How to send money to Switzerland from Philippines with the best PHP-CHF rate

Get the best deals when you send money from the Philippines to Switzerland. Find the best, cheapest, and fastest, providers for PHP to CHF transfers and exchange rates.

Read on for insights and expert information, and all you need to make money transfers to Switzerland from Philippines.

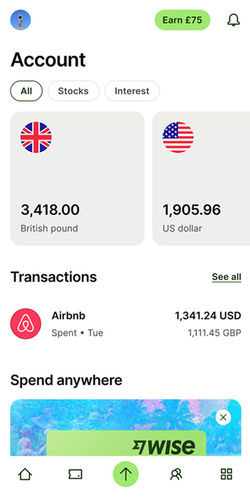

Transferring the other way? Send CHF from Switzerland to Philippines instead."Over 16 million customers use Wise, mostly for their excellent mobile app, transparent fee structure & use of mid-market rates. Now increasingly used for larger transfers."

"Over 16 million customers use Wise, mostly for their excellent mobile app, transparent fee structure & use of mid-market rates. Now increasingly used for larger transfers."

"Over 16 million customers use Wise, mostly for their excellent mobile app, transparent fee structure & use of mid-market rates. Now increasingly used for larger transfers."

"Over 16 million customers use Wise, mostly for their excellent mobile app, transparent fee structure & use of mid-market rates. Now increasingly used for larger transfers."

"Western Union agents help you send money from a wide variety of countries. Find a local branch near you to deposit cash and send your funds abroad."

"Western Union agents help you send money from a wide variety of countries. Find a local branch near you to deposit cash and send your funds abroad."

"With MoneyGram you can send money globally. Find a local MoneyGram branch near you to deposit and send cash abroad."

"With MoneyGram you can send money globally. Find a local MoneyGram branch near you to deposit and send cash abroad."

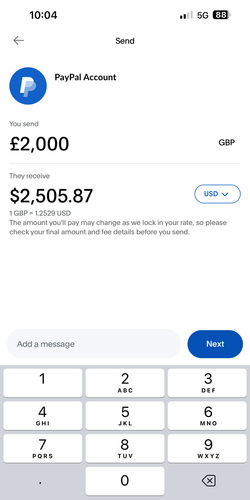

"If you and the person you are sending money to both have PayPal apps, you can quickly and easily send money between each other."

"If you and the person you are sending money to both have PayPal apps, you can quickly and easily send money between each other."

"Over 16 million customers use Wise, mostly for their excellent mobile app, transparent fee structure & use of mid-market rates. Now increasingly used for larger transfers."

"Over 16 million customers use Wise, mostly for their excellent mobile app, transparent fee structure & use of mid-market rates. Now increasingly used for larger transfers."

Overall best way: Wise

Wise scored the highest of the 4 money transfer companies supporting PHP to CHF transfers.

For example, sending 14,700 PHP to CHF will cost you ₱100.96 in fees, and the recipient will get 195.98 CHF. The delivery time is within an hour.

For a great mix of cost, speed & features, we suggest trying Wise for your Philippines to Switzerland transfer.

How to compare deals on Philippines to Switzerland money transfers

Always compare rates

Don't pay more than you need to. Use our live comparison tool to ensure the best rates on money transfers from the Philippines to Switzerland.

Choose a provider

Select the provider that gives you the best value & service for your needs.

Click, sign up & send

Follow the steps & start your transfer from the Philippines. Your funds will be converted to Swiss Franc and transferred to Switzerland.

What to consider ahead of money transfers from Philippines to Switzerland

Comparing based on your specific needs is the best way to send money from the Philippines to Switzerland with confidence.

Our analysis, and search results, include 4 providers that operate between the Philippines and Switzerland. These are ranked by speed, overall cost and ease of use.

Through this, you get a comprehensive view of all the options you have in the Philippines when you need to send money to Switzerland.

The fastest way to send money to Switzerland from Philippines is by sending cash

Cash transfers are almost instant in most cases.

However, in some cases, it can take a few days to process, depending on your branch, how much you are sending, and the deposit method you use.

Considering there aren’t many PHP/CHF transfer options available, this is by far the fastest way to do it.

The cheapest way to to send money to Switzerland from Philippines is via PayPal P2P Transfer

The coverage of PHP/CHF transfer options is very limited, therefore, PayPal’s P2P transfer service is one of the cheaper options you have, along with cash transfer via Western Union and MoneyGram.

With PayPals P2P transfer, the main cost is the conversion between currencies, which can go as high as % on top of the mid market rate, as well as a PHP transfer fee.

You can also opt to use a cash transfer via MoneyGram or Western Union, which are cheaper in some cases (depending on the amount, deposit method, and your branch).

Sending large amounts of money

Of the 4 companies compared, Wise has the strongest option for large transfers from the Philippines to Switzerland.

Whatever the reason, sending bigger sums of money can be costly if you get a bad exchange rate from Philippine Peso to Swiss Franc.

The Wise rate makes them great for large transfers between Switzerland and the Philippines.

Understanding the cost of transferring money to Switzerland from Philippines

Fees and exchange rates make up the total cost of sending money from Switzerland to Switzerland. Finding a company that can offer both ensures a good deal on your transfer.

The Mid-Market and Exchange Rates: The current PHP-CHF mid-market rate is 0.0135 CHF per Philippine Peso. You will get more Swiss Franc for your Philippine Pesos if you find a provider close to this number.

For context, over the last 7 days the PHP-CHF mid-market rate has had a high of 0.0134, a low of 0.0133 and averaged 0.0134 CHF per Philippine Peso.

Across the 4 companies compared, the best exchange rate is with Wise.

Unless fees are unusually high, the exchange rate you receive on converting PHP to CHF will be the biggest determining factor when working out the cost of transferring Philippine Pesos to Switzerland.

Fees: Transfer fees are charged as part of the transfer. Wise charges the lowest fee of 100.96 PHP at the moment. We’d always recommend comparing providers for your exact send amount as fees may change.

Amount Received: Money transfer companies will show you the amount of Swiss Franc eventually received in Switzerland. You can assume that a lower cost of sending from the Philippines will result in more money received in Switzerland.

Finding the best exchange rate between Philippine Peso and Swiss Franc

Getting a strong exchange rate between PHP and CHF is essential. The exchange rate you secure impacts how much CHF you get for your PHP.

It can pay to track rates, and keep on top of currency trends.

In the past 7 days, the mid-market rate from PHP to CHF has averaged 0.0134.

In this period there was a high of 0.0134, and a low of 0.0133.

Wise, which is our recommended service to send money online from Philippines to Switzerland offers 0.0134 CHF per PHP which is only 0.2% above the mid-market rate.

Want to secure the best PHP-Swiss Franc exchange rates?

Sign up for our rate alerts and we'll tell you when it's the best time to move your money from Philippines to Switzerland!

Funding your Philippines to Switzerland money transfer

Bank transfers

Bank transfers are often the best and easier way to send money from the Philippines to Switzerland.

By using a money transfer company such as Wise for transfers from the Philippines to Switzerland, you can send money via a bank transfer and benefit from lower fees and more favorable exchange rates than would be offered by a bank.

On average, Wise is the cheapest way to send money via a bank transfer. This is of the 4 companies we tested when sending PHP to Switzerland.

With a fee of 100.96 PHP to send money from the Philippines to Switzerland, Wise offers a decent combination of competitive exchange rates and lower fees.

Debit and prepaid cards

Sending money from the Philippines to Switzerland with a debit or a prepaid card is easy with Western Union Agent.

Western Union Agent is a leading money transfer company for debit card payments, and offers transfers from the Philippines to Switzerland.

Credit cards

We recommend avoiding credit card transfers due to high fees, and instead, you should consider a bank transfer or a debit card deposit.

However, if you do need to use a credit card to fund your transfer, to get the latest deal.

Keep on top of fees: using a credit card to transfer money can result in a fee being charged by your card issuer. Where possible, we recommend bank transfer or debit card instead.

How we analyze the market

We track the cost, speed, and product offerings of the leading money transfer services available between Switzerland and Philippines.

Our comparison engine and algorithms evaluate providers based on over 25 factors, including transfer fees, ease of use, exchange rates, mobile apps, transfer times & customer support.

We also consider how these services are rated on platforms like TrustPilot, AppStore, and Google Play, giving you a comprehensive view of what to expect.

This thorough analysis helps you get the best available deal - every time you want to move money from Philippines to Switzerland.

We also provide unbiased and detailed reviews of all the top money transfer companies. You can use these reviews to send PHP to CHF.

For a deeper understanding of our commitment to integrity and transparency, we invite you to read our editorial policy and review methodology.

Related transfer routes

Send money from Philippines

How much money can be transferred from Philippines to Switzerland?

Are there any tax implications to sending money from Philippines to Switzerland?

Can I send money from Philippines to Switzerland with MoneyTransfers.com?

What are the typical transfer fees for sending Philippine Pesos to Switzerland through various providers?

How long does it take to send money from Philippines to Switzerland?

What is the best exchange rate I can get for sending money from Philippines to Switzerland?

Are there any minimum or maximum transfer amounts for sending money from Philippines to Switzerland?

Can I schedule regular transfers between Philippines and Switzerland?

Tools & resources

Contributors