The best, fastest & cheapest ways to send money to Venezuela

Compare money transfer services and find the cheapest and easiest ways to make money transfers to Venezuela.

Learn how to secure the best VES exchange rates at the lowest transfer fees, ensuring a smooth and easy transfer process.

If you just need the best service for VES transfers, it is Wise. Out of 3 companies tested that support VES, they appeared 100% of the time as the top-rated provider in our comparisons.

Otherwise, keep reading for expert tips, top VES transfer deals, and everything you need to know about transferring money to Venezuela.

Send money to Venezuela

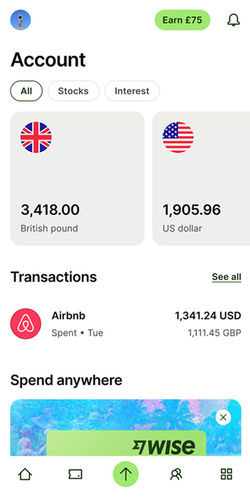

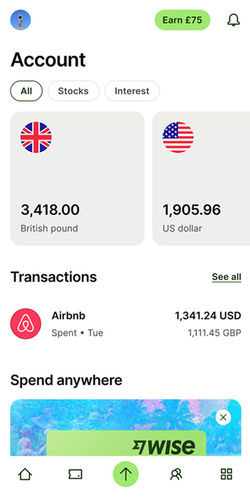

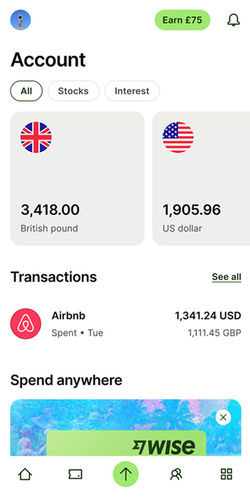

"Over 16 million customers use Wise, mostly for their excellent mobile app, transparent fee structure & use of mid-market rates. Now increasingly used for larger transfers."

"Over 16 million customers use Wise, mostly for their excellent mobile app, transparent fee structure & use of mid-market rates. Now increasingly used for larger transfers."

"Over 16 million customers use Wise, mostly for their excellent mobile app, transparent fee structure & use of mid-market rates. Now increasingly used for larger transfers."

"OFX have been helping individuals and businesses send money for over 25 years. Transfer in 50+ currencies to 170+ countries, with 24/7 phone access to currency experts."

"OFX have been helping individuals and businesses send money for over 25 years. Transfer in 50+ currencies to 170+ countries, with 24/7 phone access to currency experts."

"OFX have been helping individuals and businesses send money for over 25 years. Transfer in 50+ currencies to 170+ countries, with 24/7 phone access to currency experts."

"Over 16 million customers use Wise, mostly for their excellent mobile app, transparent fee structure & use of mid-market rates. Now increasingly used for larger transfers."

"Over 16 million customers use Wise, mostly for their excellent mobile app, transparent fee structure & use of mid-market rates. Now increasingly used for larger transfers."

"Over 16 million customers use Wise, mostly for their excellent mobile app, transparent fee structure & use of mid-market rates. Now increasingly used for larger transfers."

"OFX have been helping individuals and businesses send money for over 25 years. Transfer in 50+ currencies to 170+ countries, with 24/7 phone access to currency experts."

"OFX have been helping individuals and businesses send money for over 25 years. Transfer in 50+ currencies to 170+ countries, with 24/7 phone access to currency experts."

"OFX have been helping individuals and businesses send money for over 25 years. Transfer in 50+ currencies to 170+ countries, with 24/7 phone access to currency experts."

"Moneygram is a well established service with over 80 years in the sector. They support over 200 countries worldwide and have over 440,000 retail locations."

"Moneygram is a well established service with over 80 years in the sector. They support over 200 countries worldwide and have over 440,000 retail locations."

"Moneygram is a well established service with over 80 years in the sector. They support over 200 countries worldwide and have over 440,000 retail locations."

How to send money to Venezuela with the best rate

Always compare rates

Don't pay more than you have to. Use our live comparison tool to make sure you aren't missing the best rates when sending money to Venezuela.

Choose a provider

Select the provider that offers you the most VES and fits your needs.

Click, sign up & send

Follow the steps & make your transfer. Your funds will soon be on their way to your chosen country & currency.

Overall best choice: Wise

We tested & reviewed 3 companies offering transfers to Venezuela, and Wise scored the highest.

Wise offers the best combination of transfer fees, rates, speed, and has the best overall experience for transfers to Venezuela.

At the moment, if you were to send $7,000 to VES, it would cost you $60.74 in fees, and your recipient will get 3,023,414.76 VES.

Wise: The cheapest way to send money to Venezuela

Wise charges $60.74 per transfer to Venezuela, with a -0.71% markup on the VES exchange rate. This is 0.34% cheaper than the second cheapest option.

To get the most out of your transfer to Venezuela, use a bank transfer deposit to maximize the amount of VES received.

The fastest way to send money to Venezuela: OFX

Based on a $7,000 transfer and our comparison data for VES transfers, OFX is the quickest option for sending VES to Venezuela.

With OFX, the transfer time to Venezuela is minutes - 24 hours.

They charge $0 in fees and apply a 0.5% markup on the ‘real’ VES rate. This is 0% cheaper than the second-best provider.

For the best balance between speed and cost, we suggest using a deposit for Bolivar transfers.

The easiest way to send money to Venezuela: Wise

They’re highly transparent with fees, charging $60.74 per transfer with a -0.71% markup on the VES mid-market rate.

With multiple deposit and withdrawal options and reliable customer service, getting started with Wise takes less than 10 minutes, making it a fast, cheap, and user-friendly option.

Consider this before sending money to Venezuela

Always compare your options before sending Bolivar, as the amount of VES received can vary based on the deposit method, the amount of VES sent, and your home country.

Most services include fees and markups on the VES mid-market rate.

Our comparison of 3 providers supporting Venezuela will help you find the best fit for your needs.

Making large money transfers to Venezuela

When sending large amounts of Bolivar to Venezuela, it's important to consider factors like the limits, VES rates, customer support, as well as legal and government-imposed restrictions in Venezuela.

Wise is our top recommendation for moving large amounts of VES.

Whether you're purchasing property in Venezuela, need to pay tuition fees, have a wedding there, or transfer money for business in Venezuela, Wise will ensure a smooth and secure transaction.

Of all the companies we’ve tested and reviewed that specialize in large VES transfers, Wise consistently ranked as the top-rated choice.

They charge $60.74 per transfer and apply -0.71% markup on top of the VES exchange rate, making them perfect for moving big amounts.

Understand the costs of money transfers to Venezuela

The cost of sending VES depends on where you're sending from, the amount of VES sent, deposit and delivery methods, transfer fees, and the markup applied to the VES mid-market rate.

For example, if you're transferring $7,000 from the US to Venezuela, you can expect the following:

Transfer fees to Venezuela

Depending on the service you use to send Bolivar, transfer fees can be percentage-based, fixed, or a combination of both.

OFX charges only $0 per transfer based on our analysis of 3 services supporting VES transfers in March 2026.

Markup on VES exchange rate

A markup is a percentage added to the VES mid-market rate by a money transfer service (or a bank).

Wise offers the best VES exchange rates by applying a -0.71% markup on the USD-VES rate. This means for every US Dollar sent, you receive 425.6694 VES minus -0.71% deducted from it.

Funding transfer to Venezuela

How you fund your transfer to Venezuela can impact the cost:

Bank transfers typically have the lowest fees, often costing up to $0 per transfer.

Debit cards may cost up to $ per transfer.

Credit cards may come with cash advance fees and increased rates.

Overall, bank transfer is the cheapest funding method for VES transfers.

Get the best VES exchange rate

The exchange rate is the value of the VES (Bolivar) against other currencies, and since it fluctuates, it will affect how much VES the recipient will get. Sending money when VES reaches the highest value will result in more VES for your recipient.

Over the past 7 days, the VES exchange rate has:

Averaged at 425.6694 Bolivar per USD

Reached a high of 432.6257 VES/USD

Dropped to a low of 421.3499 VES per US Dollar

You should aim to make a transfer when the rate is closer to 432.6257 VES/USD . This will give your recipient in Venezuela more Bolivar.

Pair your transfer with Wise (who offers the best exchange rate), and you will maximize the amount of VES received.

Get notified when it’s the best time to send VES

Sign up for our rate alerts, and we’ll notify you when it’s the best time to send VES!

Payment methods available to fund your transfer to Venezuela

Bank transfers

Bank transfers are often the default option for sending money to Venezuela.

By using a money transfer company available in Venezuela such as Wise, you can send money via a bank transfer (or ACH) while benefiting from lower fees and more favorable exchange rates.

Wise is the cheapest provider for bank transfers from the 3 we tested when sending money to Venezuela.

They charge 60.74VES for sending money to Venezuela with a bank transfer, resulting in 3,023,414.76 for your recipient.

Debit and prepaid cards

Sending money to Venezuela with a debit or a prepaid card is very simple with .

is a leader in debit card payments to Venezuela, competing among a total of 3 active money transfer companies.

Credit cards

When it comes to sending VES via credit card, we to get the best deal today.

Fee alert: using a credit card to transfer money often results in a cash advance fee being charged by your card issuer. That's why we recommend a bank transfer or debit card instead.

How we analyze the market

We track the cost, speed, and product offerings of the leading money transfer services available in Venezuela.

Our comparison engine and algorithms evaluate providers based on over 25 factors, including transfer fees, ease of use, exchange rates, mobile apps, transfer times & customer support.

We also consider how these services are rated on platforms like TrustPilot, AppStore, and Google Play, giving you a comprehensive view of what to expect.

This thorough analysis helps you get the best available deal - every time you want to move money to Venezuela.

We also provide unbiased and detailed reviews of all the top money transfer companies. You can use these reviews to find the best service for your needs when sending money to Venezuela

For a deeper understanding of our commitment to integrity and transparency, we invite you to read our editorial policy and review methodology.

Related transfer routes

Send money from Venezuela

Send money to Venezuela

FAQs

Find answers to the most common questions on our dedicated FAQ page.

Are there tax implications when sending money to Venezuela?

Are there any limits on how much VES I can send to Venezuela?

Can I make regular VES transfers/payments to Venezuela?

How long does it take to transfer money to Venezuela?

What are the fees and exchange rates for sending VES from abroad?

Why can’t I use my bank to wire money to Venezuela?

What is the official currency used in Venezuela?

Can I transfer money to Venezuela from any country?

What should I do if something goes wrong with my transfer to Venezuela?

Can I use MoneyTransfers.com to transfer funds to Venezuela?

Tools & resources

Contributors