Data trends for North America

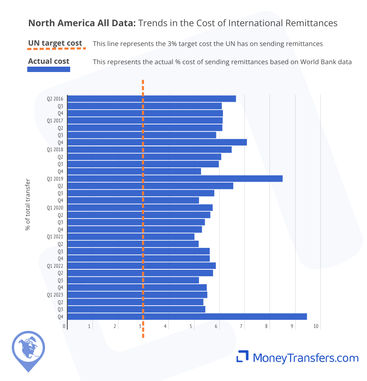

North America has one of the cheapest average costs for remittance. Between 2018 and 2022, costs were around 5%. For comparison, Europe was around 7%.

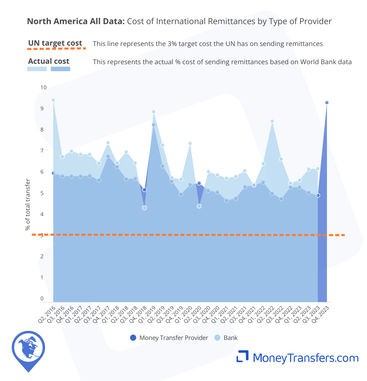

Money transfer companies and banks have shown similar trends for sending money to North America. Both have decreased their average costs by around 1.4% from 2016 to date.

Money transfer providers have continued to be around 1% less of the total transfer than sending through a bank.

Despite being a competitive and largely accessible market, North America has also not yet hit the 3% target set by the UN for transfer costs.

Average cost of sending money

The data below shows the average cost of sending $200 to North America as a percentage of the amount sent.

The data below outlines the average cost of sending money in Q4 where the data is currently available. Full data is available in each of the other tabs.

The data below shows the average cost as a percentage of the overall transfer for every quarter since 2016 for which the data is available.

Here are the numbers behind the graphs.

Date: Quarter, Year | % of transfer |

|---|---|

Q2, 2016 | 6.65% |

Q3, 2016 | 6.09% |

Q4, 2016 | 6.13% |

Q1, 2017 | 6.12% |

Q2, 2017 | 6.11% |

Q3, 2017 | 5.87% |

Q4, 2017 | 7.08% |

Q1, 2018 | 6.48% |

Q2, 2018 | 6.07% |

Q3, 2018 | 5.97% |

Q4, 2018 | 5.27% |

Q1, 2019 | 8.49% |

Q2, 2019 | 6.54% |

Q3, 2019 | 5.79% |

Q4, 2019 | 5.19% |

Q1, 2020 | 5.73% |

Q2, 2020 | 5.64% |

Q3, 2020 | 5.42% |

Q4, 2020 | 5.31% |

Q1, 2021 | 5.01% |

Q2, 2021 | 5.17% |

Q3, 2021 | 5.61% |

Q4, 2021 | 5.61% |

Q1, 2022 | 5.85% |

Q2, 2022 | 5.74% |

Q3, 2022 | 5.19% |

Q4, 2022 | 5.50% |

Q1, 2023 | 5.52% |

Q2, 2023 | 5.36% |

Q3, 2023 | 5.44% |

Q4, 2023 | 9.46% |

Cost by type of company

Money transfer companies and banks are the most popular ways to send money to North America. This data focuses on the average cost of using each service since 2016.

Generally, money transfer operators have remained cheaper than banks for remittances into North America. Q4 2023 data for banks is not yet available.

This data shows the average cost of sending money using a money transfer company vs a bank for every quarter. On average a money transfer company is 1% cheaper than using a bank for international remittances.

This table outlines the cost of sending money to North America for each quarter tracked.

Date: Quarter, Year | Money Transfer Operator | Bank |

|---|---|---|

Q2, 2016 | 6.10% | 9.57% |

Q3, 2016 | 5.96% | 6.88% |

Q4, 2016 | 5.97% | 7.16% |

Q1, 2017 | 5.96% | 7% |

Q2, 2017 | 5.98% | 7% |

Q3, 2017 | 5.78% | 6.58% |

Q4, 2017 | 6.90% | 7.56% |

Q1, 2018 | 6.42% | 6.59% |

Q2, 2018 | 5.83% | 7.13% |

Q3, 2018 | 5.85% | 6.59% |

Q4, 2018 | 5.31% | 4.47% |

Q1, 2019 | 8.40% | 9.03% |

Q2, 2019 | 6.44% | 7.43% |

Q3, 2019 | 5.74% | 5.89% |

Q4, 2019 | 5.10% | 5.82% |

Q1, 2020 | 5.55% | 7.52% |

Q2, 2020 | 5.64% | 4.53% |

Q3, 2020 | 5.29% | 6.19% |

Q4, 2020 | 5.21% | 6.04% |

Q1, 2021 | 4.81% | 5.88% |

Q2, 2021 | 4.92% | 5.95% |

Q3, 2021 | 5.47% | 6.23% |

Q4, 2021 | 5.54% | 5.53% |

Q1, 2022 | 5.67% | 6.56% |

Q2, 2022 | 5.15% | 8.57% |

Q3, 2022 | 4.90% | 6.77% |

Q4, 2022 | 5.45% | 5.64% |

Q1, 2023 | 5.44% | 5.77% |

Q2, 2023 | 5.19% | 6.31% |

Q3, 2023 | 5.05% | 6.31% |

Q4, 2023 | 9.46% | No Data |

Why are money transfer companies cheaper?

Generally, a money transfer company is cheaper for sending money into North America because they use their own network. A bank may need to use an intermediary which can increase costs.

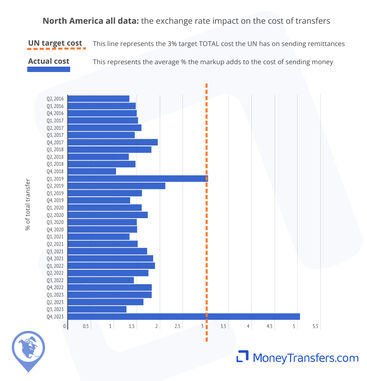

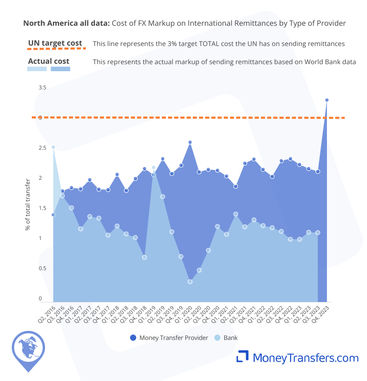

Average FX markups for North American remittances

The markup, as a part of a transfer, can equate to hidden costs or a hidden fee for sending money. Essentially, the higher the markup, the less the recipient will eventually end up with. This markup is represented as a percentage and is what is charged on top of the mid-market rate.

Average exchange rates to North America are often below 2%, and have averaged 1.5% since 2016.

Both banks and money transfer operators maintain competitiveness in this market. The lowest rate offered by a bank was 1.06%, although this irate is specific to certain countries. Money transfer providers have seen rates as low as 1.2%, but a few companies are offering the mid-market rate.

This data shows the exchange rate on transfers to North America. If no fees were included, using only the exchange rate, the cost of sending remittances to North America would exceed UN targets of 3%.

This data highlights each of the quarters in more detail.

This here is the data behind the graphs.

Date: Quarter, Year | Average FX margin on a $200 transfer |

|---|---|

Q2, 2016 | 1.33% |

Q3, 2016 | 1.47% |

Q4, 2016 | 1.49% |

Q1, 2017 | 1.52% |

Q2, 2017 | 1.60% |

Q3, 2017 | 1.45% |

Q4, 2017 | 1.95% |

Q1, 2018 | 1.81% |

Q2, 2018 | 1.32% |

Q3, 2018 | 1.47% |

Q4, 2018 | 1.04% |

Q1, 2019 | 3.05% |

Q2, 2019 | 2.12% |

Q3, 2019 | 1.61% |

Q4, 2019 | 1.35% |

Q1, 2020 | 1.60% |

Q2, 2020 | 1.73% |

Q3, 2020 | 1.49% |

Q4, 2020 | 1.50% |

Q1, 2021 | 1.34% |

Q2, 2021 | 1.52% |

Q3, 2021 | 1.72% |

Q4, 2021 | 1.85% |

Q1, 2022 | 1.89% |

Q2, 2022 | 1.75% |

Q3, 2022 | 1.43% |

Q4, 2022 | 1.82% |

Q1, 2023 | 1.82% |

Q2, 2023 | 1.64% |

Q3, 2023 | 1.27% |

Q4, 2023 | 5.05% |

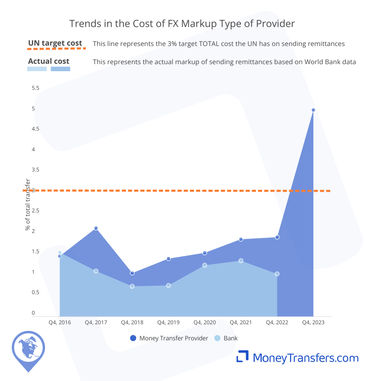

FX Markup by type of company

The following shows the same trends and changes by the type of company. This focuses on banks and money transfer companies as the most popular ways of sending money into North America.

This graph shows the average exchange rate split by type of company in Q4 of each year. At the time of writing, Q4 2023 data is not fully available for banks.

This graph shows the average exchange rate split by type of company by quarter since 2016. At the time of writing, Q4 2023 data is not fully available for banks.

This table shows all of the data for given period.

Date: Quarter, Year | Money transfer provider | Bank |

|---|---|---|

Q2, 2016 | 1.18% | 2.57% |

Q3, 2016 | 1.44% | 1.76% |

Q4, 2016 | 1.48% | 1.56% |

Q1, 2017 | 1.54% | 1.21% |

Q2, 2017 | 1.60% | 1.42% |

Q3, 2017 | 1.45% | 1.39% |

Q4, 2017 | 2.16% | 1.11% |

Q1, 2018 | 1.87% | 1.26% |

Q2, 2018 | 1.36% | 1.13% |

Q3, 2018 | 1.52% | 1.07% |

Q4, 2018 | 1.06% | 0.74% |

Q1, 2019 | 3.18% | 2.23% |

Q2, 2019 | 2.16% | 1.75% |

Q3, 2019 | 1.65% | 1.16% |

Q4, 2019 | 1.41% | 0.75% |

Q1, 2020 | 1.68% | 0.34% |

Q2, 2020 | 1.83% | 0.52% |

Q3, 2020 | 1.55% | 0.86% |

Q4, 2020 | 1.55% | 1.26% |

Q1, 2021 | 1.36% | 1.12% |

Q2, 2021 | 1.45% | 1.46% |

Q3, 2021 | 1.73% | 1.25% |

Q4, 2021 | 1.88% | 1.37% |

Q1, 2022 | 1.91% | 1.27% |

Q2, 2022 | 1.87% | 1.23% |

Q3, 2022 | 1.49% | 1.17% |

Q4, 2022 | 1.94% | 1.04% |

Q1, 2023 | 1.90% | 1.04% |

Q2, 2023 | 1.70% | 1.16% |

Q3, 2023 | 1.21% | 1.15% |

Q4, 2023 | 5.05% | No Data |

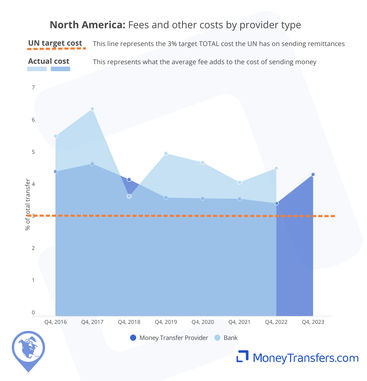

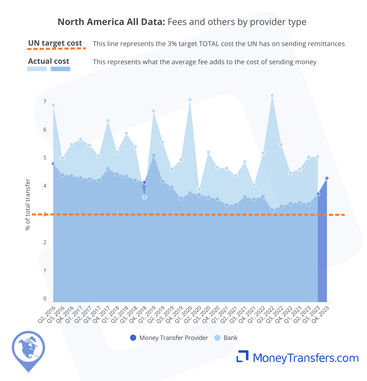

Fees and other costs

This data shows the other costs and fees associated with sending money to North America as a percentage of the overall transfer. Data is from 2016 to date. Generally, these will be fees charged and potentially intermediary fees and receiving fees.

Fees for remittances to North America have never averaged below 3.5%.

Money transfer companies tend to offer fees that reduce the cost by 1.5% when compared to banks.

In only one quarter (Q4 2018), banks have offered lower fees than money transfer companies. These were 3.73% and 4.26% respectively.

Fees for remittances into North America, fees sit just about the target overall 3% rate. Largely driven by bank costs.

This data shows the remittance fees into North America, by quarter, since 2016.

The following table highlights the data behind each of the graphs.

Date: Quarter, Year | Total Cost Minus Markup (%) |

|---|---|

Q2, 2016 | 5.32% |

Q3, 2016 | 4.62% |

Q4, 2016 | 4.64% |

Q1, 2017 | 4.60% |

Q2, 2017 | 4.52% |

Q3, 2017 | 4.42% |

Q4, 2017 | 5.13% |

Q1, 2018 | 4.67% |

Q2, 2018 | 4.75% |

Q3, 2018 | 4.50% |

Q4, 2018 | 4.22% |

Q1, 2019 | 5.45% |

Q2, 2019 | 4.43% |

Q3, 2019 | 4.19% |

Q4, 2019 | 3.84% |

Q1, 2020 | 4.13% |

Q2, 2020 | 3.90% |

Q3, 2020 | 3.93% |

Q4, 2020 | 3.80% |

Q1, 2021 | 3.67% |

Q2, 2021 | 3.66% |

Q3, 2021 | 3.89% |

Q4, 2021 | 3.76% |

Q1, 2022 | 3.96% |

Q2, 2022 | 4.00% |

Q3, 2022 | 3.76% |

Q4, 2022 | 3.67% |

Q1, 2023 | 3.70% |

Q2, 2023 | 3.72% |

Q3, 2023 | 4.17% |

Q4, 2023 | 4.41% |

Fees and other costs by company type

The graphs below show the same trends and changes the company type. This again focuses on banks and money transfer companies as the most popular ways of sending money internationally.

Fees here have been split by banks and money transfer companies as a percentage of the overall transfer amount.

This data shows fees as a percentage into North America. This is split by the type of company.

This data shows the data behind each of graphs for remittances to North America.

Date: Quarter, Year | Money transfer provider | Bank |

|---|---|---|

Q2, 2016 | 4.92% | 7% |

Q3, 2016 | 4.52% | 5.12% |

Q4, 2016 | 4.50% | 5.60% |

Q1, 2017 | 4.42% | 5.79% |

Q2, 2017 | 4.38% | 5.58% |

Q3, 2017 | 4.33% | 5.19% |

Q4, 2017 | 4.74% | 6.44% |

Q1, 2018 | 4.55% | 5.33% |

Q2, 2018 | 4.47% | 6% |

Q3, 2018 | 4.34% | 5.52% |

Q4, 2018 | 4.26% | 3.73% |

Q1, 2019 | 5.22% | 6.80% |

Q2, 2019 | 4.29% | 5.68% |

Q3, 2019 | 4.09% | 4.72% |

Q4, 2019 | 3.69% | 5.06% |

Q1, 2020 | 3.87% | 7.19% |

Q2, 2020 | 3.82% | 4.01% |

Q3, 2020 | 3.73% | 5.34% |

Q4, 2020 | 3.66% | 4.78% |

Q1, 2021 | 3.45% | 4.75% |

Q2, 2021 | 3.47% | 4.49% |

Q3, 2021 | 3.74% | 4.98% |

Q4, 2021 | 3.65% | 4.17% |

Q1, 2022 | 3.76% | 5.29% |

Q2, 2022 | 3.27% | 7.34% |

Q3, 2022 | 3.41% | 5.60% |

Q4, 2022 | 3.50% | 4.60% |

Q1, 2023 | 3.54% | 4.72% |

Q2, 2023 | 3.49% | 5.15% |

Q3, 2023 | 3.84% | 5.16% |

Q4, 2023 | 4.41% | No data |

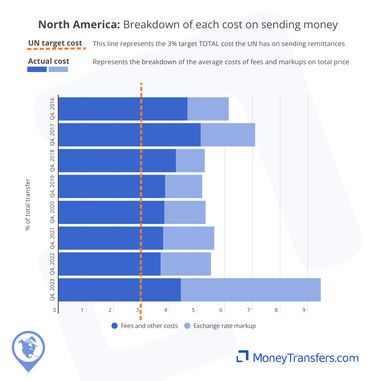

How exchange rate markup and fees make up the total cost

The graph below shows the split between the exchange rate and other costs that make up the average cost of a transfer.

More than any other continent, fees are the main driver behind not reaching the UN cost targets of 3%.

Most costs are consistent; however Q4 2023 shows an abnormally large increase in the overall cost of sending to North America. This data is likely to settle as more becomes available.

Exchange rate and fees by type of company

Within this we have covered some hybrid companies, post offices and mobile operators as well. The figures for these are correct, but testing was done with far fewer transfers.

Data for the type of company

Our data

This data has been compiled from the following sources:

WorldBank and UN data on access to remittance and the cost of remittances through different provider types.

Live data from our own comparison engine.

All data has been edited and fact checked by our team.

Explore remittance statistics

Our remittance data center is always growing.

We often cover new topics and will regularly update reports as new data emerges.

.svg)

Contributors