The first transfer is FREE!

This applies only to first transfers. There are no promotional rates.

Scoring BOSS Revolution

The key areas of our BOSS Revolution review are focused on the fees & exchange rates, transfer limits & speed, product offering, ease of use, safety, and customer feedback.

Before you choose whether to transfer funds overseas with BOSS Revolution, here’s a quick summary of the benefits and drawbacks.

Pros

Cons

BOSS Revolution fees and exchange rates

Fees and rates

Just like with most transfer companies, BOSS Revolution charges a fee and exchange rate markup.

Exchange rates

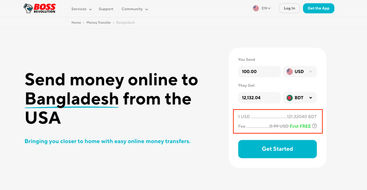

BOSS Revolution only allows transfers in USD, hence we’ve analyzed the markup based on transfers from the US, in USD.

On average, BOSS Revolution adds a 1.59% markup to the “real” exchange rate.

This rate heavily varies by destination currency, and some rates are better than the mid-market rate.

Here’s a breakdown of the currency rates and the markup by destination currency.

Destination | BOSS Revolution rate* | Mid-Market rate* | Markup |

|---|---|---|---|

BDT | 119.3502 | 119.4077 | 0.05% |

XOF | 579.675 | 591.1813 | 1.95% |

BOB | 7.1638 | 6.903979 | -3.76% |

XOF | 577.2482 | 591.1813 | 2.36% |

XAF | 592.358 | 591.1386 | -0.21% |

COP | 4086.72 | 4209.96 | 2.93% |

CRC | 487.5 | 517.9437 | 5.88% |

DOP | 58.5931 | 60.37583 | 2.95% |

ETB | 118.3182 | 118.3648 | 0.04% |

EUR | 0.877 | 0.902915 | 2.87% |

GMD | 63.7279 | 70 | 8.96% |

EUR | 0.877 | 0.902915 | 2.87% |

GHS | 15.5393 | 15.80679 | 1.69% |

EUR | 0.8792 | 0.902915 | 2.63% |

GTQ | 7.656 | 7.723782 | 0.88% |

GNF | 8363.423 | 8627.744 | 3.06% |

HTG | 131.6086 | 131.8462 | 0.18% |

HNL | 24.8215 | 24.84701 | 0.10% |

EUR | 0.877 | 0.902915 | 2.87% |

XOF | 589.5 | 591.1813 | 0.28% |

JMD | 155.3614 | 157.2862 | 1.22% |

KES | 127.296 | 128.9 | 1.24% |

MGA | 4318.7155 | 4572.613 | 5.55% |

MWK | 1631.8002 | 1732.348 | 5.80% |

MXN | 19.1565 | 19.74813 | 3.00% |

MZN | 60.4467 | 63.875 | 5.37% |

NPR | 132.83 | 133.9984 | 0.87% |

EUR | 0.8792 | 0.902915 | 2.63% |

NGN | 1630.643 | 1668.33 | 2.26% |

PKR | 277.3762 | 277.4073 | 0.01% |

PEN | 3.626 | 3.703901 | 2.10% |

PHP | 55.3918 | 56.255 | 1.53% |

RWF | 1296.4435 | 1363.853 | 4.94% |

XOF | 579.675 | 591.1813 | 1.95% |

SLL | 22.71 | 22.58011 | -0.58% |

EUR | 0.877 | 0.902915 | 2.87% |

XOF | 576.0732 | 591.1813 | 2.56% |

UGX | 3642.8702 | 3665.384 | 0.61% |

GBP | 0.7374 | 0.752025 | 1.94% |

*Rates collected in October 2024. Information collected for a $1000 transfer (in USD). Negative values mean a better rate than the mid-market rate.

In addition to the above, you can send USD to the following countries: Bolivia, Costa Rica, DR Congo, Dominican Republic, Ecuador, El Salvador, Guatemala, Haiti, Honduras, Liberia, Nicaragua, Panama, Peru, and Zimbabwe. This means the rate is 1 USD to 1 USD.

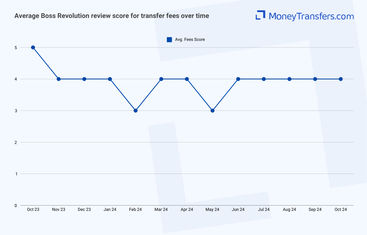

To ensure full coverage of the BOSS Revolution, we’ve looked at what other users have to say about their exchange rates and plotted the results on the graph below.

International transfer fees

BOSS Revolution charges a fixed fee per transfer. This fee depends on the transfer method and the destination.

In general, fees vary between $0 - $18 with BOSS Revolution.

Here’s a breakdown of the fees by country and payment methods.

Payment Method | Lowest Fee - Highest Fee |

|---|---|

ACH (only Ivory Coast and the UK) | $0.00 - $3.49 |

Bank transfer | $0.00 - $18.00 |

Mobile Pay, Apple Pay & Google Pay | $0.00 - $20.99 |

Debit card | $0.00 - $3.99 |

Credit card | $0.00 - $31.99 |

Transfers to countries vary by fee but are largely the same regardless of the payment method you use. However, there are a few exceptions:

Ivory Coast and the UK have a fee of $0.99 for ACH transfer and $41.49 for all other methods

Congo DR costs $3.49 with ACH but $18.00 with all others. However, ACH transfers are currently disabled to double-check at the time of transfer.

As for the rest, here is the summary of the fees (for bank transfers and mobile payments):

Fees (USD) | Destination country |

|---|---|

$0.00 | Costa Rica, Dominican Republic, Ghana, Italy, Nigeria, Peru, Philippines, Senegal, Spain |

$0.99 | Bangladesh, Guatemala, Kenya |

$1.49 | Burkina Faso, Ethiopia, France, Gambia, Germany, Greece, Guinea, Ivory Coast, Madagascar, Malawi, Mozambique, Netherlands, Sierra Leone, Togo, United Kingdom |

$1.99 | Benin, Jamaica, Mexico, Pakistan |

$2.49 | El Salvador, Honduras |

$2.99 | Cameroon, Colombia |

$3.49 | Nicaragua, Uganda |

$3.99 | DR Congo, Nepal, Rwanda |

$9.99 | Liberia |

$10.00 | Ecuador |

$15.99 | Haiti |

$18.00 | Bolivia, Panama, Zimbabwe |

Finally, if you’re depositing using a credit card, you might face additional cash advance fees on top of the following:

Credit card fee | Destination |

|---|---|

$0.00 | Senegal |

$6.99 | Ivory Coast, United Kingdom |

$20.99 | Bangladesh, Benin, Burkina Faso, Cameroon, Colombia, Costa Rica, Dominican Republic, Ethiopia, France, Gambia, Germany, Ghana, Greece, Guatemala, Guinea, Honduras, Italy, Jamaica, Kenya, Madagascar, Malawi, Mexico, Mozambique, Nepal, Netherlands, Nigeria, Pakistan, Peru, Philippines, Rwanda, Sierra Leone, Spain, Togo, Uganda |

$31.99 | Bolivia, DR Congo, Ecuador, El Salvador, Haiti, Liberia, Nicaragua, Panama, Zimbabwe |

In addition, any payments that involve banks may also be charged by the intermediary fees and network fees.

These are very rare, but will be applied and deducted from the amount, or, in some cases the receiver will need to pay these.

Now let’s put these numbers into perspective, let’s assume you’re sending $1000 from the US via debit card to a bank account in the following countries:

Country | BOSS Revolution fees | Wise fees | TD Bank fees |

|---|---|---|---|

$1.49 + 1.94% markup ($20.89) | Total $6.69 | $50 + ~2.98% markup | |

$0.00 + 1.94% markup ($15.30) | Total $9.46 | $50 + ~3.09% markup | |

$1.49 + 2.87% markup ($30.19) | Total $6.26 | $50 + ~3.01% markup |

In addition, if paying by credit card, you may also be charged cash advance fees by your credit card provider.

Similar to the rates, we’ve looked at how other users have rated BOSS Revolutions in terms of their fees.

Transfer speed

Transfer speed

BOSS Revolution states that the transfers should generally be available within 30 minutes, although this can depend on the method of payment you use, local bank holidays, and pickup location operating hours.

In general, all payments should arrive within 30 minutes. Bank transfers can be delayed up to 3 business days depending on when you made the transfer and any intermediaries involved.

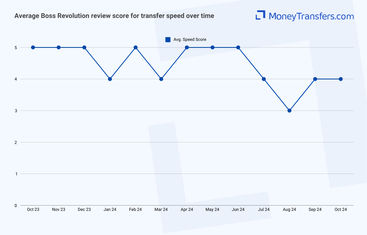

When it comes to user reviews, this is what it looks like in terms of speed.

Transfer limits

Transfer limits

BOSS Revolution has a minimum transfer limit of $10.00 and a maximum limit of USD 2,999 per transfer.

We’ve also looked at online user reviews for BOSS Revolution limits.

Product offering

Product offering

Supported currencies & destinations

BOSS Revolution supports international money transfers from the US to 53 countries worldwide, with over 320,000 agent locations to make cash pick-ups more accessible.

You can make transfer to the following countries and currencies:

Bangladesh (BDT)

Benin (XOF)

Bolivia (BOB)

Burkina Faso (XOF)

Cameroon (XAF)

Colombia (COP)

Costa Rica (CRC)

Dominican Republic (DOP)

Ethiopia (ETB)

France (EUR)

Gambia (GMD)

Germany (EUR)

Ghana (GHS)

Greece (EUR)

Guatemala (GTQ)

Guinea (GNF)

Haiti (HTG)

Honduras (HNL)

Italy (EUR)

Ivory Coast (XOF)

Jamaica (JMD)

Kenya (KES)

Madagascar (MGA)

Malawi (MWK)

Mexico (MXN)

Mozambique (MZN)

Nepal (NPR)

Netherlands (EUR)

Nigeria (NGN)

Pakistan (PKR)

Peru (PEN)

Philippines (PHP)

Rwanda (RWF)

Senegal (XOF)

Sierra Leone (SLL)

Spain (EUR)

Togo (XOF)

Uganda (UGX)

United Kingdom (GBP)

In addition, you can send USD to the following countries:

Bolivia

Costa Rica

DR Congo

Dominican Republic

Ecuador

El Salvador

Guatemala

Haiti

Honduras

Liberia

Nicaragua

Panama

Peru

Zimbabwe

Transfer types

With BOSS Revolution you can send money in the following ways.

Bank transfers

With this option, you can use your bank account to make a transfer online. This option includes funding your transfer with a bank account, debit card, credit card, Apple Pay, and Google Pay.

Cash transfers

You can transfer cash with BOSS Revolution. You will start the process in the app, and finish it at any of their branches.

Mobile transfers

This includes sending money to supported mobile money accounts. These wallets will depend on the country but a few examples include M-PAiSA and GCash.

Mobile top-up

Slightly outside of this review, but they also offer mobile top-ups. This allows you to send airtime to over 270 carriers across 102 countries. This is similar to what WorldRemit is offering.

Payment methods

BOSS Revolution has two payment options:

Debit card

You can fund your transfer using a debit card. Simply link it to your BOSS Revolution account and fund the transfer. Depending on the location, fees will range from 0.00 - 3.99 USD.

Credit card

Credit cards are a fairly rare option for deposits (as it’s very expensive), however, you can fund your transfer with it. Fees will vary from 6.99 - 31.99 USD per transaction (other than Senegal, which is free).

Mobile pay

Mobile pay includes payment processors linked to your phone, such as Apple Pay and Google Pay. The fees for all options range between 0.00 - 20.99 USD. Simply select the option during the checkout and follow the usual process.

Bank deposit

Similar to debit cards, you can add your bank to the account and fund your transfer from there. The process is the same, but the funds might take a bit longer to deposit. The fees range between 0 - 18.00 USD depending on the destination country.

ACH

You can use ACH deposits when sending to Ivory Coast and the UK. Oddly, all other locations seem to be disabled on the website. This is the cheapest option, with fees ranging from 0 - 3.49 USD.

Cash payment

Alternatively, you can select ‘Pay at Store’. This option allows you to submit a money transfer order via the app, and then pay for your transfer in cash at an authorized agent location.

Receiving methods

BOSS Revolution offers four delivery methods:

Cash pickup

With over 300,000 agent or partner locations across the world, you can send your money to be picked up as cash. This type of transfer is often available very quickly, so ideal if you need to send money urgently or to someone without access to a bank account.

Bank deposit

A popular method of sending money internationally, bank transfer seems to be the most widely accepted type of transfer for all the countries BOSS Revolution supports transfers to.

They also have a “Direct to debit” transfer, which is the same as this, as money will land in the recipient's bank account.

Home delivery

For selected countries, you can also opt to have your funds delivered directly to your recipient’s door. This won’t be an option for every country the company supports, so check if it’s offered for your recipient’s country first.

Mobile wallet deposit

You also have the option to send instantly to mobile money accounts, which is another useful and secure alternative to sending money to a bank account.

Mobile app

Somewhat confusingly, BOSS Revolution has two mobile applications: the Calling App and the Money Transfer App. The two applications work seamlessly with one another to ensure a streamlined online experience.

Using the app, you can:

Send an international money transfer

Track money transfers

Check rates and fees

Find branches around you

Send airtime top-up

Make international calls

If you are based in the US you can download the BOSS Revolution Money Transfer app for free from the App Store or Google Play Store.

Ease of use

Ease of use

Overall the website and the app are easy to use with information displayed across all functions.

What I really like about it, is that you can see all the fees before downloading the app or signing up through the site.

That’s useful for me because I (and you) want to know what you are getting after the promo expires.

You would probably expect this from every money transfer provider, but you would be surprised. For example, OrbitRemit hides this information unless you sign up.

As with the website, the mobile app guarantees total transparency throughout the money transfer process; this includes a handy comparison tool that allows customers to compare exchange rates to leading competitors, reviewing how much money will be saved.

Most recently the app was updated and the latest redesign is intended to be faster and easier to use, with an emphasis on greater rewards for loyal customers.

This being said, according to user feedback - particularly on the Play Store - some customers have experienced issues with the app crashing or performing slowly when arranging international money transfers.

Similarly to other sections of this review, we’ve looked at what others had to say about the usability and plotted the results on the graph below.

Customer service

If you have questions about the service or your transfer, you can contact BOSS Revolution via:

Email

Phone

Use their FAQs

These options are fairly limited compared to similar services, but still better than many others.

Use the following details if you need to contact them:

Contact option | Details |

|---|---|

Call | 0330-777-1374 |

FAQs | You can find it here. Although, most are related to mobile top-ups. |

Customer support is usually the downside of many transfer companies. We’ve looked at what users had to say about BOSS Revolution in terms of their support.

Safety and trust

Safety and trust

Legitimacy of the BOSS Revolution

BOSS Revolution Money Transfer is a service offered by IDT Retail Europe Limited (a company registered in England and Wales with registration number 135555314) and Interdirect Tel Limited (a company registered in Ireland with registration number 294260)

Both companies are regulated by Ofcom, according to their terms and conditions.

In addition, BOSS Revolution offers a 100% money-back guarantee.

If for some reason your transfer does not reach its destination, the company will refund you in full.

Similar to other areas of this review, we’ve analyzed what others had to say regarding BOSS Revolution safety.

Customer feedback

Customer feedback

BOSS Revolution receives an ‘Excellent’ rating of 4.3 out of 5* on Trustpilot, with over 15,000 reviews regarding their money transfer services.

Most reviews (71%) are rated as 5/5* and only a few (17%) with 3* or less.

ANALYSIS OF USER REVIEWS

The reviews for Boss Revolution's international money transfer service are fairly mixed.

Many find it convenient and easy to use, mention that the app is straightforward for sending money abroad with fast transfer times, and some even mention low fees and good rates.

However, the majority find the exchange rates less favorable compared to competitors. Many mention technical issues with the app and unhelpful customer service.

While the service is convenient and quick, exchange rates, technical reliability, and customer support could be better.

Here's a summary of average user reviews so far this year.

Review Category | Apr 24 | May 24 | Jun 24 | Jul 24 | Aug 24 | Sep 24 |

|---|---|---|---|---|---|---|

International Transfers | 5 | 4 | 4 | 5 | 4 | 4 |

Fees | 4 | 3 | 4 | 4 | 4 | 4 |

Exchange Rates | 4 | 4 | 4 | 4 | 4 | 4 |

Speed | 5 | 5 | 5 | 4 | 3 | 4 |

Limit | 5 | 3 | 3 | 4 | 5 | 4 |

Features | 4 | 4 | 4 | 4 | 4 | 4 |

Ease of Use | 5 | 5 | 5 | 5 | 5 | 5 |

Safety | 5 | 4 | 4 | 5 | 3 | 5 |

Customer Support | 5 | 4 | 3 | 4 | 4 | 4 |

Opening an account with BOSS Revolution

To open an account with BOSS Revolution, you will need the following:

A phone to download their app

An email

A phone number

Once you have these details, follow the steps below to open an account:

Download the app

Navigate to the app store on your mobile phone find the BOSS Money app, and click download.

Sign up

Once downloaded, open it up and follow the onscreen instructions

Verify the account

Once you click sign up, you will receive a verification SMS. Add the PIN from the message to your account to complete verification. That is it, you can now use it to send money.

Making international transfers

To send money with BOSS Revolution, you will need the following:

Recipient details

Transfer amount and currency

Deposit method to fund the transfer

Delivery method (how the recipient will receive the money)

If you are sending money to a bank account outside of the EU, you will also need to provide a SWIFT code.

Sending money abroad via the BOSS Money app

Once you have all the details ready, you can send money with BOSS Revolution by following the steps below.

Choose the destination

Select the country you are sending to, and then input the amount you want to send your payment method, and delivery method. These options may be limited depending on where you are sending to.

Enter the recipient's details

Click to proceed and enter your recipient’s details (e.g. full name, address, bank account information) and add your payment details.

Confirm your transfer

Check you have entered all the information correctly, and start your transfer.

Sending money abroad via the BOSS Revolution agent

You can also transfer cash if you want in one of 300,000 BOSS Revolution agent locations. Simply follow these steps.

Find your nearest agent

Visit the Boss Revolution website and select the store finder to find your nearest agent.

Start the transfer

Visit the store and fill out the relevant paperwork to make the transfer. The information required will be the same as on the app (recipient details, transfer details, payment method, etc..).

Confirm and pay

Ensure everything is correct and make the payment.

Receiving money

You’ll be given a transaction ID which you then can pass to the receiver so they can collect the cash and track the transfer.

Canceling transfer

Transfers can be canceled unless they've reached the destination. If you've made a mistake you can contact BOSS Revolutions (ideally by phone to speed it up), and ask to cancel the transfer.

Receive international transfers

In most cases, money will land directly in the receiver's bank account or wallet.

If they want to collect the cash, follow the steps below:

Receiving in-store

Once the transfer has been made, pass the transaction ID to the receiver. They will need it to collect the funds.

Once they are at the store, they’ll need to show the transaction ID and a government ID to verify their identity.

Receiving home delivery

For home deliveries, the process is the same. Once the courier arrives, the receiver will need to provide the same information as in-store.

How BOSS Revolution compares to other transfer services

Other Alternatives

Alternatively, consider using one of these neobanks for international transfers.

BOSS Revolution: Is it good for transfers abroad?

Overall, BOSS Revolution is a bit more expensive than most providers and doesn’t really offer any special features.

What I mean, is that you can find a better alternative with the same (and more) features, better rates, and lower fees.

The only time you should use it is if it’s convenient for you and if it serves the destination. But given that you can only send USD, there are much better options available.

Use the form below to compare your options, and get a better rate for your transfer.

Find the best rates for your transfer

A bit more about the BOSS Revolution

Are BOSS Revolution exchange rates guaranteed?

Help & FAQ

Get answers to the most common questions asked when sending money abroad. Covers costs, fees and the best way to compare.

More Money Transfer Services