Compare the best ways to send money to Iran

The United States introduced economic sanctions against Iran following the 1979 Iranian Revolution. Since then, sending money to the country without significant restrictions has become difficult.

In fact, sending money to Iran for commercial purposes isn’t just challenging; it’s illegal.

Still, the USA allows residents to send money to Iran for non-commercial purposes, including travel expenses. The Department of the Treasury spells out the details of the sanctions and its exemptions.

This means you can send money to friends or loved ones in Iran provided you go through a third-party provider or institution and prove that the funds are for non-commercial purposes.

Due to concerns about funding terrorism, many Iranian banks are off-limits for payments sent from the USA. You may face certain transfer limits even when sending to an authorized bank.

Before you attempt to send funds to Iran, it is a good idea to contact the Office of Foreign Assets Control to confirm that you can legally make the transfer.

Send money to Iran

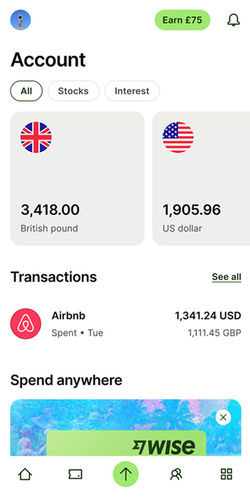

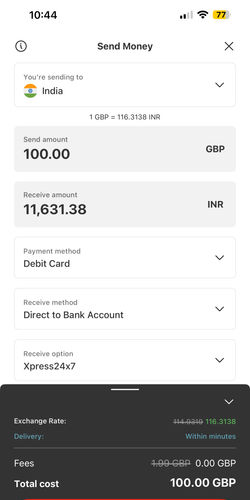

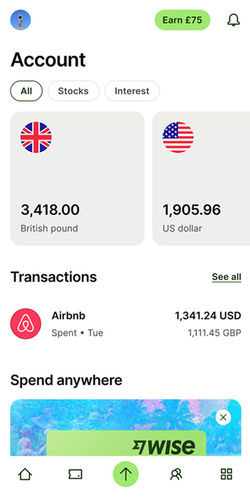

"Over 16 million customers use Wise, mostly for their excellent mobile app, transparent fee structure & use of mid-market rates. Now increasingly used for larger transfers."

"Over 16 million customers use Wise, mostly for their excellent mobile app, transparent fee structure & use of mid-market rates. Now increasingly used for larger transfers."

"Over 16 million customers use Wise, mostly for their excellent mobile app, transparent fee structure & use of mid-market rates. Now increasingly used for larger transfers."

"Over 16 million customers use Wise, mostly for their excellent mobile app, transparent fee structure & use of mid-market rates. Now increasingly used for larger transfers."

"Over 16 million customers use Wise, mostly for their excellent mobile app, transparent fee structure & use of mid-market rates. Now increasingly used for larger transfers."

"Over 16 million customers use Wise, mostly for their excellent mobile app, transparent fee structure & use of mid-market rates. Now increasingly used for larger transfers."

"Moneygram is a well established service with over 80 years in the sector. They support over 200 countries worldwide and have over 440,000 retail locations."

"Moneygram is a well established service with over 80 years in the sector. They support over 200 countries worldwide and have over 440,000 retail locations."

"Moneygram is a well established service with over 80 years in the sector. They support over 200 countries worldwide and have over 440,000 retail locations."

How to get the best rate when sending money to Iran

Always compare rates

Don't pay more than you have to. Use our live comparison tool to make sure you aren't missing the best rates on IRR transfers.

Choose a provider

Select the provider that offers you the most IRR and fits your transfer needs.

Click, sign up & send

Follow the steps & make your transfer. Your transfer to Iran will soon be on its way.

We found Wise to be the best way to send money to Iran.

After testing and reviewing 2 money transfer providers servicing Iran, Wise came out on top.

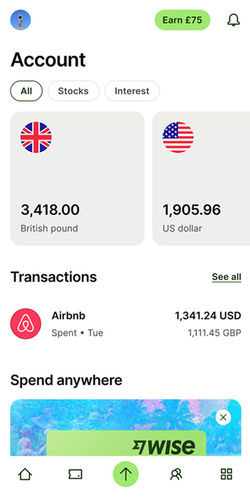

Wise offers quick transfers, adds a 0.3% markup on IRR transfers, and costs $60.74 in fees.

This makes it the best option for a mix of cost, speed & features for IRR transfers.

Cheapest way to send money to Iran: Wise

If you want to make the most of your IRR transfer, the cheapest way is to use Wise and pay for your transfer with a bank transfer.

With just $60.74 in fees and 0.3% markup, Wise is 7.79% cheaper than the next best option.

With Wise, if you were to send 7,000 USD to IRR, your recipient would get 291,448,920 Iranian Rial, this is more than with other providers on our list.

*Based on 7,000 USD transfer.

The fastest way to send money to Iran: MoneyGram

Based on a $7,000 transfer and our comparison data for IRR transfers, MoneyGram is the quickest option for sending IRR to Iran.

With MoneyGram, the transfer time to Iran is minutes - 24 hours.

They charge $490.00000000000006 in fees and apply a 2% markup on the ‘real’ IRR rate. This is 0% cheaper than the second-best provider.

For the best balance between speed and cost, we suggest using a deposit for Iranian Rial transfers.

Wise is the easiest way to send money to Iran

Wise is very transparent with its fees, charging $60.74 and 0.3% markup on IRR transfers.

They offer multiple deposit options, have good customer service, and take less than 5 minutes to get started with.

Consider this before sending money to Iran

Don't settle for the first option. Always compare ways to send money to Iran to find out about fees, speed, and reliability.

Our analysis included 2 providers that operate in Iran.

Through this, you get a comprehensive view of all the options you have when sending money to Iran.

Need to send over $10,000?

For transfers over $10,000, your best bet is Wise.

While Wise may not always be the cheapest or fastest way to send IRR, but they offer the best exchange rate, years of experience, and will offer you the peace of mind you need when sending large amounts abroad.

Understand the costs of money transfers to Iran

The total cost of IRR transfers depends on your location, the amount of IRR sent, the delivery/deposit methods, transfer fees, and the markup applied to the IRR exchange rate.

Transfer fee

The money transfer service you use to send Iranian Rial can apply a fixed fee, a percentage-based fee, or a combination of both.

For example, a $7,000 transfer to Iran will cost you $60.74 in fees with Wise, based on our February 2026 analysis of 2 services supporting Iranian Rial transfers.

IRR exchange rate markup

An exchange rate markup is the percentage added to the mid-market IRR rate.

Using the same example, Wise offers the best IRR exchange rates, with a 0.3% markup on the USD-IRR rate. This means for every USD sent, you receive 42,125.0002 IRR with 0.3% deducted from it.

Deposit method

How you fund your transfer can significantly impact the overall cost.

Bank transfer is the most common option, costing up to $490 per transfer to Iran.

Debit card transfers can go as high as $ in fees, while credit cards are usually more expensive and may include additional cash advance fees.

bank transfer is the cheapest payment method for sending IRR.

How to find the best exchange rate for Iranian Rial transfers

An exchange rate is a constantly changing value of IRR in relation to another currency. The exchange rate you secure impacts how much IRR you will get, so timing your transfer is essential to get the most out of it.

Let's dive into some recent IRR trends.

Over the past week, the exchange rate from USD to IRR has seen some fluctuation. On average, it stood at 42,125.0002 Iranian Rial.

During this period, the highest value recorded for Iranian Rial was 42,125.0002, while the lowest was 42,125.0002.

Wise, which is our recommended service for sending money online to Iran offers an exchange rate that is only 0.3% above the mid-market rate.

Want to secure the best Iranian Rial exchange rates?

Sign up for our rate alerts and we'll tell you when it's the best time to move your money to Iran!

Payment methods available for money transfers to Iran

How you fund your money transfer to Iran directly affects the speed, cost, and the amount of IRR your recipient will receive. Here are the most common options for funding your transfer to Iran:

Bank transfers

Bank deposits are reliable and common for international IRR transfers, available through most services.

While they tend to be cheaper, it may take up to 2-3 business days for the funds to arrive.

You also may have an option to use the SWIFT network for a bank deposit to Iran, avoid it where possible. SWIFT deposits are slow and expensive, instead check if there are cheaper options.

Based on our recent testing of 2 providers accepting Iran transfers, we found Wise to be the cheapest option, charging $60.74 per transfer with a 0.3% markup.

Debit and prepaid cards

Debit card transfers to Iran are generally faster than bank transfers. Most IRR transactions will be completed within a few hours. However, this convenience usually comes with increased fees.

We recommend for debit and prepaid card deposits when sending money to Iran. charges a % markup on the IRR rate and $ in transfer fees.

Credit cards

A credit card deposit is another option for sending IRR to Iran.

Typically it is more expensive, and your CC company may charge you cash advance fees, and apply increased interest rates.

If you want to fund your transfer to Iran with a credit card, we to get the best deal.

How we analyze the market

We track the cost, speed, and product offerings of the leading money transfer services available in Iran.

Our comparison engine and algorithms evaluate providers based on over 25 factors, including transfer fees, ease of use, exchange rates, mobile apps, transfer times & customer support.

We also consider how these services are rated on platforms like TrustPilot, AppStore, and Google Play, giving you a comprehensive view of what to expect.

This thorough analysis helps you get the best available deal - every time you want to move money to Iran.

We also provide unbiased and detailed reviews of all the top money transfer companies. You can use these reviews to find the best service for your needs when sending money to Iran

For a deeper understanding of our commitment to integrity and transparency, we invite you to read our editorial policy and review methodology.

Related transfer routes

FAQs

Find answers to the most common questions on our dedicated FAQ page.

How much money can be transferred to Iran?

Are there any tax implications to sending money to Iran?

What are the typical transfer fees for sending money to Iran?

How long does it take to send money to Iran?

Are there any minimum or maximum transfer limits for transfers to Iran?

Can I schedule regular transfers to Iran?

What currency is used in Iran?

Can I send money to Iran from any country?

How can I track my money transfer to Iran?

What should I do if my money transfer to Iran goes wrong?

Can’t I use my bank to send money to Iran?

Why send money to Iran?

Can I send money to Iran with MoneyTransfers.com?

Useful links for Iranians abroad

Contributors