How to send money to Dominican Republic from US with the best USD-DOP rate

Compare the best deals on transfers from the United States to Dominican Republic. Explore the cheapest, fastest, and most reliable providers with the best USD to DOP exchange rates.

Read on for the insights and in-depth analysis, and all you need to send money to Dominican Republic from United States.

Transferring the other way? Send DOP from Dominican Republic to United States instead."Over 16 million customers use Wise, mostly for their excellent mobile app, transparent fee structure & use of mid-market rates. Now increasingly used for larger transfers."

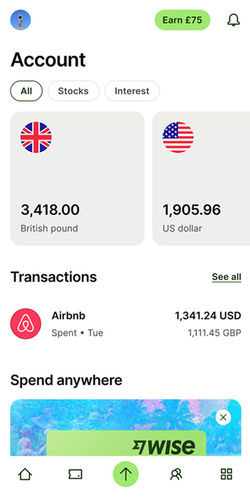

"Over 16 million customers use Wise, mostly for their excellent mobile app, transparent fee structure & use of mid-market rates. Now increasingly used for larger transfers."

"Xe has over 30 years of currency exchange experience, and is one of the most reputable names on the market. 200 countries, 100 currencies, & funds often received in seconds."

"Xe has over 30 years of currency exchange experience, and is one of the most reputable names on the market. 200 countries, 100 currencies, & funds often received in seconds."

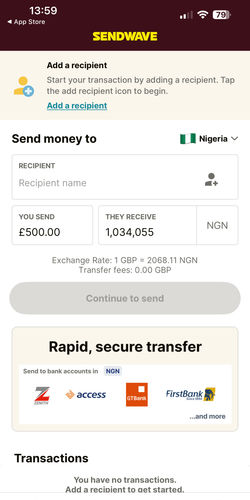

"Sendwave is trusted by over 1 million users across the US, UK, Canada and EU. 24/7 support is available online and via the app."

"Sendwave is trusted by over 1 million users across the US, UK, Canada and EU. 24/7 support is available online and via the app."

"Over 16 million customers use Wise, mostly for their excellent mobile app, transparent fee structure & use of mid-market rates. Now increasingly used for larger transfers."

"Over 16 million customers use Wise, mostly for their excellent mobile app, transparent fee structure & use of mid-market rates. Now increasingly used for larger transfers."

"Xe has over 30 years of currency exchange experience, and is one of the most reputable names on the market. 200 countries, 100 currencies, & funds often received in seconds."

"Xe has over 30 years of currency exchange experience, and is one of the most reputable names on the market. 200 countries, 100 currencies, & funds often received in seconds."

"Over 16 million customers use Wise, mostly for their excellent mobile app, transparent fee structure & use of mid-market rates. Now increasingly used for larger transfers."

"Over 16 million customers use Wise, mostly for their excellent mobile app, transparent fee structure & use of mid-market rates. Now increasingly used for larger transfers."

"Xe has over 30 years of currency exchange experience, and is one of the most reputable names on the market. 200 countries, 100 currencies, & funds often received in seconds."

"Xe has over 30 years of currency exchange experience, and is one of the most reputable names on the market. 200 countries, 100 currencies, & funds often received in seconds."

Overall best way: Wise

We tested & reviewed 7 transfer providers, and Wise scored highly.

Sending 7,000 USD to DOP will cost you $72.99 in fees, and you will get 412,351.05 DOP. The delivery time is within a week, but it depends on the day you make the transfer.

So for a great mix of cost, speed & features, make your United States to Dominican Republic transfer using Wise.

How to get the best deal on sending money from United States to Dominican Republic

Always compare rates

Don't pay more than you have to. Use our live comparison tool to make sure you aren't missing the best rates to send money from the United States to Dominican Republic.

Choose a provider

Select the provider that offers you the best value on buying DOP & service for your needs.

Click, sign up & send

Follow the steps & make your transfer. Your funds will soon be on their way to your chosen country & currency.

Considerations for sending money from United States to Dominican Republic

Always compare ways to send money from the United States to Dominican Republic to get the best options for fees, speed, and reliability.

Our analysis included 7 providers that operate between United States and Dominican Republic.

Through this, you get a comprehensive view of all the options you have in the United States when you need to send money to Dominican Republic.

Cheapest way to send money from the United States to Dominican Republic: Sendwave

Sendwave fees are 0 USD per transfer and you can expect an exchange rate between USD-DOP that is -2.33% different to the mid-market rate

Against the others tested, Sendwave is 2.79% cheaper than the second-best option.

To secure a cheap way to transfer USD to Dominican Republic, Sendwave is our recommendation.

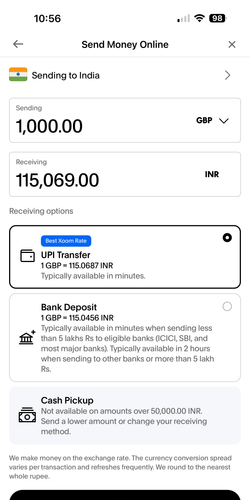

Fastest way to send money to Dominican Republic from the United States: Xoom

The transfer time is minutes - 24 hours with Xoom for a $7,000 transfer, but it will depend on the time, day of the week, and the amount you send.

A USD-Dominican Peso transfer through Xoom comes with a 0 USD fee (based on a $7,000 transfer).

To ensure Xoom was the 'fastest' option we compared 7 providers. This comparison was for overall speed of sending money from the United States to Dominican Republic and is a combination of depositing US Dollar, transfer times to Dominican Republic and withdrawal timeframes where applicable.

When speed is a priority, Xoom is the top choice for sending into Dominican Republic from the United States.

The best apps to send USD to Dominican Republic from United States

Most money transfer companies have apps you can use to send money abroad.

We've compared and analyzed over 7 apps & companies for USD/DOP transfers and these are the best apps we found. All these apps are available on iOS and Android for free.

App | Rating | Mobile wallet |

|---|---|---|

iOS: 4.9 / 2.3M reviews Android: 4.8 / 1.29M reviews | Yes (Remitly One) | |

iOS: 4.7 / 73.2K reviews Android: 4.7 / 117K reviews | No | |

iOS: 4.8 / 158K reviews Android: 4.8 / 1.52M reviews | Yes (40+ currencies) |

Sending large sums of money?

Of the 7 companies tested, Wise is the best rated for larger transfer amounts.

Whether for a property purchase, or as a gift, sending large amounts of money to Dominican Republic from United States can be expensive.

Wise is our choice for big transfers to USD because of all round price, speed and management when making large transfers.

Understanding the costs involved when transferring money from United States to Dominican Republic

When calculating the costs of money transfers between United States and Dominican Republic, opt for the best combination of fees and exchange rates:

The Mid-Market and Exchange Rates: Today, the USD-DOP mid-market rate equals 59.2774 DOP per US Dollar.

For reference, the USD-DOP average mid-market rate for the past 7 days has been 60.3205 DOP per US Dollar, with a high of 60.5729 and a low of 59.9897.

The company offering the best exchange rate is Sendwave.

Often the USD-DOP exchange rate you receive is the bigger factor than how much it costs to send US Dollars to Dominican Republic.

Fees: Fees are charged on top of a transfer. The company offering the lowest fee is Sendwave, cahrging 0 USD per transfer. We would recommend searching for your exact send amount to get an idea of fees.

Amount Received: The amount received in Dominican Peso is the biggest indicator the total cost of sending money from the United States to Dominican Republic. Essentially, the more the recipient receives in Dominican Republic, the less it is costing to send from the United States.

How to find the best exchange rate for US Dollar to Dominican Peso

Timing is essential for sending money between USD and DOP. The exchange rate you secure impacts how much DOP you get for your USD.

Let's dive into some interesting recent trends.

Over the past week, the exchange rate from USD to DOP has seen some fluctuation. On average, it stood at 60.3205.

During this period, the highest value recorded was 60.5729, while the lowest was 59.9897.

Wise, which is our recommended service to send money online from United States to Dominican Republic offers an exchange rate that is only 0.77% above the mid-market rate.

Want to secure the best USD-Dominican Peso exchange rates?

Sign up for our rate alerts and we'll tell you when it's the best time to move your money from United States to Dominican Republic!

United States to Dominican Republic money transfer payment methods

Bank transfers

Bank transfers are often the best payment method for money transfers from the United States to Dominican Republic.

A money transfer company like Sendwave offer bank transfers between the United States and Dominican Republic with lower fees and better exchange rates than you would get from a traditional bank.

On average, Sendwave is the cheapest provider for bank transfers of the 7 we tested when sending USD to Dominican Republic.

Sendwave has a fee of 0 USD for money transfers from the United States to Dominican Republic. Overall, they offer a great combination of competitive exchange rates and lower fees.

Debit and prepaid cards

Sending money from the United States to Dominican Republic with a debit or a prepaid card is very simple with Xe.

Xe is a leader in debit card payments for transfers from the United States to Dominican Republic, competing among a total of 7 active money transfer companies on this route.

Credit cards

Not many money transfer companies offer direct credit card deposits, because it is more expensive for everyone.

We recommend using a bank transfer or a debit card transfer if you can; otherwise, .

Fee alert: using a credit card to transfer money can result in a fee being charged by your card issuer as it is considered as a cash advance. That's why we recommend bank transfer or debit card instead.

How we analyze the market

We track the cost, speed, and product offerings of the leading money transfer services available between Dominican Republic and United States.

Our comparison engine and algorithms evaluate providers based on over 25 factors, including transfer fees, ease of use, exchange rates, mobile apps, transfer times & customer support.

We also consider how these services are rated on platforms like TrustPilot, AppStore, and Google Play, giving you a comprehensive view of what to expect.

This thorough analysis helps you get the best available deal - every time you want to move money from United States to Dominican Republic.

We also provide unbiased and detailed reviews of all the top money transfer companies. You can use these reviews to send USD to DOP.

For a deeper understanding of our commitment to integrity and transparency, we invite you to read our editorial policy and review methodology.

Related transfer routes

Send money from United States

Send money to Dominican Republic

How much money can be transferred from United States to Dominican Republic?

Are there any tax implications to sending money from United States to Dominican Republic?

Can I send money from United States to Dominican Republic with MoneyTransfers.com?

What are the typical transfer fees for sending US Dollars to Dominican Republic through various providers?

How long does it take to send money from United States to Dominican Republic?

What is the best exchange rate I can get for sending money from United States to Dominican Republic?

Are there any minimum or maximum transfer amounts for sending money from United States to Dominican Republic?

Can I schedule regular transfers between United States and Dominican Republic?

Tools & resources

Contributors