How to send money to the US from Iran with the best IRR-USD rate

Get the best deals when you transfer from Iran to United States. Find the cheapest, fastest, and most reliable providers with the best IRR to USD exchange rates.

Read on for the best deals, expert information, and all you need to send money to United States from Iran.

Transferring the other way? Send USD from United States to Iran instead.Send money from Iran to United States

While you can’t send IRR to USD with Wise, you can transfer USD to USD.

"Over 16 million customers use Wise, mostly for their excellent mobile app, transparent fee structure & use of mid-market rates. Now increasingly used for larger transfers."

"Over 16 million customers use Wise, mostly for their excellent mobile app, transparent fee structure & use of mid-market rates. Now increasingly used for larger transfers."

"Over 16 million customers use Wise, mostly for their excellent mobile app, transparent fee structure & use of mid-market rates. Now increasingly used for larger transfers."

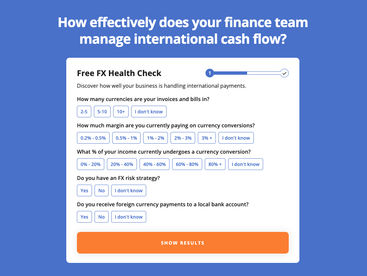

In our experience, there are always efficiencies to be made in how businesses manage international payments in and out.

Why not take our free FX health check test to see how effective your business is in managing these. It only takes a couple of minutes.

How to send money from Iran to United States

Sending money from Iran to United States doesn’t have a huge amount of options. Because of this, we suggest sending money via:

An agent like Western Union, MoneyGram, or Ria Money Transfer

Wise (USD/USD or EUR/EUR transfers)

Send cash to United States from Iran

Agents are physical stores where you hand in IRR as cash and the receiver picks it up from the store in United States.

Western Union Agent

We suggest using Western Union agent as it's reputable, fast, and is partnered with multiple banks in Iran.

The fees and rates will vary from day to day and based on your transfer amount, but it's still much cheaper than using your bank directly.

To get started, find the closest WU agent using the store locator, fill in the forms at the counter, pay for your transfer and let the recipient know.

Most transfers will be available for collection the same day, but sometimes can take up to a few days.

How to to send from Iran to United States in the best way

Always compare rates

Money transfers to United States should be easy. Use our live comparison tool to make sure you aren't missing the best rates to send money from Iran to the United States.

Choose a provider

Select the provider that offers you the best value on your Iranian Rial & service for your needs.

Click, sign up & send

Follow the steps & start your transfer. Your funds will soon be on their way to the United States.

Sending money from Iran to United States: key insights and tips

Don't settle for the first option. Always from Iran to United States to find out about fees, speed, and reliability.

Your analysis should include all the providers that operate between Iran and United States. Through this, you get a comprehensive view of all the options you have in Iran when you need to send money to United States.

Cheapest way to send money from Iran to United States

Without any money transfer providers serving the Iran to United States route, the cheapest money transfer options are limited.

We would recommend using:

.png)

Understanding the costs involved when moving money from Iran to United States

When calculating the costs of money transfers between Iran and United States, here's what really matters:

The Mid-Market Rate: Today, the IRR-USD mid-market rate equals to 0. Keep in mind that this rate fluctuates all the time.

The IRR-USD average exchange rate of the past week has been 0, with a highest of 0 and a lowest of 0.

Fees and Markups: When you pick a service with competitive exchange rates and low fees, you get to make the most out of your IRR to USD transfers. This strategy keeps your costs down, offering a smart way to handle your international transactions.

The best exchange rate for Iranian Rial to US Dollar transfers

When sending money between IRR and USD getting a good deal on an exchange rate is essential. The exchange rate you secure impacts how much USD you get for your IRR.

Here's how the mid-market rate has performed recently, which will impact the overall cost of the exchange rate.

In the past week, the mid-market rate from IRR to USD has been 0.

During this period, there was a high of 0, and 0 being the lowest point.

, which is our recommended service to send money online from Iran to the United States offers an exchange rate with a % markup against the mid-market rate.

Want to secure the best IRR-US Dollar exchange rates?

Sign up for our rate alerts and we'll tell you when it's the best time to move your money from Iran to the United States!

What payment methods are available when sending money from Iran to United States?

Sending bank transfers from Iran to United States

Bank transfers are the most common way of sending IRR to United States as they are secure, reliable, and convenient.

If you want to send Iranian Rials to United States via bank transfer, you can use your bank where no provider is available, but it will likely be at a bad exchange rate.

Sending money from Iran to United States by credit card

Credit card payments are quick, convenient, and typically more secure than other methods, thanks to backing by the issuing party. Some users may even be able to rack up reward points when making large transactions.

If you want to send Iranian Rials to United States with a credit card.

Credit card payments are often classified as cash advances, which bring their own charges, as well as currency conversion and usage fees. Forgetting to pay your balance can also result in high interest charges, and can even damage your credit score.

Sending money from Iran to United States by payment apps

If you’d like to send money from Iran to United States via payment app, follow these steps:

Download the app and register. Download the app from the App Store or Google Play. You’ll need to register to be able to open an account. Make sure the app services transfers from Iran to United States.

Enter your details. Enter any of the details required. You may need a valid form of ID.

Start your transfer. Enter the details of your recipient. Some apps will require full payment details, while others allow you to pay with just an email address. You may need to state that you’re planning to send money to United States in US Dollar at this stage.

Check the details. It’s vital that you check the details you’ve added to make sure everything is correct. It can be very difficult to reverse a transfer, and most payment apps don’t let you cancel a transfer from Iran to United States after it’s been sent.

Send the money. Your app will probably charge a fee for the transfer. They may also add a markup to the IRR to USD exchange rate. Check the rate they’re offering against the mid-market rate to make sure you’re getting a good deal.

The current mid-market rate of IRR to USD is 0

How we analyze the market

We track the cost, speed, and product offerings of the leading money transfer services available between United States and Iran.

Our comparison engine and algorithms evaluate providers based on over 25 factors, including transfer fees, ease of use, exchange rates, mobile apps, transfer times & customer support.

We also consider how these services are rated on platforms like TrustPilot, AppStore, and Google Play, giving you a comprehensive view of what to expect.

This thorough analysis helps you get the best available deal - every time you want to move money from Iran to United States.

We also provide unbiased and detailed reviews of all the top money transfer companies. You can use these reviews to send IRR to USD.

For a deeper understanding of our commitment to integrity and transparency, we invite you to read our editorial policy and review methodology.

Related transfer routes

Send money from Iran

Send money to United States

How much money can be transferred from Iran to United States?

Are there any tax implications to sending money from Iran to United States?

Can I send money from Iran to United States with MoneyTransfers.com?

What are the typical transfer fees for sending Iranian Rials to United States through various providers?

How long does it take to send money from Iran to United States?

What is the best exchange rate I can get for sending money from Iran to United States?

Are there any minimum or maximum transfer amounts for sending money from Iran to United States?

Can I schedule regular transfers between Iran and United States?

Tools & resources

Contributors