Scoring Paga

The key areas of our Paga review are the fees & exchange rates, transfer limits & speed, product offering, ease of use, safety, and customer feedback.

Paga’s platform has recorded high growth over the years it has been in the financial services industry.

Its multi-channel network has brought lots of benefits to customers.

Here are some of its pros and cons to help you get a clearer picture of the service they provide.

Pros

Cons

Paga fees and exchange rates

Fees and rates

For international money transfers, Paga uses its global partners who also determine the applicable rates and fees.

Exchange rates

Depending on the transfer route, you can use Paga partners like Moneytrans, MoneyGlobe, WorldRemit, and TerraPay to send money to their recipient’s Paga mobile wallets in Nigeria.

This ultimately means that the rates will depend on which provider you choose to go with.

For instance, WorldRemit offers promotional rates on transfers from the US to Nigeria with a rate better than the mid-market rate, around 1% better.

International transfer fees

International transfer fees also depend on the money transfer platform you use.

WorldRemit charges zero fees to Paga if sending from the US, while Moneytrans charges fees starting from £2.01 if sending from the UK.

Apart from the international fees, Paga has a price list for local transactions.

Here is a summary of the costs involved:

Transaction Type | Naira Amount | Fee | Card Fee | Bank Fee | VAT | Limit |

|---|---|---|---|---|---|---|

Account funding via card or bank debit | 1 - 5,000,000 | Free | 1.50% | 3.50% | 7.50% | N/A |

Money Transfer (Free P2P) | 1 - 5,000,000 | Free | 1.50% | 3.50% | 7.50% | No Limit |

Deposit to Bank* | 1 - 5,000 | 10 | 1.50% | 3.50% | 7.50% | No Limit |

Deposit to Bank* | 5,001 - 50,000 | 25 | 1.50% | 3.50% | 7.50% | No Limit |

Deposit to Bank* | 50,001 - 5,000,000 | 50 | 1.50% | 3.50% | 7.50% | No Limit |

Merchant Bill Pay (Non-Express) | 1 - 100 | 10 | Free | Free | 7.50% | No Limit |

Merchant Bill Pay (Non-Express) | 101 - 200 | 20 | Free | Free | 7.50% | No Limit |

Merchant Bill Pay (Non-Express) | 201 - 400 | 30 | Free | Free | 7.50% | No Limit |

Merchant Bill Pay (Non-Express) | 401 - 500 | 40 | Free | Free | 7.50% | No Limit |

Merchant Bill Pay (Non-Express) | 501 - 5,000,000 | 100 | Free | Free | 7.50% | No Limit |

Merchant Bill Pay (Express) | 1 - 5,000,000 | Free | Free | Free | 0.00% | No Limit |

Airtime or Data | 50 - 5,000,000 | Free | Free | 3.50% | 7.50% | KYC 1 - N3k, KYC 2 - N100k, KYC 3 - N1m |

Withdraw from Agent | 1 - 1,000,000 | 100 | N/A | N/A | 7.50% | No Limit |

Withdraw to own/linked bank account** | 1 - 5,000,000 | Free | N/A | N/A | 7.50% | N/A |

*1st to 30th transactions within a month are charged applicable txn fee, 31st and above are charged N150 fee per transaction

**1st to 10th transactions within a month is free, 11th and above are charged applicable Deposit to Bank txn fee

When making an international money transfer to Paga, the bank may charge you a cash advance fee for using a credit card to pay for your transfer.

Paga to bank deposits cost 1.50% of the transfer amount in debit card fees.

Transfer speed

Transfer speed

Local and international transfers are instant when using Paga, one of the big benefits of using the service.

Transfer limits

Transfer limits

The minimum and maximum transfers users can make depend on the level to which their account is verified.

Here is a summary of the daily limits per level.

Level I customers: Can transfer up to₦50,000 or $138

Level II customers: Can transfer up to ₦200,000 or $551

Level III customers: Can transfer up to ₦5,000,000 or $13,780

Product offering

Product offering

Supported currencies & destinations

The only destination for international transfers is Nigeria, the rest of the transactions on Paga are performed from within Nigeria.

From Nigeria, you can transfer money pretty much anywhere where their partner network allows.

Payment and transfer methods

For international payments, the provider you choose will determine how you pay for your transfer.

However, for local payments, you can fund your Paga account through any of the following methods:

Automated deposits

Visit a partner bank like Fidelity Bank, Access Bank, or GTBank and request to fund your Paga account.

Bank transfer

Customers can use online bank transfers to load their Paga accounts.

Debit card

You can use your naira debit card to fund your deposit.

GT collections

Use your GTBank mobile app or online platform to fund your Paga account.

GTBank 737

Dialing the *737# shortcode gives you access to the GTBank service menu to help you load your Paga account.

Paga agent

Visit any Paga agent to load your account. There are over 25,000 agent locations across the country.

Receiving methods

International transfers are made directly into the recipient's Paga account using their mobile number as the account number.

Local transfers can also be sent into the recipient’s Paga account, bank account, or merchant pay bill account.

Anyone with an email address or a Nigerian phone number can also receive funds using the service.

Recipients can withdraw the funds sent from their Paga accounts at an agent, ATM, or POS terminal.

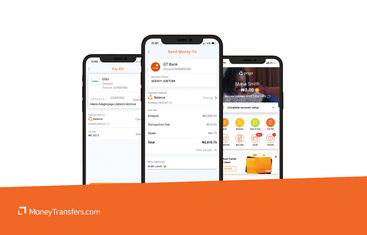

Mobile app

Paga has a mobile app where you can:

Sign up for an account

Send money

Request money

Pay bills

Buy airtime

Buy data

View transaction activity

Users of the Paga app appear to have a positive experience; it has a 4.4 rating on the Play Store with 18,912 reviews and 4.2 on the App Store with 1,248 reviews.

Ease of use

Ease of use

Customer service

To get in touch with Paga customer support, use any of the following channels.

Telephone: Customers can get help within Nigeria on 07000007242 or 012777160.

Online ticketing: You can create a support ticket online for further assistance.

WhatsApp: The WhatsApp messaging line is 08099227242.

Email: Email the support team directly at service@mypaga.com.

Safety and trust

Safety and trust

Paga is a mobile payment company that has gained popularity in both Nigeria and other partner countries since it was launched in 2012, currently being utilized by 8% of Nigeria.

When using a service to send your money, the primary concern is whether you can rely on the platform, so here’s a quick summary of everything you need to know about Paga’s trustworthiness.

Legitimacy of Paga

The service is registered as a private limited company by the Corporate Affairs Commission (CAC) and regulated by the Central Bank of Nigeria as a provider of electronic payment systems services.

Key industry partnerships

Investors and Awards

Customer feedback

User feedback

Most Paga customer reviews are on Instagram and Twitter. Users speak favorably of the company, with these being some of the most common comments:

Pros

Cons

Making international transfers

If you are transferring funds from abroad, the money transfer provider you use when sending money to a Paga wallet will define the process to follow.

For local payments, follow these steps:

Sign Up for an Account

Customers can sign up for a Paga account in four ways: online by visiting the website, using the Paga mobile app, through an agent, or by dialing *242# on their phones and following the prompts.

Account Verification

This process happens on three levels as follows:

Level I: Customers provide only their phone number and full name.

Level II: To get verified at this level, users must provide their full name, phone number, and address.

Level III: To get to this level you need to provide two references and a credit check report in addition to the information provided in Level II.

Fund Your Account

Once your account has been verified, you can now fund it through deposits at an agent, bank transfer, or using your debit card.

Transfer Funds

You can now transfer funds to your recipient in whichever way you like, and the transfer is instant. The beneficiaries can be saved in the system or added during the transaction.

Canceling transfer

Since transfers are instant, cancellations are impossible. In case of an erroneous transfer, you’ll have to get in touch with the recipient for a reversal.

Receive international transfers

Paga can transfer funds to the designated recipients’ bank accounts, Paga mobile wallets, merchants’ business accounts, or even non-Paga recipients using email addresses or their Nigerian phone numbers.

How does Paga compare to other transfer services

Other Alternatives

Alternatively, consider using one of these neobanks for international transfers.

Paga: Is it good for transfers abroad?

All in all, I think it’s a great app for making local payments, similar to how you would use Revolut or Monzo in the UK or Venmo and Cash App in the US.

However, since Paga “plugs” into existing money transfer companies, why not use them directly and get better offers when sending money abroad?

Help & FAQ

Get answers to the most common questions asked when sending money abroad. Covers costs, fees and the best way to compare.

More Money Transfer Services