a reference code for you.

When making the transfer, ensure you include the reference code in your payment description.

Cash Payment

You can pay for your transfer at the branch using cash.

It is important to note that you can begin your transfer on the app and complete it in-store.

The app will generate a reference code which you will use when paying at the branch.

Receiving methods

Recipients can get their money from LuLu Exchange in one of the following ways.

Direct to account

Money is deposited directly into the receiver's bank account.

Cash pickup

Recipients can collect the funds transferred in cash from any of the provider's cash pickup locations near them.

LuLu Now

This is the latest offering by the provider and allows instant credit transfers to banks in India, the Philippines, Bangladesh, Nepal, Egypt, and Indonesia

Door-to-door cash delivery

LuLu Money, the Hong Kong subsidiary of LuLu International Exchange L.L.C., supports door-to-door delivery to the Philippines. Funds take only 48 hours to be delivered.

Other payment services

In addition to the money transfer and currency exchange services, LuLu Exchange offers;

Import and export of banknotes & currencies

Wage and salary administration

Mobile top-ups

Bill payments

Ticket paying services

Mobile app

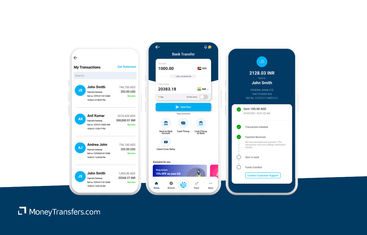

LuLu Exchange has an app called LuLu Money available on both Play Store and App Store.

On the app, you can:

Make transfers to supported countries and currencies

Check real-time exchange rates to help you plan your transfers

Add new or update your existing recipients.

Track the status of your transfer

Set rate alerts to get notified when your target rate becomes available

Locate LuLu Exchange branches near you

View transfer history up to the last 20 transactions

Ease of use

Ease of use

Customer service

If you have any questions and need to contact one of the branches, you have the following options available:

Live Chat: There is a built-in 24/7 live chat function in the mobile app and on the website. They usually take a few minutes to respond.

Email: You can either send your message through the website or email the support team via info@ae.luluexchange.com.

Phone: There is phone support available 24/7 on a toll line (+971561772755).

The support phone line is different depending on your country:

Country | Phone Number |

|---|---|

UAE | +971 44 504 900 |

Bahrain | +973 17 641 290 |

Bangladesh | +880 29 341 435 |

Hong Kong | +852 27 793 900 |

India | +91 484 418 7786 |

Kuwait | +965 22 022 185 |

Oman | +968 24 709 777 |

Philippines | +63 25 111 835 |

Qatar | +974 44 217 862 |

Seychelles | +248 461 0812 |

Safety and trust

Safety and trust

Regulatory compliance

In the UAE, the provider is licensed by the Central Bank of the United Arab Emirates (CBUAE) to offer foreign currency exchange, payment of wages, and remittance operations.

In the Philippines, it is licensed by Bangko Sentral Ng Pilipinas (BSP) as an Electronic Money Institution (EMI) and TYPE A Remittance Transfer Company.

LuLu Exchange also fully complies with the Anti-Money Laundering (AML) and Combating the Financing of Terrorism (CFT) legal standards.

Key industry partnerships

Industry awards

Customer feedback

Customer feedback

LuLu Exchange doesn’t have many reviews online. However, based on what’s available the reviews are very mixed.

The majority of positives are around Lulu Exchange's efficiency, reliability, and good in-store support. Many find it convenient due to the number of available locations, and fairly easy to use.

On the other hand, a fair few report delays in transactions blocked accounts, and discrepancies in the advertised exchange rates.

Overall, the reviews indicate that while some customers experience smooth, efficient service, many others face serious problems that affect their trust in the company.

Opening an account with LuLu Exchange

To open an account with LuLu Exchange, you will need the following:

Your personal details

A phone number

Government ID

Once you have these details, open the LuLu Money app and click ‘Next’ until you get to the phone verification screen. From there:

Select your country

There is a dropdown list with all the 10 countries you can sign up from. Select your country and continue.

Enter your phone number

Enter your phone number and continue. The app will send you a 5-digit one-time-pin (OTP). Key it in and click ‘ Confirm PIN’. Read through the terms and conditions and click ‘AGREE’.

Enable biometric login

For added security, you can enable fingerprint or face ID login. You can also do it later in the app settings.

Identity verification

Tap on ‘Send Money’ to enter your ID number and confirm your details.

If you live in the UAE, you’ll need your Emirates ID, for Bahrain use the Central Population Registry (CPR) number, for Kuwait, enter your Civil ID, or your Resident Card if signing up from Qatar.

Activate the app

Visit the nearest LuLu Exchange branch to complete your registration and activate your app.

You can also call customer care and have the app activated.

Once that is done, you can access the app features and transfer money.

You don’t need an account to send money through one of LuLu Exchange's physical stores.

Making international transfers

To send money with LuLu Exchange, you will need the following information:

Recipient’s country

Transfer amount

Payment method

Recipient's details

Delivery method

Government ID for in-person transfers

If you are sending money to a bank account outside of the EU, you will also need to provide a SWIFT code.

Sending money abroad

Once you have all the details ready, you can send money with LuLu Exchange by following the steps below.

Making a transfer through the LuLu Money app

Open the LuLu Money app on your smartphone and enter your 4-digit PIN to unlock it and access the transfer features.

Then proceed as follows.

Select the recipient

Tap on ‘Send Money’ to open the recipients' screen and select your beneficiary.

Enter the amount to send

The source and destination currencies will be displayed on the screen. When you enter the amount you want to send or what you want the recipient to get, it will be automatically converted at the rate displayed on the screen.

Select a source of income

You are to choose either business or salary

Enter the purpose

Depending on your sending reason you can choose savings or family maintenance and savings then click ‘Proceed’.

Canceling LuLu Exchange transfer

Transfers can only be canceled by visiting a branch. However, on both the app and the website, there is a live chat with a dedicated stream known as 'Transaction Error/Complaints' where you can raise an issue about any of your transactions for quick assistance.

Receive international transfers

Depending on the payout method, here’s how to receive money with LuLu exchange.

Direct deposit

If you choose 'Direct to Account' or 'LuLu Now' as the payout method, the funds will be deposited directly into the recipient's bank account.

Cash pick-up

For cash pickup, the recipient will receive a notification when the transfer is complete.

To claim the money, they will need to visit the nearest pickup location with their ID and the transaction code for verification purposes.

Door-to-door delivery

For door-to-door deliveries, the LuLu Money representative takes the cash to the recipient’s doorstep.

All that the beneficiary needs to do is provide their ID, give a transfer code for verification, and show the transfer receipt.

How LuLu Exchange compares to other transfer services

Other Alternatives

Alternatively, consider using one of these neobanks for international transfers.

LuLu Exchange: Is it good for transfers abroad?

LuLu Exchange is a good transfer company if you live near one of their branches and make frequent transfers to one of their supported countries.

However, their biggest downside is the lack of an online portal for transfers and small coverage in terms of where you can send the money.

If you need to make a transfer from another location, want to send money online, or make a large transfer, we suggest using our comparison form below to find the best rate for your needs.

Find the best rates for your transfer

A bit more about LuLu Money

Can I track transfers with Ria?

Help & FAQ

Get answers to the most common questions asked when sending money abroad. Covers costs, fees and the best way to compare.

More Money Transfer Services