Send money to Australia

"Over 16 million customers use Wise, mostly for their excellent mobile app, transparent fee structure & use of mid-market rates. Now increasingly used for larger transfers."

"Xe has over 30 years of currency exchange experience, and is one of the most reputable names on the market. 200 countries, 100 currencies, & funds often received in seconds."

"Over 16 million customers use Wise, mostly for their excellent mobile app, transparent fee structure & use of mid-market rates. Now increasingly used for larger transfers."

"Currencies Direct have over 30 years of global money transfer expertise. Award winning service with a TrustPilot rating of 4.9. Lock-in rates for the future or trade 24/7 on web or mobile."

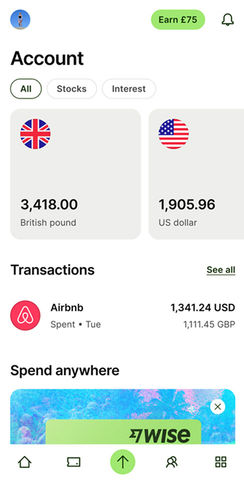

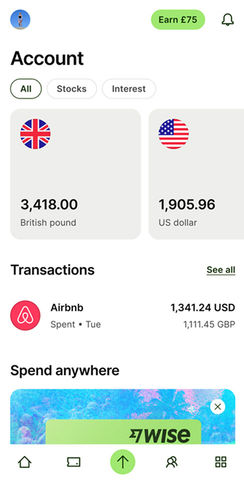

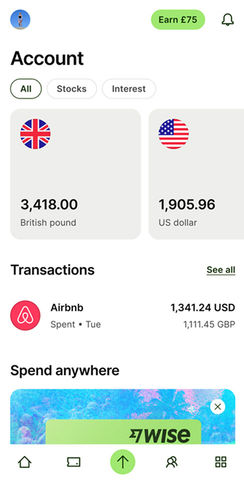

"Revolut has 50+ million customers globally. You can hold up to 36 currencies in the app and send money quickly in 70+ currencies to 160+ countries."

"Key Currency offers a personal service with a dedicated account manager. There are no transfer limits or fees which is perfect for larger send amounts."

"Xe has over 30 years of currency exchange experience, and is one of the most reputable names on the market. 200 countries, 100 currencies, & funds often received in seconds."

"OFX have been helping individuals and businesses send money for over 25 years. Transfer in 50+ currencies to 170+ countries, with 24/7 phone access to currency experts."

"Regency's UK-based account management team has vast experience. Get support on all kinds of transfers, from overseas property transactions to business payments & more."

"Currencyflow is a modern FX broker backed by industry veterans with 30+ years of currency trading experience. Contact the UK-based team for a free quote."

"Remitly focuses on sending money to friends and family in Asia, Africa and South America. Wide coverage and well-suited to regular transfers home."

"Lumon has cared for over 69,000 customers since 2000. Get support for larger transfers from dedicated currency specialists."

"Xoom, a PayPal service, allows you to send money in more than 160 countries. You can send cash for over-the-counter pickup or home delivery, as well as send by bank transfer or debit card."

"Securely send money to and from 150+ countries and 20+ currencies. Same-day transfers avaialble on most major currencies."

"Fast, secure internatinal transfers with no fees and transparent rates. They offer a free currency card for use at home and abroad."

"Send money to over 40 destinations online and in the mobile app."

"Paysend has transparent fees and rates, with transfer sent within seconds to your recipient's bank. They also have global 24/7 support for any enquiries, and bank-level security."

"Moneycorp is an established player in the market, with a focus on private clients and corporates. Make overseas payments in over 120 currencies and 190 countries."

"Moneygram is a well established service with over 80 years in the sector. They support over 200 countries worldwide and have over 440,000 retail locations."

How to get the best rate for money transfers to Australia

Overall best choice: Wise

We tested & reviewed 17 companies offering transfers to Australia, and Wise scored the highest.

Wise offers the best combination of transfer fees, rates, speed, and has the best overall experience for transfers to Australia.

At the moment, if you were to send $7,000 to AUD, it would cost you $26.86 in fees, and your recipient will get 10,765.97 AUD.

MoneyGram is the cheapest way to send money to Australia

MoneyGram charges $490.00000000000006 per transfer and adds a 2% markup on top of the Australian Dollar exchange rate.

bank transfer is the cheapest funding option when sending money to Australia. Pair it together with MoneyGram, to get the most out of your AUD transfer.

Fastest way to send money to Australia: Wise

Our data shows that Wise is the fastest way to transfer AUD right now.

With Wise, the transfer time to Australia is same day (for a $7,000 transfer).

Wise charges $26.86 in fees on $7,000 transfer and adds a -0.01% markup.

The ‘fastest’ way to transfer money to Australia includes the transfer amount, deposit method, and transfer and withdrawal times.

The easiest way to send money to Australia: Wise

They offer transparent fees, charging $26.86 per transfer with -0.01% markup added to the AUD rate.

Getting started with Wise takes less than 3 minutes, making it a fast, affordable, and user-friendly choice for sending Australian Dollars.

Consider this before sending money to Australia

Compare AUD transfer deals

Whether you're supporting family, covering tuition, or paying someone who just relocated, choosing the right money transfer provider can make a big difference.

We analyzed 17 major services that support AUD transfers. Based on real user data:

MoneyGram offered the lowest fees in 100% of searches

Wise ranked fastest overall

Wise delivered the best AUD exchange rates

Small decisions like how you pay or who you choose can mean hundreds more AUD received on the other side.

Exchange AUD rates matter

Find the cheapest AUD transfer option

Receiving AUD in Australia

How fast do you need AUD to arrive?

Transfer limits and ID checks

Understand Australian taxes

Need to send over $10,000?

For transfers over $10,000, your best bet is Wise.

While Wise may not always be the cheapest or fastest way to send AUD, but they offer the best exchange rate, years of experience, and will offer you the peace of mind you need when sending large amounts abroad.

Understanding the costs involved when moving money to Australia

When calculating the cost of money transfers to Australia, here's what really matters: the country of origin, amount, payment method, fees, and the markup on the AUD exchange rate.

Exchange rate markup

This is a percentage added on top of the "real" AUD rate (known as the mid-market rate).

Wise, for example, offers the best exchange rate. It adds -0.01% markup to the USD-AUD exchange rate (1.5385 AUD - -0.01% per US Dollar).

Transfer fees

These are fixed and/or percentage fees added for the service when sending money to Australia.

Let's imagine you want to send $7,000 from the US to Australia.

After analyzing 17 companies supporting Australian Dollar, we found Key Currency to offer the lowest fees ( $0 in fees and 0.25% markup).

However, exact fees vary by deposit method and the service, for example:

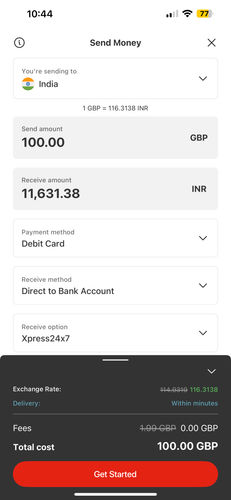

Bank transfers vary from $490.00000000000006 to $0

Debit cards range from $0 to $0

Credit card fees vary a lot, mainly due to cash advance fees and/or additional fees from your credit card provider.

How to get the best AUD exchange rate for transfers to Australia

An exchange rate represents the value of the Australian Dollar (AUD) relative to another currency. Since it fluctuates continuously, the rate you get directly affects the amount of AUD you receive.

Recent trends in AUD exchange rates:

The average rate was 1.5384 Australian Dollar per US Dollar, with a high of 1.5453 AUD/USD and a low of 1.5323 AUD/USD.

During the past week, the AUD/USD exchange rate experienced some fluctuations. Ensuring you exchange or convert money at a higher rate would result in more AUD received.

Wise is our top recommendation for sending AUD as it offers an exchange rate that is -0.01% above the mid-market rate, which is 0% cheaper than the next best option.

Secure the best AUD exchange rates with our rate alerts

Sign up for our rate alerts, and we'll notify you when it’s the best time to send AUD!

Top payment methods to use for transfers to Australia

Money transfer companies will offer different ways to fund your transfer to Australia. Depending on the service used, deposit options can affect the speed, the cost of your transfer, and the amount of AUD received.

Need to deposit money to a bank in Australia?

You can transfer money to most Australian bank accounts (including ANZ Bank, Commonwealth Bank, NAB, and many more) using online money transfer services or wire transfers.

Wire transfers might be more convenient, but they are much more expensive compared to online money transfer services.

In either case, you will need the recipient's bank details, including the BSB (Bank-State-Branch) number and account number.

How we analyze the market

We track the cost, speed, and product offerings of the leading money transfer services available in Australia.

Our comparison engine and algorithms evaluate providers based on over 25 factors, including transfer fees, ease of use, exchange rates, mobile apps, transfer times & customer support.

We also consider how these services are rated on platforms like TrustPilot, AppStore, and Google Play, giving you a comprehensive view of what to expect.

This thorough analysis helps you get the best available deal - every time you want to move money to Australia.

We also provide unbiased and detailed reviews of all the top money transfer companies. You can use these reviews to find the best service for your needs when sending money to Australia

For a deeper understanding of our commitment to integrity and transparency, we invite you to read our editorial policy and review methodology.

Related transfer routes

Send money from Australia

FAQs

Find answers to the most common questions on our dedicated FAQ page.

.svg)

.svg)